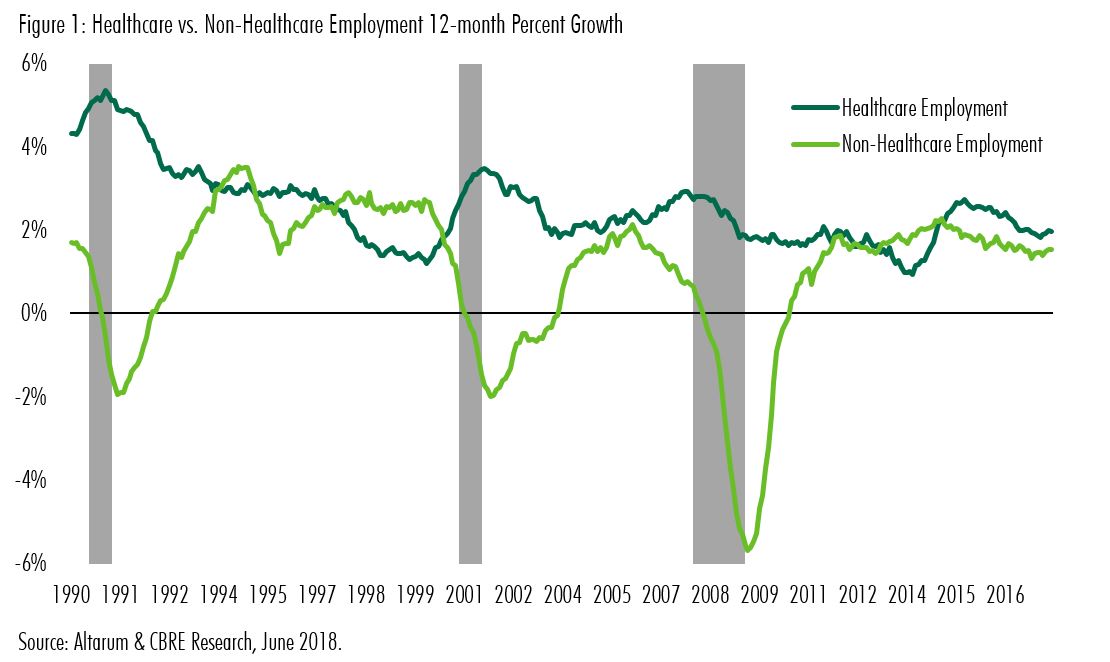

Employment growth is one of the key indicators of the economic cycle in the U.S. It drops off just ahead of a recession, falls to negative in the trough and bounces back in recovery. Most industries follow this pattern, except for one – healthcare.

U.S. healthcare employment has grown continuously since 1990. From 7% of the total employment in 1990, it has grown to contribute 16 million jobs, or 11% of the U.S. job market, officially the strongest job generator in the economy.

More interestingly, in the last three downturns, healthcare employment growth has actually accelerated as the economy has slowed (Figure 1). This is not a deliberate act of economic policy. It reflects the fact that public and private healthcare improvements can be made when the public finances are good and these initiatives have a lagged impact. However, healthcare in recent times has played a significant role stabilizing the economy through difficult times.

Will healthcare employment surge during the next recession? We think there is a reasonable chance that it will, although its depends a little on how the current debate on the public finances plays out. Nevertheless, unshakable fundamentals including the aging U.S. population and rapidly advancing medical technology will continue to drive the healthcare economy forward. By 2022, over one third of the U.S. population will be older than 55. The healthcare and social assistance sector will add the largest number of jobs in the run-up to that date, according to the Bureau of Labor Statistics.

What does it mean for commercial real estate investing?

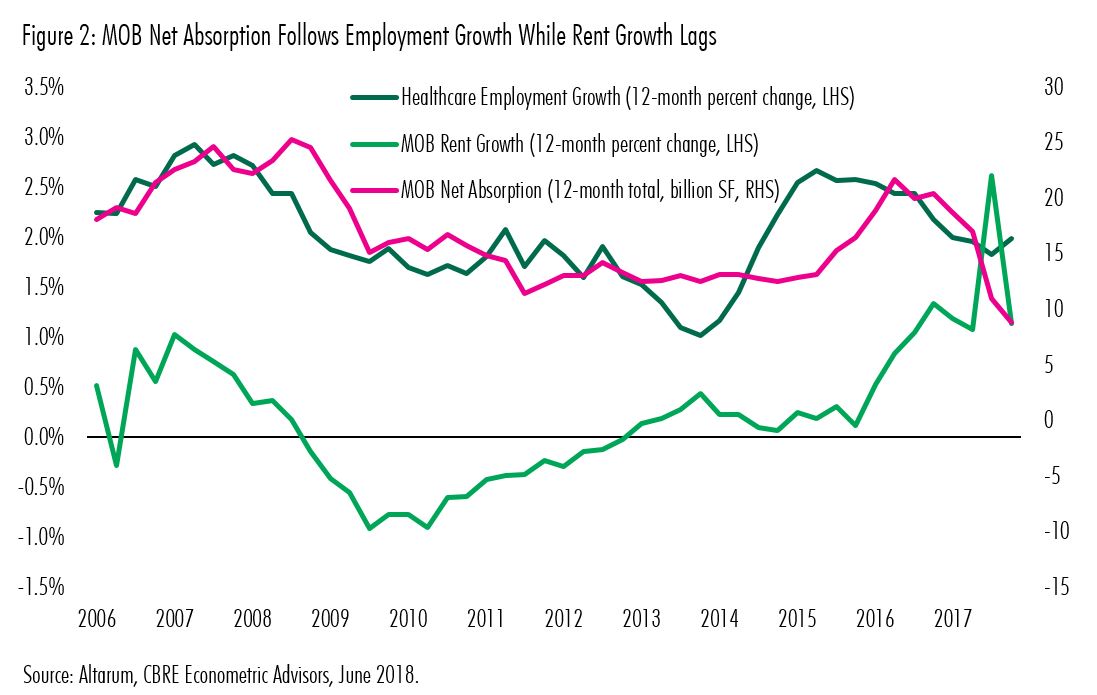

Like healthcare employment, the net absorption of medical office buildings (MOB) never goes negative, or at least, it has not done so for the period in which we have data. Figure 2 shows that the net absorption of medical offices correlates quite closely with healthcare employment growth. MOB rent growth is more volatile than net absorption with some periods of rental falls but the relatively modest rent growth enabled healthcare businesses to nurture growth and create more jobs. Most importantly, from an investment perspective, positive net absorption points to stable and consistent cash flows, including during recessions!

Of course, healthcare real estate, medical offices in particular, is not any old asset. It needs to be managed sensitively, with due regard to the vision and mission of healthcare providers which are rarely focused on profit alone. Indeed, professional real estate managers have much to contribute to the healthcare system as it seeks to utilize its valuable real estate to the best effect.

Nevertheless, as we see development completions increasing in all the main property types, and interest rates rising, we think investors should include medical office and healthcare real estate in their general plans because of its apparent counter-cyclical characters and admirable long-term fundamentals.