The likes of LA, London and Mumbai are being challenged as consumer appetites becomes more global.

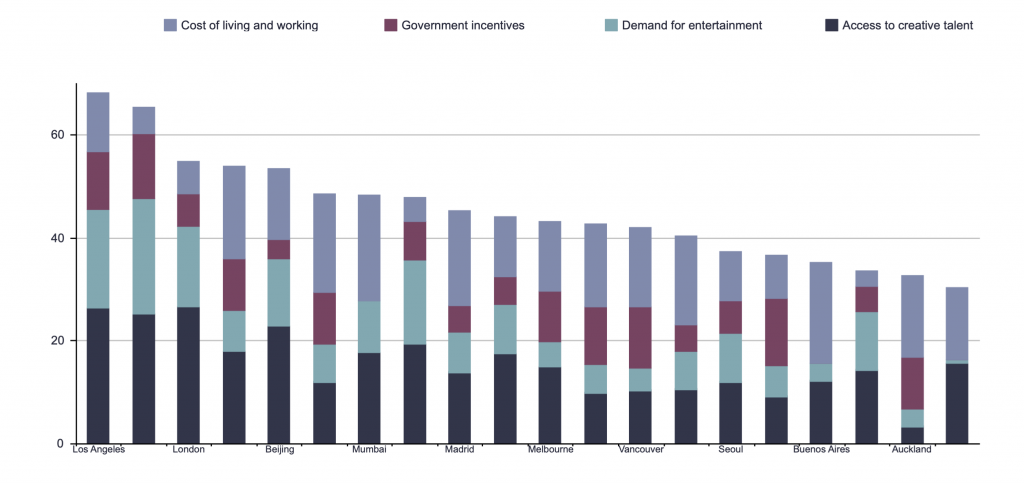

Media cities are hubs of creativity where films, television, and music are produced, edited, and consumed. A new analysis by Savills of media cities around the globe puts Los Angeles in the top spot – not surprisingly, given that it is the location of Hollywood and the centre of the US film industry. In second and third place respectively are New York City and London, thanks to their depth of creative talent, demand for entertainment, and relatively robust programme of government incentives.

Atlanta, Beijing, Mumbai (the home of Bollywood) and Paris fall just outside the top three, and beyond that new challenger locations are quickly establishing themselves, as audiences embrace content not produced in their native languages and the industry becomes increasingly globalised and democratised through technology.

Lagos, Buenos Aires and Dublin, ranked 20th, 17th and 16th respectively, are likely to rise up the ranks in coming years. Looking further ahead, Singapore, Cape Town, Albuquerque, Manchester (in the UK) and Changsha, Hengdian and Xiangshan (in China) are locations not yet ranked, but which are also likely to benefit from the expanding globalised landscape.

Media city rankings

With continuing covid-19 restrictions making the live consumption of media and cultural content difficult, consumers have turned to streaming services to a growing degree. As a result, productions that used to be considered too regional or niche can now be viewed by increasingly global audiences who previously might not have been exposed to such content. The various Korean language series known as K-dramas that are being streamed on many non-Korean speaking versions of Netflix are an example. This trend will diversify production to areas outside the traditional core media cities.

Rocketing demand for content this year and the increasing importance of technology are both having profound effects on how and where media is produced. Traditional core locations still lead the industry but that will change, as a more globalised media industry allows challenger cities in a wealth of new geographies to build a media sector, increasing content for consumers and industry resilience.

Studio costs and availability, prime office rents, and the cost of living all factor into decisions about where media companies choose to locate both production and office space. Although high living costs can be a deterrent for potential employees, that is balanced out by the fact that many of the most expensive cities offer a wealth of creative opportunities. Among the top 20 media cities, New York has the highest cost of living, and Mumbai the lowest. Beijing (ranked fifth in Savills’ analysis), Montreal (sixth) and Madrid (seventh) all appear near the bottom of the table for living costs, implying that they could rise up the rankings if the cost of living for creative talent becomes a more important factor in media production.

The industry is shifting towards production companies’ long-term control of soundstages and production lots rather than renting out space as needed for a project’s duration. Netflix has signed a production deal with Shepperton Studios in the UK and purchased ABQ Studios in New Mexico in an effort to grow its production capability, for instance. New studio space is scarce in Los Angeles, pushing many production companies further afield, while in London, New York, Atlanta and New Zealand disused industrial warehouses and distribution facilities are being converted into studios to meet demand. More innovative use of space is set to be one of the key trends in the sector over the next decade, alongside expansion into areas with low real estate costs but where but creative and tech talent are present.