At our recent Economic Perspectives breakfast seminar, ‘Who saves the world from 2020 peril?’, I identified three bear scenarios for the global economy and financial markets. While the threats to prosperity and tranquillity that they represent are distinct, they are clearly not mutually exclusive. Bears can’t resist a picnic. The first bear, whose focus is advanced economy government and highly-rated corporate and financial bonds, concerns the Inconvenient Threat. The second bear, with illiquid equities in mind, is the Avoidable Threat. The third and most frightening bear, lurking in corporate credit and other contexts of sub-prime credit, is the Unavoidable Threat.

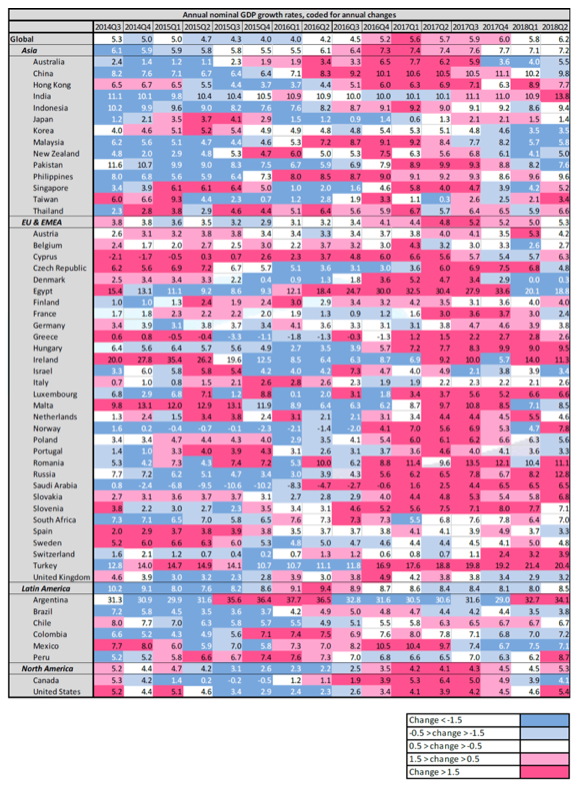

Figure 1

The Inconvenient Threat is posed by the persistence of nominal global economic growth, especially, but not exclusively in the U.S. Our global GDP heat maps (Figure 1), confirm that nominal GDP grew by 6.2% over the past year, with inflation making a larger contribution most recently. The advance estimate for U.S. nominal growth in the year to Q3 was 5.5%; China’s reported Q3 growth was 9.6%. If nominal growth remains stronger for longer, then the whole term structure of interest rates will push higher, defying conventional wisdom. In extremis, government bond yields will spike as leveraged bond investors are compelled to exit their poorly-performing positions. This is a bear scenario that could snuff out the global economic recovery.

The Avoidable Threat concerns the planned cessation of bond purchases by the ECB, the silent tapering of purchases by the Bank of Japan and the outright liquidation of bonds by the U.S. Federal Reserve. The rhetoric of the central banks is that the removal of a thick slice of banks’ excess reserves is unlikely to have a market impact. Many market participants and former policymakers beg to differ, citing the tough regulatory liquidity requirements and the risk that access to liquidity for some borrowers would be constricted far sooner than the authorities expect. The evaporation of market liquidity could lead to asset fire sales, particularly in emerging markets. The good news is that central bankers could abandon the policy at a moment’s notice and turn on the taps.

The Unavoidable Threat is that rising interest rates will collide with a massive requirement to refinance corporate debt, causing a sudden re-pricing of all sub-prime bonds. The tide of retail and institutional flows reaching for high-yielding corporate bonds will reverse, exposing some embarrassing liquidity mis-matches. The sharp fall in the share prices of leading U.S. fund management groups may already be factoring in this liquidity risk. Corporate credit spreads will widen and default experiences will multiply. Corporate investment will plunge and share buybacks will come to an end. Join the dots.

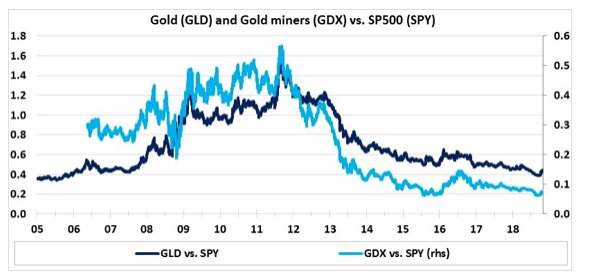

Figure 2. Data source: Thomson Reuters Datastream

The maturing of these three bear market threats, either sequentially or simultaneously, would present a vexing challenge to wealth preservation. In the search for an uncorrelated asset, beaten-up, beaten-down gold equities (see figure 2) deserve a reappraisal.