Is investors’ preference for them warranted?

An important issue for investors is that of how to structure their exposure to commercial real estate. A common allocation strategy is to tilt real estate portfolios towards well-located, high-quality properties in economically important markets, such as New York, Tokyo or London (ie, gateway markets). Several economic mechanisms can provide grounds for explaining the preference of investors for gateway markets. Large cities should have higher economic productivity, which translates into production factors (both human and physical) being more valuable and exhibiting higher appreciation rates. This reasoning applies to commercial properties, as they constitute an important production factor. This should be particularly true for the office and industrial sectors. For residential and retail properties, the effect is likely to be more complex given that higher wages can be allocated to other items than sheltering and consumption. However, the benefits of holding a large exposure to gateway markets have not been well documented so far.

Our latest research paper (Hoesli, M. and L. Johner, 2022, “Portfolio Diversification Across U.S. Gateway and Non-Gateway Real Estate Markets”, Journal of Real Estate Research, Available in open access at https://doi.org/10.1080/08965803.2022.2038902) intends to fill this gap by isolating the impact of macro-location quality, ie, gateway versus non-gateway markets, on real estate performance. For this, we use a large database of institutionally owned commercial real estate holdings in the United States graciously made available to us by the National Council of Real Estate Investment Fiduciaries (NCREIF) and covering the period 2004-2019. This permits us to investigate the effects of macro-location on commercial real estate return and risk characteristics using over 310,000 data points, representing more than 14,000 properties across 254 metropolitan areas. This is undertaken for the four main sectors (ie, office, retail, apartment and industrial). Following common wisdom, we use New York, Los Angeles, Chicago, Washington DC, Boston and San Francisco as gateway markets.

For the period under review, gateway markets have higher total returns (8.4% vs 7.7%) than their non-gateway counterparts, but those returns are also more volatile. The higher variability of returns in gateway markets is not attributable to differences in systematic risk, which is comparable across market types, but rather to the idiosyncratic nature of the market. This is surprising, as one would have expected gateway markets to be more tightly connected to widespread shocks in the economy.

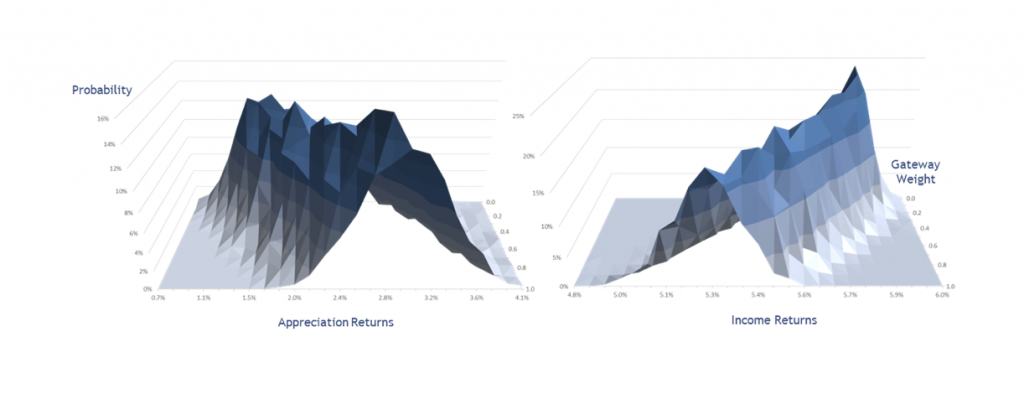

Figure 1: Appreciation and income returns for varying levels of exposure to gateway markets

To grasp gateway market performance better, it is necessary to focus on the two components of total returns, namely income and appreciation returns. As expected, given their higher capitalisation rates, non-gateway markets have higher income returns than gateway markets (5.8% vs 5.3%, see figure 1). Investors requiring sizeable cash flows will be interested to learn that this holds true even after accounting for capital expenditures, which amount approximately to 150 basis points on a yearly basis. In contrast, and consistent with economic intuition, gateway markets have a higher appreciation return than non-gateway markets (3.0% vs 1.8%, see also figure 1). Over the period, non-gateway markets on average did not provide capital protection in real terms, given that the average compound inflation rate was 2.1%. A minimum allocation to gateway markets of 30% would have been warranted to insure preservation of the invested capital in real terms.

Given that some investors may favour a specific sector over others, it is important to assess whether any differences exist across sectors. This is not the case for income returns. However, there are noteworthy differences across sectors regarding appreciation returns. Whereas the appreciation return spread between gateway and non-gateway markets is 129 basis points in the overall analysis, the spread is markedly higher for office and industrial properties (281 and 191 basis points, respectively). For retail, the spread (118 basis points) is in line with the overall spread, whereas for apartments it is much lower (18 basis points). The wider spreads for office and industrial properties is consistent with economic intuition. In contrast to these sectors, the residential sector is not a production factor per se and thus will capture productivity gains only indirectly and partially through increases in wages. The demand for apartments is also related to other factors, like demographics and technological changes, as evidenced by the growth in the Sun Belt states. Both elements could explain the lower spread in appreciation returns for apartment properties. Despite being production factors, retail properties are also largely dependent on household spending, notably due to sales-based rents. Accordingly, the spread for that sector is lower than for office and industrial properties but higher than for apartments.

Focusing now on downside risk, the value of a typical portfolio fell by some 30% during the global financial crisis (GFC), with no material differences across gateway and non-gateway markets. Capital loss measures, albeit important, are not sufficient to ascertain the riskiness of portfolios. A complementary metric is the recovery time, ie, the number of years needed to revert to the pre-drawdown portfolio high-water mark, which is materially shorter for gateway markets (5.5 vs 7.1 years). From a practical perspective, this indicates that non-gateway portfolios are at a disadvantage in an asset-liability management framework, as asset values will take longer to regain the level of the associated liabilities. This is even more problematic for leveraged investors, especially if the lender is monitoring closely the loan-to-value ratio as part of the agreed covenants.

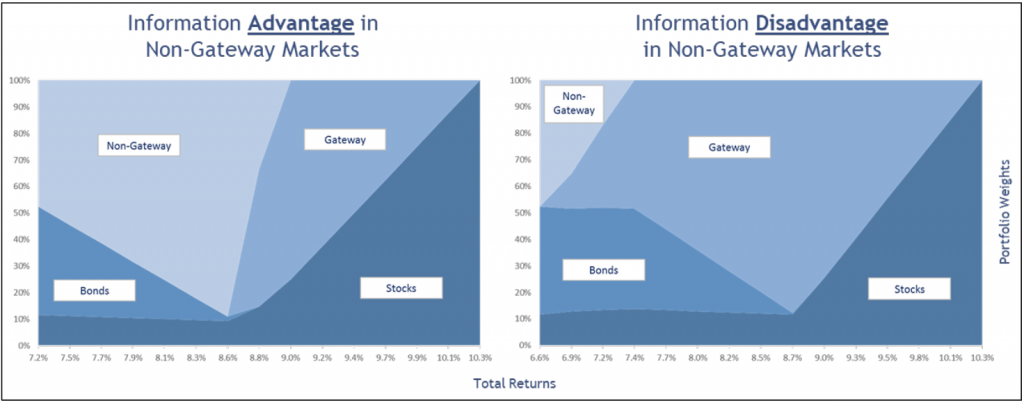

Figure 2: The impact of information asymmetry on optimal portfolio allocations

Finally, considering gateway and non-gateway markets separately is useful for mixed-asset diversification purposes. Gateway markets constitute the preferred macro-location for medium- to high-risk portfolios, while non-gateway markets appear in low-risk portfolios. In practice, an information advantage (or disadvantage) is crucial for portfolio allocation. For instance, regional players should have a far deeper knowledge of their local market. In contrast, gathering sufficient information for a large number of small non-gateway markets can be cumbersome for some other investors. Our results show that an information advantage for non-gateway markets leads to an increased allocation to such markets (see figure 2). On the other hand, non-gateway markets are useful in diversifying low-risk portfolios, even for investors with high information disadvantages.

In sum, the empirical evidence generally supports the preference of investors for gateway markets over the period under review that includes the GFC, but virtually no inflation. However, it is important to bear in mind some mitigating considerations. As discussed above, information plays a crucial role when allocating across market types. Also, with capitalization rates at their historical low, there is the lingering issue of whether gateway markets are still priced fairly. It remains to be seen how gateway markets pricing will react going forward considering a potential repricing of assets due to inflationary pressures.