Are criminals rational? In his groundbreaking work of 1968, Gary Becker argued that they are. The American economist, who would go on to win the Nobel prize in economics in 1992, theorised that individuals engage in crime only if the returns are greater than the returns from engaging in legal activities, after you factor in the risk of being caught.

This has been largely supported by empirical evidence. But one aspect of Becker’s model which has proven difficult to confirm is whether criminal activity is sensitive to changes in the financial returns from crime. This is mostly because those returns are themselves affected by criminal activity.

For example, when more phones are stolen, the supply of stolen phones increases and their retail value drops, which makes them less attractive to steal. Since the price affects the burglaries as well as the burglaries affecting the price, it can be difficult for researchers to empirically assess the extent to which each is affecting the other.

One way around this problem is to look at a commodity whose price won’t be affected by how much is stolen by criminals. We chose gold. The question our research asked was: how does the gold price affect the rate of burglary in England and Wales?

The burglary business

Jewellery is only stolen in 7% of burglaries. This is according to the Crime Survey for England and Wales (CSEW), which also says that these types of burglaries are perceived as more serious by the victims than other types. No doubt this is partially because of the sentimental value associated with some of the jewellery, but also because of its financial value.

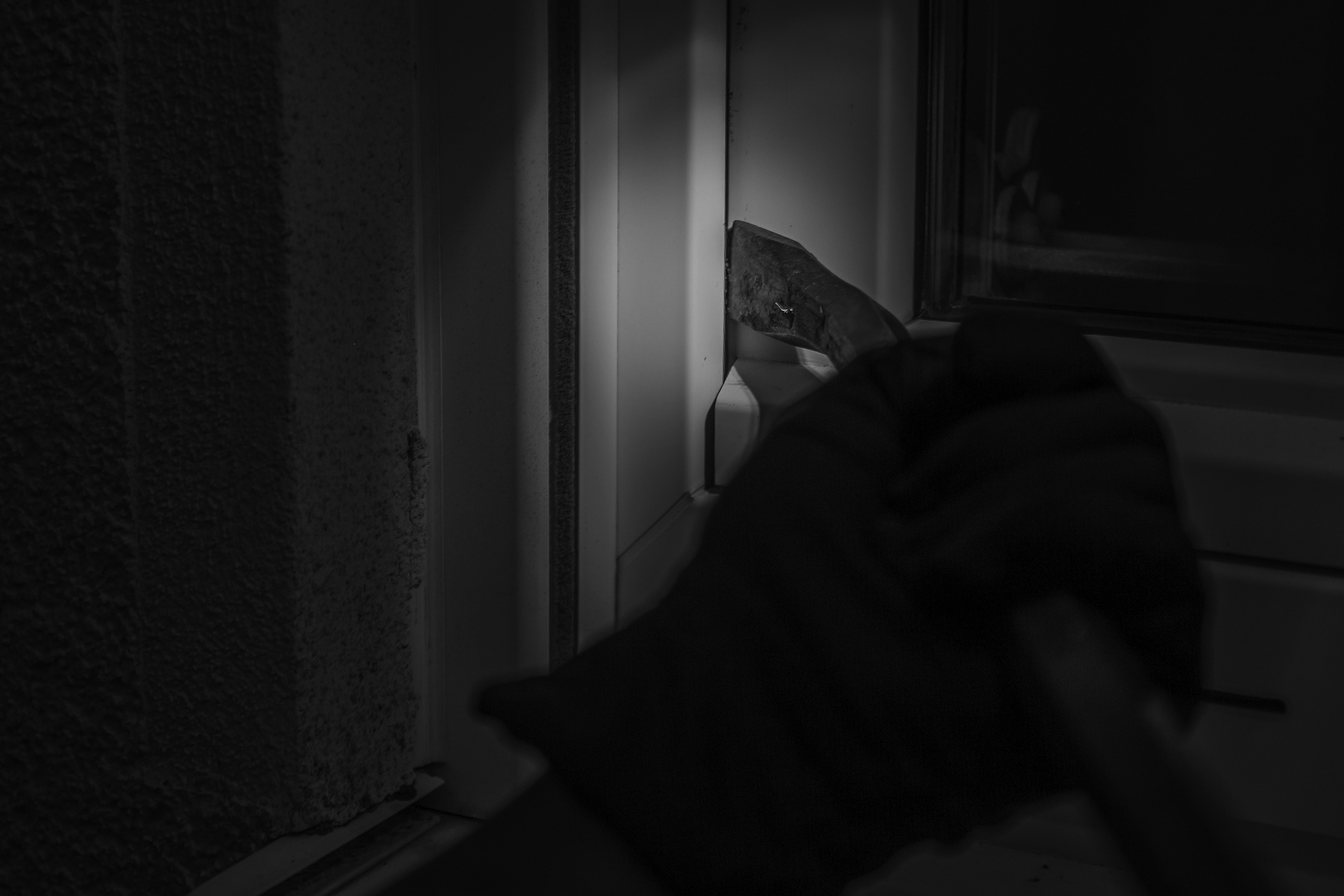

Anecdotal evidence, supported by the CSEW, suggests that south Asian households are more likely to store gold jewellery, in some cases as a way of saving, though also for cultural reasons. This means that when the price of gold goes up, the returns from burgling a south Asian household will go up too. You might therefore expect the rational burglar to disproportionately target these households when the gold price is higher.

It might not be easy for these burglars to recognise a house as belonging to a south Asian family, but they will know which neighbourhoods tend to be popular with this ethnic group. So we should expect that when the price of gold goes up, burglars may become more active in neighbourhoods with a greater share of south Asian families.

Using detailed crime data at the neighbourhood level for the period 2011-19, we tested this hypothesis by comparing burglary rates in neighbourhoods with a relatively high share of south Asian households and neighbourhoods with a lower share. To make the comparison more pertinent, we only compared neighbourhoods within the same local authority, contrasting periods in which the gold price was low to when it was high.

What we consistently found was that burglaries increase when the price of gold surges. A 10% increase in the price of gold increases the burglary rate by an average of 1.5%. In south Asian neighbourhoods, however, burglaries increase by 3.4%.

The wider economy

You might be thinking that burglars aren’t responding to the gold price but to economic conditions more generally, but this is an unlikely explanation. There certainly is a link between burglary rates and economic conditions. For example, when unemployment rises, there are more burglaries everywhere.

But by comparing neighbourhoods within the same local authority, we found it was only neighbourhoods with a higher share of Asian households that saw a larger increase in the rate of burglaries when the price of gold increased. We also found that the location of other crimes was unaffected by variations in the gold price.

In any case, gold and the economy are not especially well correlated. The price of gold is determined by global supply and demand rather than economic conditions in the UK.

Finally, we showed that variations in the price of gold drive up the burglary rate in general. So it’s not just a case of burglars relocating their activities to neighbourhoods with a higher share of south Asian households. When gold is more valuable there are more burglaries, and disproportionately more in south Asian neighbourhoods.

Our results seem to confirm that burglars act rationally and redirect their efforts towards neighbourhoods with higher returns when the reward is greater. If police forces allocate more resources to visible police patrols in areas rich in potential targets when the price of gold or some other valuable commodity is high, it may prove a successful deterrent. Additionally, it might be helpful to introduce policies making it more difficult to resell jewellery.

To end on a positive, the gold price is around 20% down from the highs of the past couple of years. So long as that continues, the temptation to burglars should at least be slightly less than it was before.

Arnaud Chevalier, Professor of Economics, Royal Holloway University of London; Nils Braakmann, Professor of Economics, Newcastle University, and Tanya Wilson, Lecturer in Economics, University of Glasgow

This article is republished from The Conversation under a Creative Commons license. Read the original article.