WeWork’s ill-fated IPO is the tip of an iceberg

WeWork revenue and operating losses and ‘valuation’ (US$)

Riddle me this. We eat $229,000 every hour, every day, year after year. We are in nearly 500 places at the same time. We lose a dollar for every dollar of revenue taken. We have a mission to ‘raise the world’s consciousness’ and a CEO-founder whose ambition is to be the world’s first ‘immortal trillionaire’.

What are we?

The answer, of course, is co-working landlord The We Company – better known as WeWork.

‘We’ is a unicorn: a private start-up business worth over a billion dollars. It is the largest private tenant in New York. In London, only Her Majesty’s government rents more space.

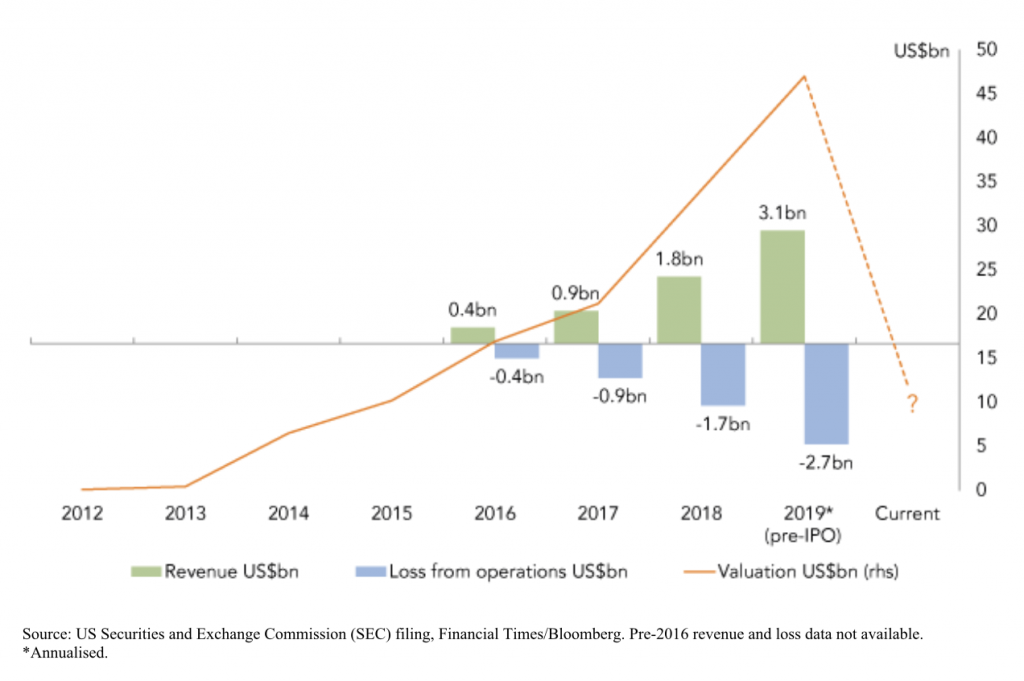

This month’s chart plots WeWork’s recent revenues against operational losses, overlaid by its implied valuation. Revenues have been growing rapidly, doubling most years since the firm’s foundation in 2010. Operational losses have grown just as fast. But in an ultra-low interest rate world, rapid growth – the implicit promise of future profitability – has been prized above all else. Unicorn losses are considered down payments on Amazon-sized prizes at the end of the rainbow.

Speedy expansion earned We a colossal valuation in private markets. Japanese giant SoftBank, We’s biggest investor, injected money earlier this year at a $47 billion valuation. But being a greedy beast, WeWork needed to raise another$3 billion in an IPO (initial public offering) this year to unlock a further $6 billion in bank loans – just to keep going. Only weeks ago, leading bankers were suggesting an IPO valuation of $67 billion.

In private markets, a small group of investors can mark their own homework. That’s harder in public markets, and WeWork’s stratospheric valuation has just been gored by reality.

That’s not all. WeWork has a business model that looks dubious even in benign conditions. It takes long-term office leases and sub-lets them to start-ups and businesses shorter-term. If it’s not profitable now, what happens when a recession hits and WeWork is left with long-term leases but no tenants?

Unsurprisingly, having collapsed to an estimated $10 billion valuation, WeWork cancelled their IPO. But WeWork is only one of a stable of household names to take the plunge – literally – with IPOs this year (loss-making ride-hailers Lyft and Uber are down 47% and 35% since their respective 2019 flotations).

Back in June, we highlighted the record number of loss- making businesses being floated on public markets – a triumph of hype and low rates.

The good news for those not keen to pay tech multiples for property businesses, there’s plenty else to buy. $47 billion would buy you Tesco, Britain’s largest supermarket, plus Land Securities, the UK’s biggest commercial property developer. And that would still leave change to buy broadcaster ITV, IT security firm Sophos and recovering retailer Dixons Carphone. As it happens, we’ve got a bit of all of them. At Ruffer, we prefer profits to promises and seek always to avoid market manias.

The zero-interest rate world has wrought extreme distortions across the financial landscape, of which WeWork is simply the tip of the iceberg. Our bet is that the easy money era will not have a fairy-tale ending and we are positioned accordingly.

Disclaimer: Past performance is not a guide to future performance, investments can go down as well as up and you may get back less than you originally invested. The information contained in this document does not constitute investment advice or research and should not be used as the basis of any investment decision. References to specific securities are included for the purpose of illustrationonly, they are not a recommendation to buy or sell. Ruffer LLP is authorised and regulated by the Financial Conduct Authority.