New retail leasing models and platforms capture the uplift a physical store can bring to online sales.

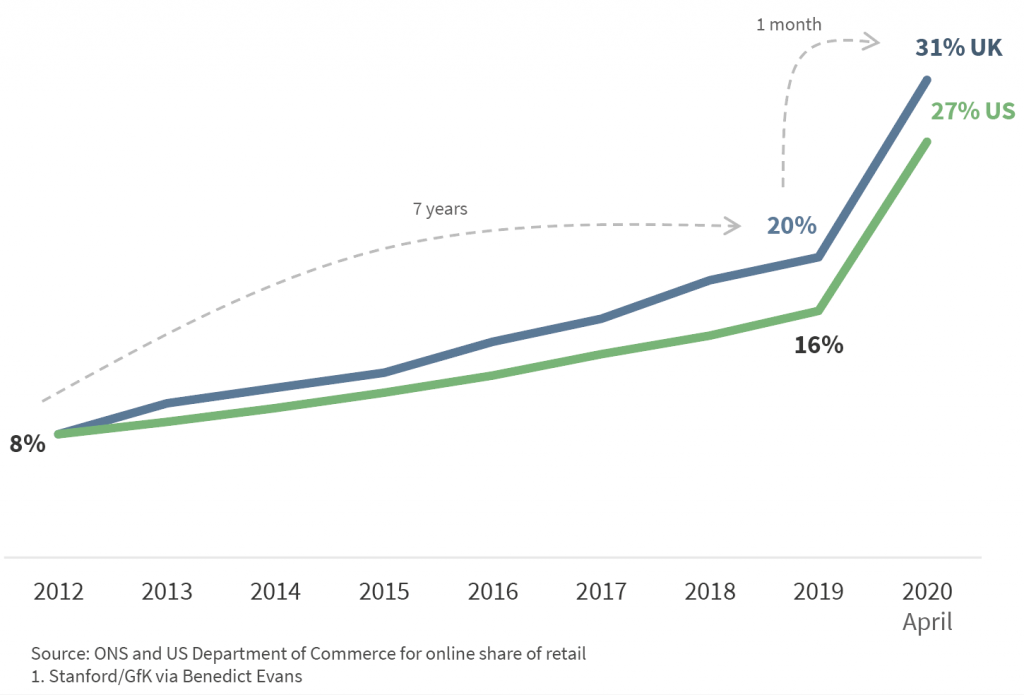

It is no secret that the retail sector has been in decline for some years, largely because the economics of online retailers and their network of next-day logistics enables them to outcompete physical stores. Meanwhile, personal consumption of experience-related services, such as going to restaurants, amusement parks and shows, has grown 1.5 times faster than overall personal spending and four times faster than expenditure on goods. In fact, 72% of Millennials now prefer to spend money on experiences than material items. As if things weren’t already bad enough for the high street, statistics released in April 2020 showed an unsurprising ten-year high in year-on-year online retail growth, up 23.8% on April 2019, as a direct result of covid-19 lockdown orders. This represented an additional £5.3bn in UK online spending.

Online share of retail sales, UK and US

This seismic shift in purchasing patterns has placed a renewed urgency on retail occupiers to seek technological solutions that let them compete with online retailers. Meanwhile their landlords are experimenting with more flexible leasing concepts to identify a sustainable rent model that works for both parties.

It has become clear that what constitutes a successful retail store in 2020 is very different from a decade ago, and the value of physical presence to retailers is no longer quantifiable through the amount of over-the-counter goods sold. The most forward-thinking retailers are turning to the new concept of a dynamic store, which uses intelligent product selectors to offer a smaller selection of the most desirable products in any submarket, based on online search data. It is estimated that these tactics of using AI to better understand consumers could inject £27bn a year into the UK retail market, while retailers using AI are growing 30% faster than those that are not.

The capture of such consumer data by retail occupiers is fast becoming an essential tool for their landlords too. However, while nearly 80% of UK retail landlords expect the pandemic to lead to permanent changes in how shop rents are calculated, two-thirds lack access to the necessary data. The inability to capture any uplift in online sales resulting from the presence of a physical store is now the biggest challenge facing retail landlords – and one that is being targeted by a host of start-ups.

One of these is Coniq, whose July 2020 release of its Total Customer Engagement Platform claims to overcome this issue, bringing the digital and physical worlds together into one unified tool for retailers. Monitoring the movement of customers in store as well as their subsequent interaction with products through Coniq’s online offer platform unveils data on the conversion of physical store visits.

Another such start-up is Placense, which helps businesses understand the connection between people’s behaviour and physical locations by turning data from mobile apps into aggregated and anonymous real-time insights. Uncovering metrics such as customer visit duration and frequency, modes of transport and customer journey paths, combined with demographic information such as gender, age groups and income levels, Placense can help retail landlords understand the quality of their location and identify the correct tenant to maximise any turnover-indexed lease.

We are witnessing not the death of physical retail but the digital metamorphosis of an industry

Experimenting with emerging digital-first measures of store success will become a necessity for landlords and is a first step towards fulfilling both Colliers’ and CACI’s vision for a ‘halo’ inclusive rental model. Rather than simply basing rent on store turnover, this proposed new performance-indexed lease model suggests retailers adopt a low base rent, with a top-up rent calculated on five variables: store sales, click and collect sales, returns, the marketing value of a store, and the online sales uplift generated in a store’s surrounding area.

At the furthest end of the lease innovation spectrum is retail space-as-a-service start-up Sook. Offering high-street booking by the hour at a demand-driven rate, Sook proposes that prime retail space is leased to it for zero base rent, instead offering landlords a revenue-sharing model that breaks even at 30% occupancy – and at 70% occupancy would see the landlord benefit from twice the market rate.

We are witnessing not the death of physical retail but the digital metamorphosis of an industry that will emerge from the grey, lifeless cocoon of covid-19 with renewed purpose. Retail landlords will have to turn to new, flexible leasing models as the pandemic will only accelerate the trends of the past five years, wherein retail business launches and failures have increased by 29%. The demand from businesses looking to operate with a makeshift physical presence has perhaps never been a bigger opportunity. However, where a strong retail covenant may be linked to the size of a brand’s social media following, identifying those tenants that will maximise rents as a function of in-store experience and online sales will not be straightforward.

Owners will suffer if they fail to take up emerging lease concepts and the required technologies to capture the new digital-first indicators of store performance, such as mobile footfall analytics, customer engagement monitoring, social media interaction, the impact on online sales and the flexibility to identify and adjust stock towards local sub-market shopping trends. Those who are experimental now will be the first to realise that no two stores carry the same solution and will be one step closer towards reaching the sustainable, flexible, data-indexed rental model that looks set to flourish in this new retail landscape.

Read the full research piece here.