Just as geopolitical headwinds eased in late January with a phase-one U.S./China trade deal and the U.K. formally leaving the European Union, worries about the Chinese coronavirus outbreak surged and the growing optimism on global growth dampened.

On the positive side, low inflation allowed the U.S. Federal Reserve and the European Central Bank to cut interest rates and provide monetary stimulus in 2019. This is still rippling through the global economy and boosting growth.

In the U.S., consumers are confident and the manufacturing downturn has eased, but overall growth is being held back by relatively low levels of business investment, largely due to lingering trade uncertainty. A rebound in capex may not occur until after the U.S. presidential election in November. CBRE forecasts U.S. GDP growth of around 2% in 2020, enough to generate moderate employment gains.

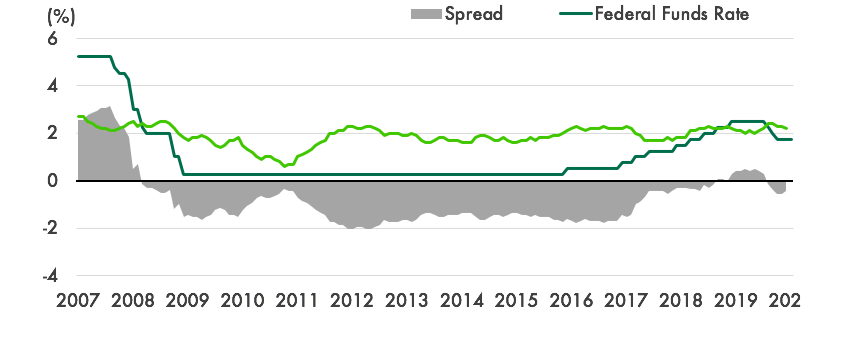

Despite a recent drop in core CPI inflation, real interest rates in the U.S. remain negative (Figure 1). This is good for real estate, although it is perplexing in a broader economic context. The Fed has put a hold on further policy rate reductions but has room to cut further if needed. Open-market operations have resumed. Fiscal policy will be neutral for growth in 2020 as the impact of earlier tax cuts eases. Further tax cuts are likely in 2021 if President Trump is reelected.

Figure 1: The U.S. Real Interest Rate Remains Negative

Source: Bureau of Labor Statistics, Federal Reserve, CBRE Research, January 2020.

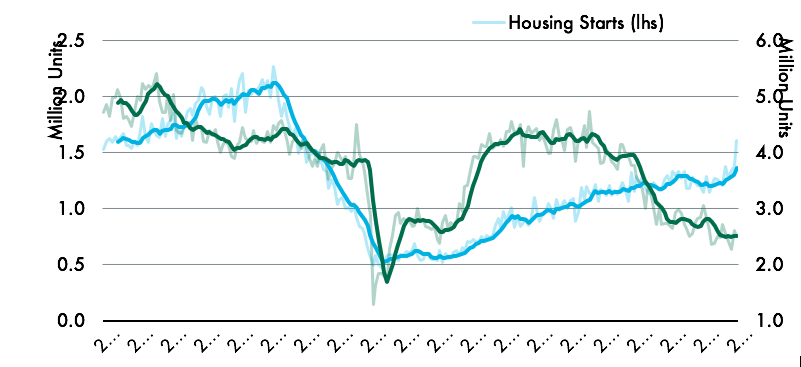

Manufacturing activity has stabilized in the U.S., including auto production that had declined for four years. Housing construction and sales are picking up with low mortgage rates and accelerating wage growth (Figure 2).

Figure 2: Housing and Auto Activities Pick Up

Source: Census Bureau, BEA, Macrobond, CBRE Research, January 2020.

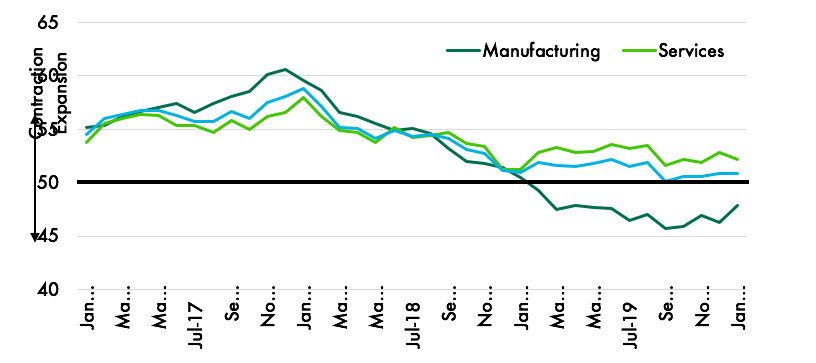

Europe continues to fend off recession risks. Growth slowed further in the Euro Area during the fourth quarter of 2019, attributed to strikes in France and political volatility in Italy. Nevertheless, business confidence has been largely restored in the manufacturing sector (Figure 3) as Germany stabilizes with rising manufacturing PMI and strong domestic demand. Based on healthy consumer confidence and employment, Germany’s real GDP growth is expected to exceed 1% in 2020. As some Brexit uncertainty lifts, the U.K. also can expect modest economic recovery in the next few quarters, but full-year growth likely will remain slow as the U.K. and EU work to hash out the terms of their future trade relationship.

Another potential upside lies in pro-growth fiscal policies in Europe, including Germany, where the budget is now in balance. Increased government spending will highly benefit the private sector.

Figure 3: Euro Area Markit Business Confidence Index

Source: Markit Business Survey, Macrobond, January 2020.

On the negative side, China’s economy has been affected by the outbreak of coronavirus, and the outlook depends on how soon the situation improves. China’s central bank has injected RMB500 billion, or US$71.5 billion into China’s banking system, with further stimulus such as rate cutting in the queue. The package can potentially deliver a modest pickup in activity but will mostly materialize after the public health crisis is over. The key is whether the services sector, which drives 59.4% of China’s GDP growth, will recover and resume growth in 2020.

We expect the Chinese economic trajectory to be largely affected like it was during the SARS epidemic of 2003, going through a loss of 2% growth over two quarters and then a bounce-back. It is too early to assess the overall impact on global growth, but presumably it will be relatively limited given increased work flexibility today. However, we note the potential negative impact of reduced Chinese tourist travel to global destinations.

We think that the economic positives still outweigh the negatives, but the coronavirus and the legacy of the U.S./China trade dispute mean that 2020 will have a weak first half and be a mildly weaker year than 2019. Moderate growth and low interest rates, as we have seen for the past 10 years, provide an environment in which real estate, particularly capital markets, can thrive.