Interest hikes are not always a smooth answer.

The inflation rate has been a recent ongoing hot topic of debate as more and more countries are experiencing a surge in consumer prices, according to the latest data. It is, however, an expected trend to see inflation decrease during a recession period and increase during expansions. A controlled inflation is regarded as a healthy measure of economic recovery, but what is currently happening is indicative of a potential recession, as inflation in many countries continues to be high and persistent. The aftermath of the pandemic had direct and indirect consequences that transformed our consumption habits, stressed the global supply chain and the economy in general.

Extreme outlier events, such as the ongoing Covid-19 pandemic, have a tendency to create a destabilising force throughout many socio-economic aspects of our life. Our behaviours and habits have sustained considerable changes that collectively impact long-term macroeconomic trends. The usual way when norms and social behaviour undergo transformations can be associated with some technological innovation that becomes a catalyst for change. Many changes observed recently were accelerated through government policy regarding public health, safety and economic assistance. These changes are seen in consumer habits, such as shopping preferences, living locations or work norms, such as online meetings vs work travel. The purpose of these policies was to target specific problems, such as lockdowns to combat the surging number of cases, economic assistance to combat rising unemployment and so on. Yet as one problem is tackled, another sprouts out like a game of Whac-A-Mole.

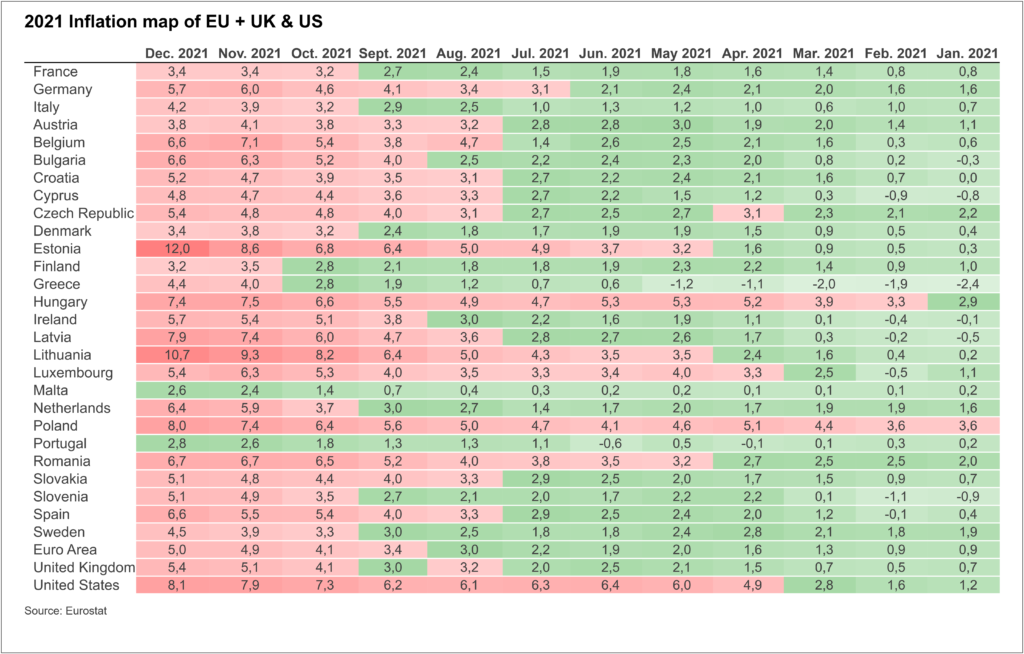

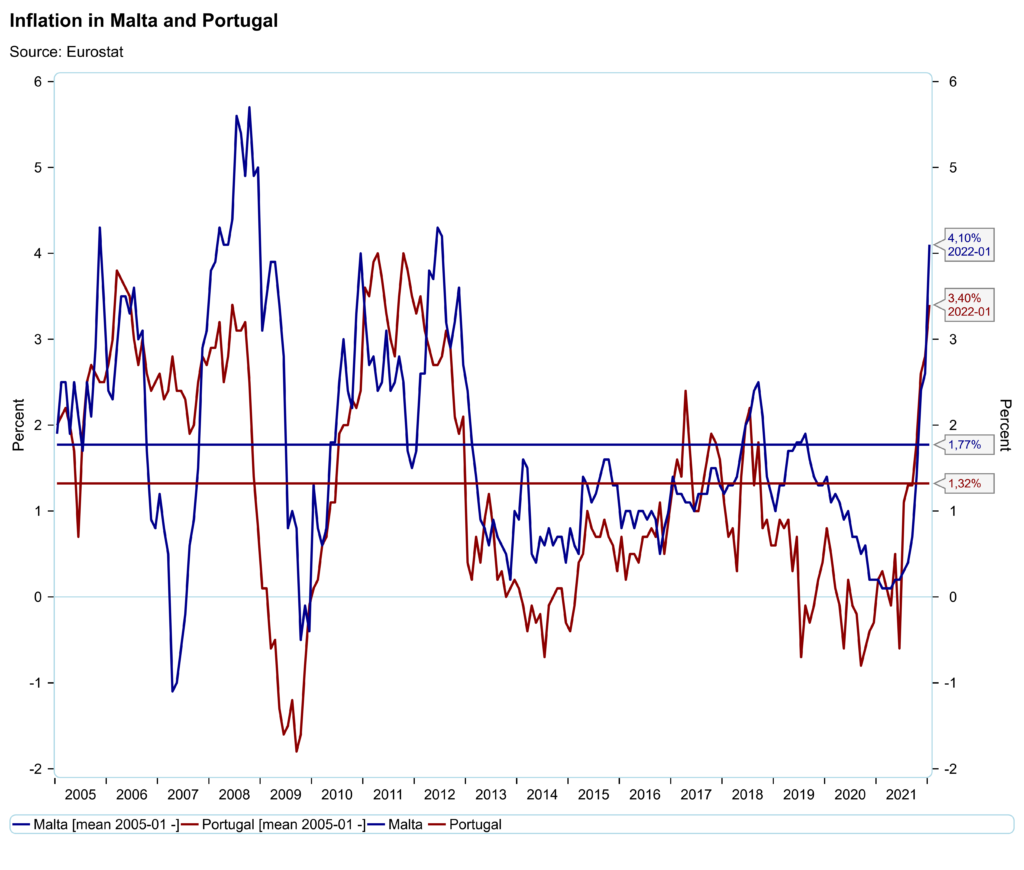

According to the heatmap chart, inflation started heating up in almost all countries in the list, closer to the end of the year 2021. Malta and Portugal were the only two countries that had an inflation rate below 3% at the time. Both countries, however, had a sustained increase since the beginning of 2021, when the inflation rate was still at 0.2%. A historical view of Portugal and Malta inflation rates, according to the time chart, is even more revealing. The January 2022 figures show a continued rise in inflation surpassing the average since 2005 of less than 2%.

One important instrument that central banks use to combat an increase in inflation is by hiking interest rates. The increase in borrowing cost is a traditional way of cooling down an overheated economy, but that comes with its own caveats. Such a move encourages more savings, rather than expenditures and investments, which in turn have negative impacts on stock markets and businesses in general. The risk of asset price bubbles occurring as a consequence of high and persistent inflation is becoming more probable. There were expectations that inflation would eventually slow down without the need for hiking interest rates, but that doesn’t seem to be the current perspective. It will be clear in the coming months how central banks are going to react to the persistent inflation rate and how many incremental interest rate hikes will follow.