What do investors want right now? What are their preferred opportunities, and what do you need to know about them? This series sums up what one investment adviser has gathered from roadshows, conferences

Heard in Paris during a conference by the CEO of a leading global property asset manager: “The current 2.5% to 3% pricing for prime offices does not work for us. For this part of the market, we will do development and value-added acquisition but no core strategies for core offices” – a remark that confirmed this CEO’s reputation as having a blunt, straightforward personality. In front of a large real estate audience, the point was made clear: most of the classic investors (funds, asset managers and listed property companies) are not involved in prime offices. This market is instead driven by a small group of pension funds and insurance companies and also by some families. In this context, for core strategies, the asset managers’ preferred sectors for 2020 are likely to remain industrial, alternative and residential, not offices.

Heard during MAPIC in Cannes, where the retail property industry gets together in November: “Are you aware that company A is preparing a mega portfolio disposal?” … “I have learnt that the 2019 published footfall is going to be the highest growth rate of the last ten years” …

“Company B will not launch its landmark shopping centre development – I have been told” … “Company C has no other choice than a highly discounted rights issue and it is going to hurt.”

I will be able to quote much more of such retail-related gossip, as I am finding that many investors, advisers and brokers are now sharing with me gossip as well as facts. In my view, this is due to the high level of uncertainty in the asset class as well as, to a certain extent, a spirit of revenge.

Market participants are keen to focus on the issues now facing the former sector leaders. Retail experienced a golden age when both offices and industrial went through ups and downs. Now it is the time for retail to experience a tough environment. I won’t comment here on the potential shopping centre mega-deal that has been creating plenty of attention (not unlike the Monster of Loch Ness – of which, too, everybody has their own version).

The only public news that makes a difference for the shopping centre sector is the statement from Aermont Capital, the opportunistic fund run by former Unibail CEO Léon Bressler, which invested around €400m in Unibail-Rodamco-Westfield stock in November. But there have been very few discussions about that: it is a fact, not gossip, and it is pretty positive news.

Heard in various forms across several European cities: “Our biggest competitor on this transaction was a Belgian group that we did not know very well” … “Brussels seems to be the upcoming hub for investors in alternative assets like healthcare or student housing.” Belgium is often seen as just good for chocolate and beer, not the obvious strategic place for real estate, but 2019 was an incredible vintage for its listed property sector. I see three noteworthy points. First, 70% of the market cap of the sector is industrial and alternatives (healthcare and student housing). Second, these companies have raised €1.4bn of new equity in 2019, through ABB, rights issues and contribution in kind paid in new shares. Since 2015, they have raised between €150m and €450m a year. Third, these companies are genuinely pan-European.

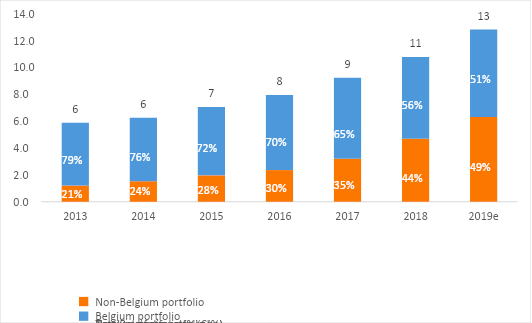

The chart below shows the evolution of the portfolios of Belgian property companies, with a distinction made between their assets inside and outside Belgium. Property values recognised in balance sheets have risen, thanks to a valuation effect as well as an asset rotation (investment/divestment) effect. Belgian property companies have traditionally invested mostly in Belgium as well as occasionally in neighbouring and culturally similar countries (the Netherlands, Germany, France, Luxembourg). But 2019 saw them carrying out deals in the UK, Nordic countries and Spain. The total assets held by Belgian property companies are expected to exceed a value of €13bn in 2020 and be located mostly outside Belgium.

Figure 1: Property portfolio breakdown across 16 Belgian listed

Source: VIEWS+S based on annual reports