More join the “healthcare is the jobmaker” chorus, but there’s more than just ‘told you so’.

- healthcare jobs replaced all the manufacturing jobs (much to the benefit of women and aides)

- KKR confirms that, yes, healthcare is the money-maker, but there’s more to it than that

- ADP says employee morale is . . . exactly the same, and again, green shoots

- manufacturing, actually on the march?

I’d like to be wrong on this at some point, but there is yet another entry in the ‘turns out that Random Walk was correct—healthcare does, in fact, make all the jobs’ series.

‘The rise of healthcare jobs’ or how healthcare replaced manufacturing in the overall labor market

This time it’s a research paper titled The Rise of Healthcare Jobs.

It’s chock full of interesting observations about, well, the rise of healthcare jobs, and the outsized share healthcare plays in the overall employment picture (which has been a multi-decade trend, albeit much more so, recently).

Among other things:

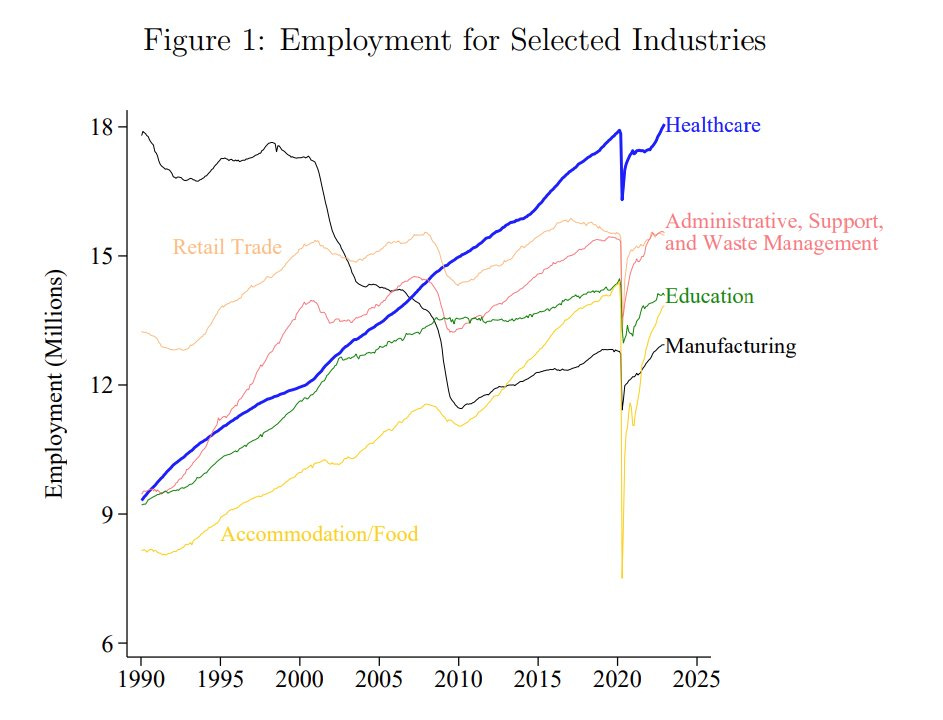

Healthcare jobs have largely replaced manufacturing jobs (but the benefits have inured primarily to women):

There are ~5M fewer manufacturing jobs since 2000 and there are ~5M more healthcare jobs, over the same period.

The paper does test the “manufacturing to meds” hypothesis, i.e. that a higher share of manufacturing jobs would predict a higher share of healthcare jobs, but finds the evidence lacking (with some exceptions). The evidence is more consistent with broader demographic and economic shifts than a deliberate strategy to convert a manufacturing base into a healthcare one.

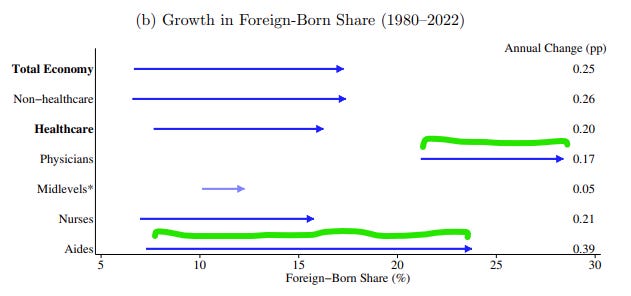

The “foreign born” share of healthcare aides specifically grew vary rapidly (and exceeds what the overall share of foreign-born workers would predict):

Aides went from ~7% foreign born to ~24% since 1980 (and this excludes 2023-24, which had very high inflows of “foreign born” workers).

The annual change is about 50% more than what the overall change in the foreign born share would predict. So, perhaps instead of Uncle Sam’s Immigrant Nursing Brigade, we call it Uncle Sam’s Immigrants Aides Brigade?

Perhaps not.

Anyways, I’ve laid out the implications of this more times than I can count or backlink. The tl;dr is that the “strength” of our economy is largely a demographic and deficit-financed rotation to a national nursing home, driven in substantial part by low-wage foreign-born service workers.

It’s not the rosiest picture to begin with, but also, if not healthcare, then what?

It’s a really good question that almost no one was asking, until very recently.

KKR says, “can confirm, healthcare is driving most of the job gains”

I would note, for the sake of completeness, that KKR has joined the party, as well:

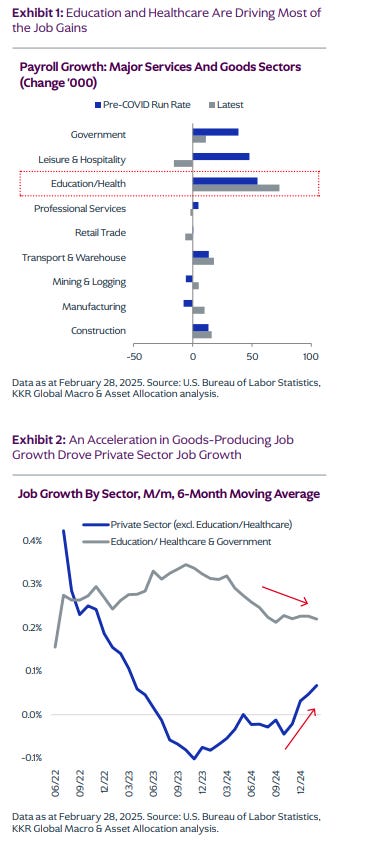

Healthcare has been the massive (and above-trend) driver of the great post-covid job catch-up.

And it’s slowing down (and has been slowing down, for the better part of a year). The good news is that “goods producers,” like manufacturing and construction actually started to improve a bit towards the end of last year.

Hopefully it sticks.

ADP finds that workers are decently motivated

I’m never sure what to make of this stuff, but ADP has a “motivation and commitment” index, and it says “employees are freaking out.”

No, just kidding.

Fortunately, the Great Tariff Uncertainty Crisis appears to be mostly fake (or, at least, more specious-than-not).

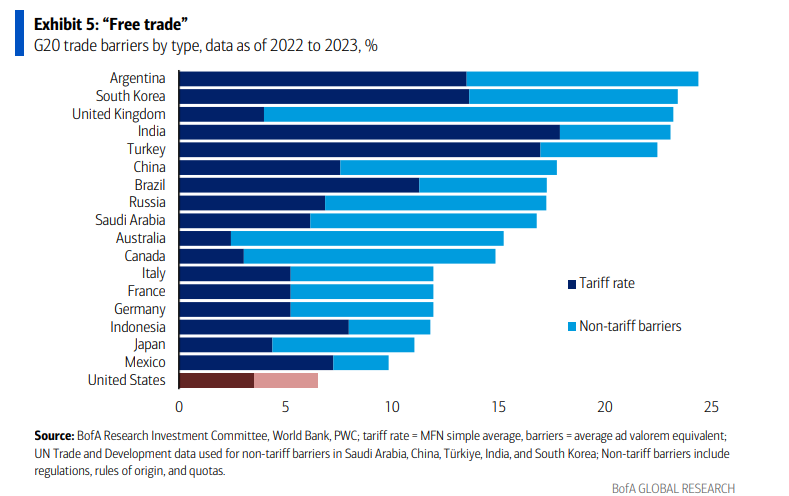

Argh, why did Trump start this trade war?

And by “start” it, I mean that actually pretty much everyone else started it.

I’m still not a fan of tariffs, in the main, but I really hate bad faith teeth-gnashing and histrionics.

But back to employee motivation.

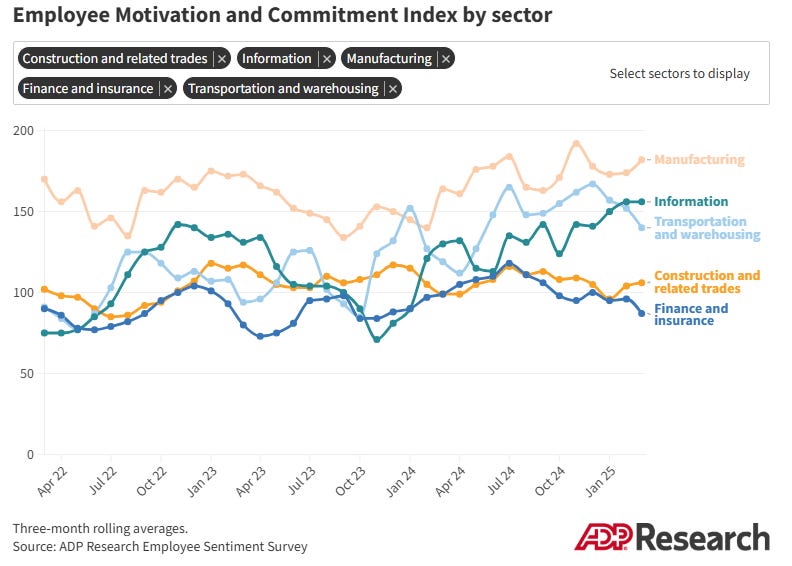

ADP’s Employee Motivation and Commitment index did tick down slightly, but basically it’s the same as it’s been since April ‘24

Employee sentiment has hovered between 129 and 124 (whatever that means) since the Spring of last year.

But, especially manufacturing workers?

I bring this up to show that (a) again, the Great Tariff Uncertainty Crisis has not actually manifested in much, if any, meaningful change; and (b) this little nugget about manufacturing and construction workers, specifically.

Look who’s feeling especially chipper this time around:

Construction and Manufacturing sentiment actually improved, recently.

That’s a bit surprising (and certainly surprising for the Great Tariff Uncertainty Crisis), but good news, I guess.

My guess, though, is that this sentiment is probably lagging some of the year-end exuberance (that has since tapered), but I don’t really know.

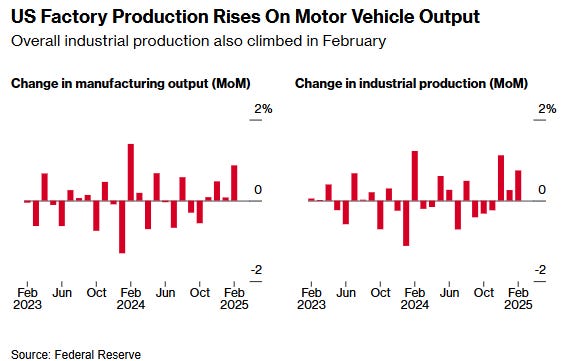

For what it’s worth, the Fed’s measure of manufacturing output did see a pretty big jump in February:

Both industrial and manufacturing outputs far-exceeded expectations for February.

Again, this MoM wiggles are hard to trust, but maybe manufacturing is really getting some pep in its step? Wouldn’t that be something. Or maybe it’s front-running tariffs, or maybe it’s just noise.

It’s definitely worth watching, however.

This article was originally published in Random Walk and is republished here with permission.