Originally published in February 2021.

The pandemic has been with us for over a year, infecting more than 100 million people. Although vaccinations have begun around the world, the damage to the global economy is done. According to the International Monetary Fund (IMF), the world economy shrank by 3.5% in 2020 as lockdowns, freight bottlenecks and almost complete annihilation of global travel affected international trade. According to the World Tourism Organisation (UNWTO), global tourism took the biggest hit, with international travel contracting 74% in 2020. In comparison, during the global financial crisis in 2008, global travel shrank by only 4% and the global economy by 0.8%.

Amid this unprecedented environment, the flow of capital into the real estate market only contracted by some 20% globally in 2020. During the global financial crisis, the market contracted by some 54%. Most severely impacted in 2020 was America, with a 32% contraction, followed by EMEA at 25%.

Asia-Pacific markets also suffered, but given the region’s experience with SARS, the cities were much quicker to impose social lockdowns and contain the spread of the pandemic than Europe and North America. The contraction in real estate activity in the Asia-Pacific was around 10% in 2020.

Nonetheless, the economies in the Asia-Pacific are on the cusp of a recovery. Purchasing Managers’ Index figures (a leading indicator for prevailing economic trends) for January are in stable to expansionary mode across major APAC markets, except Japan which is marginally below 50. Manufacturing PMI for ASEAN has been in an expansion zone since November 2020, backed by highly expansionary fiscal and monetary policies. Other than China, yields of major short-term government bonds in the Asia-Pacific are well below those of a year ago, supporting the economic recovery.

Governments have the unenviable task of finding the appropriate moment to withdraw these financial life support without causing premature damage to the overall economy

However, the recent emergence of a more contagious variant of the virus has spooked the equity market. The CBOE VIX Index rose at the end of January, suggesting greater market volatility.

Despite these new growth opportunities, downside risk remains. The new variant of the coronavirus will dampen business and consumer confidence. While this has improved of late, the wave of new cases and the discovery of new variants of the virus in gateway cities such as London, Sydney, Hong Kong and Tokyo have resulted in tightened social restrictions, which inevitably could drag down confidence and affect local and regional economic activities.

There have been a vast amount of government incentives accorded to support this pandemic. According to CBRE’s report, some $4.4tn has been pumped into the economy. While the sudden removal of these measures is unlikely, governments have the unenviable task of finding the appropriate moment to withdraw these financial life support without causing premature damage to the overall economy.

What is causing the disconnect between the real estate market and the economy?

The answer is clear – a persistently low interest rate environment coupled with high liquidity. Investors are loaded with abundance of capital they have been eager to deploy. Real estate has been a natural choice for many looking to diversify their portfolio.

ANREV survey results suggest that in 2019 investors had, on average, some 5.7% allocation to real estate (weighted by assets under management – AUM). By 2021 this has risen to 9.3%, with a target of 10%.

Besides diversification benefits, returns from direct real estate funds have also outperformed those of equity stocks. Based on ANREV and MSCI indices (real estate equities), the returns from real estate stocks range between 2% and7% between 2010 and 2019, while real estate funds generated some 6% to 11%. On risk-adjusted basis, returns from Asia-Pacific centric real estate funds continue to outpace Europe and US-focused funds.

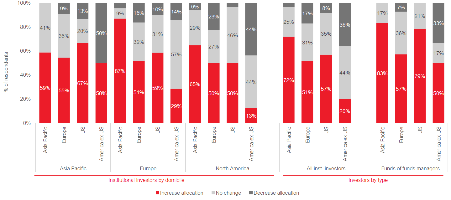

Coupled with the stronger economic recovery, investors remain confident of the Asia-Pacific’s long-term growth story. This is further affirmed in an ANREV survey, where most investors in North America and Europe plan to increase their allocations to Asia-Pacific over other regions.

Expected change in allocation over next two years, by region

Where does that leave us?

With a strong underlying investor interest and ultra-low interest rate environment, asset yield compression is on the cards. Interest rate and office yields in the Asia-Pacific are closely correlated, as our correlation study indicates. Interest rates in Australia and South Korea have a correlation of 0.86 with the average office yields in the Asia-Pacific between 2011 and 2020.

Expectedly, unspent capital as provided by PERE showed inverse relation to the yield trend. With prolonged low interest rates and incoming unused capital in 2021, we should expect competition to stiffen yields for Asia-Pacific assets.

According to PREQIN data, there is more than $43bn, a 6% year-on-year increase, of dry powder focusing on real estate investments in the Asia-Pacific. This capital is likely to find its way into the traditional asset classes such as office, logistics and niche sectors (cold storage, healthcare, lifestyle and rental housing) factoring in secular trends.

With a strong underlying investor interest and ultra-low interest rate environment, asset yield compression is on the cards

Additionally, ESG (environmental, social and governance) driven assets are likely to get to the front of the line. Based on the number of reports and surveys with respondents having ESG on their investment agenda, we can expect not only greater interest from investors in Europe and the US but also the Asia-Pacific.

The covid-19 pandemic, along with the continuing rise in economic loss arising from climate-influenced disasters in 2020 (Aon finds climate-influenced weather is key driver of $268bn global damage from 2020 natural disasters with 64% uninsured), have socially and politically motivated investors to review their investment mandates.

Enabling further integration of sustainability principles into our business and operations, ARA has recently formalised our sustainability policy. This comprehensive set of principles, policies and methods guides our operations within a sustainability framework and serves to enable the firm in managing our investors’ assets responsibly, making positive social impact and creating long-term value for our stakeholders. Our assets are also GRESB-rated for our participating REITs and private funds to meet the increasing expectations of our environmentally-conscious global and local investors.