Over just a few months, Covid-19 has disrupted almost every corner of the globe. In the residential market, this has led to transaction numbers drawing to a standstill in many countries as lockdown measures prevent sales. In Savills Research, we have carried out a sentiment survey of Savills global residential network to assess how Covid-19 is changing the residential property market.

Current Market Sentiment

When asked what proportion of buyers that are still looking and will travel as soon as lockdown is lifted versus those who have put their plans on hold for the time being, there was a fairly even distribution for both. Some markets such as Lake Como in Italy have found more buyers have put plans on hold for a period. Others are still looking and will travel as soon as lockdown is lifted, such as the majority of buyers in the South West of France where there is a

One clear trend is that, whether buyers are planning to look straight after lockdown or will pause briefly, very few buyers are stopping their search altogether. Over 90% of respondents stated that 30% or fewer of their buyer have stopped looking altogether.

Price reductions are topical at the moment and the majority of respondents stated that a high proportion of their buyers expect to get a lower price than before the lockdown. This is particularly noticeable in countries like Spain which have seen severe lockdowns and where there is more available stock. There are a few exceptions; in some luxury second home hotspots including the French Riviera, very few buyers are expecting a lower price.

As well as very few buyers withdrawing from the market altogether, the survey highlighted that only 6% of respondents are seeing vendors considering taking a property off the market or have already done so. The remaining vendors are broadly split into two categories: those who have or are considering lowering prices and those who are keeping their property on the market for the same price.

Long Term Impact of Covid-19

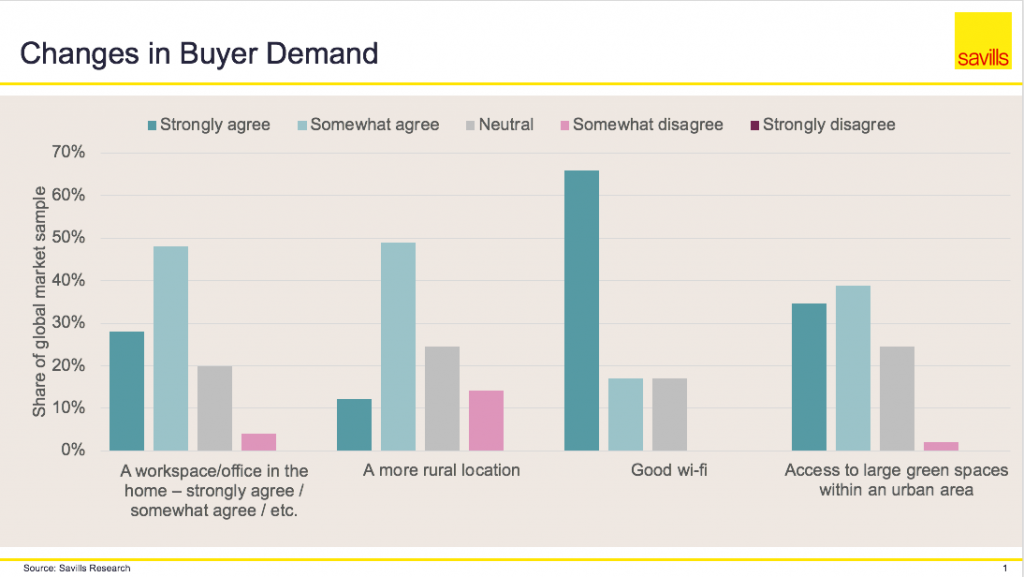

One of the impacts of the lockdowns in various countries is that people are spending significantly more time in their homes. This time is allowing households to dwell on what they need in a home, particularly in a post Covid-19 world. An increase in homeworking after Covid-19, which is expected by 86% of respondents, is likely to have a direct impact on the residential market as buyers shift priorities. Three quarters of respondents believe that demand for a home office will increase, and 83% believe that good Wi-Fi will be a priority for buyers going forward.

Green space in its various forms is also marked as a priority for buyers with 73% of respondents agreeing that demand for a green spaces for urban buyers will increase. A further 61% of respondents believe that demand in rural areas will be on the rise. These design and location desires are factors that developers across the world will need to take into account when designing the homes of the future.

Changing Buyer Demand

Will the long term impacts of Covid-19 increase buyer demand in your region for the following?

About the Survey

The Savills Residential Sentiment Survey is designed to take the pulse of residential property markets worldwide which is important in today’s fast-paced environment. The findings provide a snapshot of current market conditions and future trends based on an internal survey of 50 experts across the Savills global residential network. The results displayed are an aggregate of all replies, unless otherwise stated.

The survey was conducted on 20th to 24thApril 2020. Responses come from markets within the following countries: Austria, Bahrain, Barbados, Cayman Islands, Croatia, Cyprus, Czech Republic, Egypt, France, Greece, India, Italy, Monaco, Montenegro, Oman, Portugal, Russia, Spain, Switzerland, The Bahamas, United Arab Emirates, and the United States.