Everywhere we look, the world looks bubbly.

Politically, we may point to the anger bubbling among people who feel like they were robbed of power ‒ or their opponents who want to wield that power for their own, not exactly goodhearted purposes. Economically, we may point to the monetary extravagances of 2020, and whether we’ll ever get out from under this pandemic yoke.

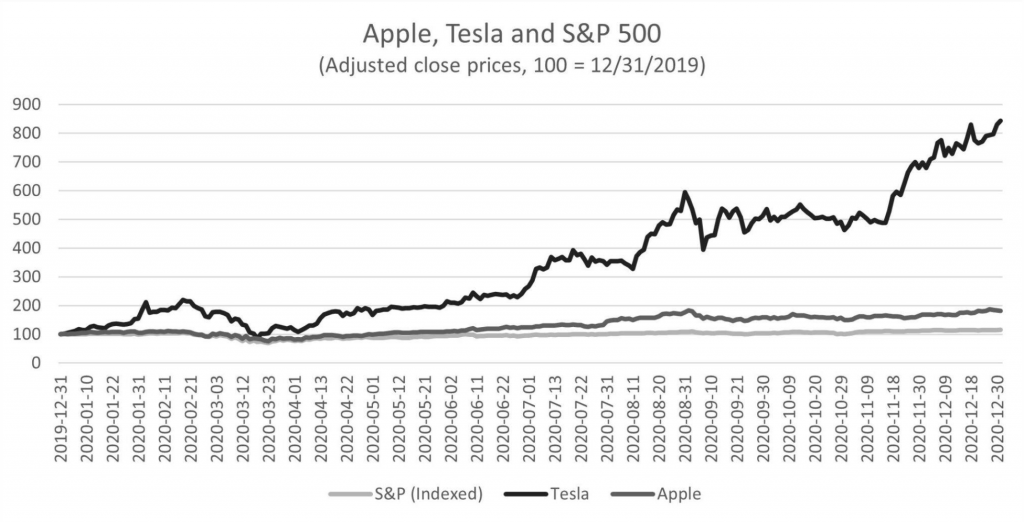

Financially, the stock markets (and certain cryptocurrencies) are also thankful recipients for the epithet ‘bubble’. Last year, as the US economy faltered some 4-5% ‒ much more than during the financial crisis and rivalled only by the Great Depression ‒ the S&P 500 index grew by 16.3%. Some notable stocks delivered returns in the hundreds of percent: the biotech company Moderna, +434%; Etsy, the online retail platform, +302%; Square, the fintech payment processor, +248%. The world’s largest company by market capitalization, Apple, saw its stock price increase by 77% (to which dividends added a few points’ additional return).

But none of them approached the bubbliest of all stocks: Tesla, the now-fourth largest component of the S&P 500. During 2020 it absolutely exploded in value, stating a return of over 700%.

How, you may ask, can the largest companies in the world be more valuable after a year when the economy they form part of collapsed, and the consumers and businesses who provide them with income streams lost their jobs or closed down?

Unless, say some, it’s a bubble.

Tesla’s price-to-earnings ratio, a common metric for valuing companies, is almost a thousand. If you’re not usually slinging P/E ratios, that’s a lot ‒ incomprehensibly so. Its market value as of 15 January is something like 25x its sales for 2020 ‒ way ahead of even some lofty fast-growing unicorns, even though sales of Tesla cars are growing much slower than these companies. We had individual days last year where Tesla’s market value increased by more than the entire market capitalization of other car companies.

If anything was ever a bubble, this is a grand candidate.

The classic definition of a financial bubble is that prices exceed ‘fundamentals’. We may talk about asset prices that are way above, detached, or separated from their fundamental values. A recent and wholly uncontroversial description runs: “A stock bubble occurs when sentiment or other market forces bid up the price of a security (or other asset) such that it becomes divorced from its economic prospects/free cash flow generating capability.”

We reserve the derogatory term ‘bubble’ only to those who don’t succeed

Here’s one major problem that researchers in finance have dabbled with for decades, and that longs and shorts involved in whatever bubbly assets are vocally battling over: what, then, are the relevant fundamentals? How much cash flow can this asset really generate? What will this company’s future hold? How likely are its ‘economic prospects’ to reach that?

This empty bubble definition merely pushes the dispute one step further and forces us to argue about what a relevant fundamental is.

As if that wasn’t enough, here’s another tricky idea to wrap your head around: we can only identify bubbles in hindsight. We can’t conclusively identify them until they’ve burst. Even worse: the accused bubbles that actually make it are never called ‘misidentified bubbles’ ‒ they’re just successful ventures. Bubbles that make it are talked about as prosperous companies that prevailed against impossible odds, run by eccentric entrepreneurs who persevered when nobody else believed in them, or perhaps when only the wrong kind of people believed in them.

The fights over bubbles are boring battles over what constitutes fundamentals, intensified by a backward-looking selection bias for what constitutes past financial bubbles. Looking at the real world, without the help of accurate crystal balls, the only thing that separates a disastrous bubble from a company meeting its lofty expectations is its future success! Its promoters become validated or judged by the future only.

In a strange way, we reserve the derogatory term ‘bubble’ only to those who don’t succeed.

The difference between Amazon, the online retail giant we all know, and Pets.com, the obscure 1990s startup that only financial nerds now talk about, is that Amazon succeeded. In hindsight, that’s obvious; from the point of view of 1999, it wasn’t. Widespread use of the internet was new and revolutionary, and nobody knew what it would bring.

Amazon was as much a part of the mad rush to internet-related financial investment as was Pets.com. Still, a thousand dollars invested in Amazon at the peak of its dot-com journey (December 1999) would have been worth $27,500 today. The same amount invested in Apple at the peak of its dot-com boom ‒ after increasing almost 400% between March 1999 and March 2000 ‒ would have been worth a whopping $95,000 today. If those are the ways of bubbles, do sign me up.

Then again, as a long-term Amazon stockholder you would have had to stomach a collapse of almost 95% between 2000 and 2001 when the hallucinatory promises of the early internet companies finally evaporated. Apple shares didn’t regain their peak dot-com price until five years later.

Was the difference between the world’s fastest IPO-to-insolvency and the world’s second company to be valued above $1trn really that books were more marketable online than dog food?

Of course, around the dot-com bubble, nobody could have known what these tech giants would become. Or that of the myriad other promising companies at the time, they would be market leaders two decades thence. Plenty of other companies were available, with similarly lofty promises of future success ‒ very few of which survive, other than as discouraging case studies in business schools and finance departments.

I’m sure that corporate historians can give lots of reasons for why Amazon and Jeff Bezos, even in the late 1990s, had better potential than Pets.com and its founders whom nobody has heard of today. But was the difference between the world’s fastest IPO-to-insolvency and the world’s second company to be valued above $1trn really that books were more marketable online than dog food?

Hardly: the business models were so similar that Amazon even owned 30% of Pets.com. In its short entry at Investopedia.com, Andrew Beattie writes: “Given the choice between ordering online and waiting for delivery or walking into the nearest store to buy the product [pet food and toys] and take it home immediately, the majority of people preferred the latter. Granted, Amazon has made a gigantic business of doing just that today. Pets.com was perhaps a bit too early on this idea.”

Today, those preferences of convenience have flipped entirely. But I often argue that if you’re early in financial markets, you are wrong, and if you can’t hold the position long enough to be vindicated, you weren’t right in any meaningful way.

Whenever accusations of ‘bubbles’ are thrown about, I think of these extraordinary stories and the grand selection mechanism that is financial markets. Amazon wanted to sell books online, with great potential and great service; Pets.com wanted to sell dog food. In the late 1990s, both looked bubbly, but we only slapped ‘bubble’ on the company that failed.

For the aspiring startup today, perhaps working away in the venture-cap lands of overpriced unicorns, the history of bubble allegations teaches you one thing: be right or be a bubble. Until the dust has settled, nobody can really tell.

This article was originally published by the American Institute of Economic Research and is here republished with permission.