Recovery will take more than street parties and more bins.

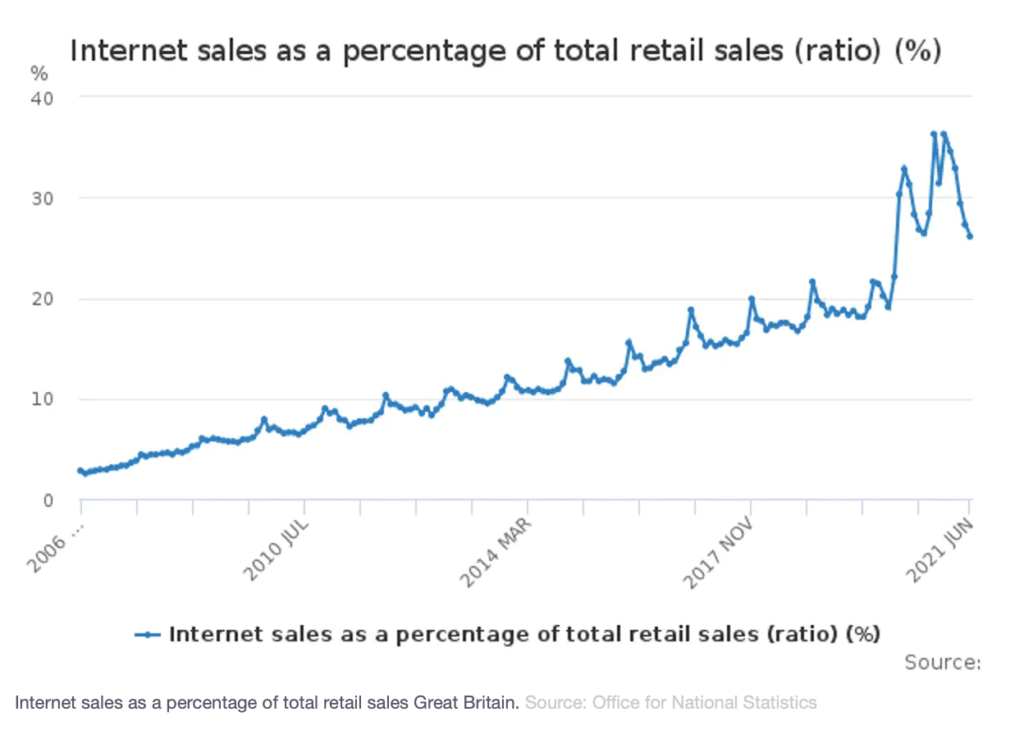

For politicians and pundits, the death of the British high street has long been a refrain. The pandemic has accelerated the existing trend towards online shopping.

In its recently published ‘levelling-up’ plan for post-pandemic recovery, the UK Government sets the context for its new high-street strategy for England. The big question is: will it work?

The markers the Government has used to determine declining high-street performance – falling sales, vacant retail units, fewer shoppers, attractions and activities – are not new. In 2010, when the Government appointed retailer and broadcaster Mary Portas to solve the high-street problem, in the wake of the global recession, she focused on supporting retailers.

But retail is only part of it. As Scotland’s 2012-13 national review of town centres showed, high streets are places embedded in, and reflective of, local communities. The health of the high street mirrors the economic, social and cultural wellbeing of the people it serves.

Pandemic impact

While Covid has seen a dramatic rise in online sales, local stores gained sales too during lockdown, as consumers explored their local areas. Food retail, in particular, mopped up trade from the closed hospitality sector.

Non-essential retail, however, was badly hit. This negatively affected high streets and town centres.

With restrictions easing, the trends have begun to reverse. High streets have opened up once again and consumer spending is on the rise. However, and despite what the headlines might suggest, the high-street picture is just as patchy as it was before the pandemic.

Since Portas, there have been numerous reports on high-street health, arguing variously for a more digital approach and greater financial support.

Major Government investment has been channelled into English high streets, but not without controversy. The perceived politicisation of the allocations has led to accusations that the funding has been directed to Conservative constituency towns and not based on identified need.

Recovery strategy

The government’s new ‘build back better’ high street strategy lays out five priorities: breathe new life into empty buildings, support high-street businesses, improve the public realm, create safe and clean spaces, and celebrate pride in local communities.

It is hard to discern what is new in all this and what the government’s real commitments are. For a strategy aimed at, as it states on page three, ‘clearing away pointless red tape’, it is heavy on reviews to be undertaken and guidelines, codes and manuals to be adhered to. Requesting local communities come together on what it calls a National High Streets Day to ‘clean up their high street’ seems unlikely to be widely embraced.

The strategy does contain some welcome elements. It focuses on tackling empty buildings and freeing up space on pavements and roads for cafes and restaurants to add vibrancy. It highlights the need for more green space and increased investment in historic buildings.

Conversely, it has very little to say on the fundamental issues consistently highlighted since the Portas review: business rates and operational costs; the inequality of car-parking charges between town centres and out-of-town developments; the costs related to other modes of transport and access.

It does not address ownership models for retail spaces, or the wider costs and logistics of operating on the high street. And it does not mention support for the local independent businesses hit by the pandemic.

Instead, it lays out controversial ways in which the Government is relaxing (and seeking to further relax) planning and building-use regulations. This risks encouraging substandard, purely profit-driven developments and squeezing out smaller businesses.

Will it work?

The strategy gives little detail about how its recommendations should be implemented. Providing money to local authorities does not necessarily empower communities. Beyond noting the need for an emotional connection between people and place, however, the plan is silent about how to include and engage those communities.

Research has highlighted several crucial needs: focused spending on local businesses; tackling problematic behaviour by corporations and absentee landlords; a rethink of how development, and operational and fiscal systems might encourage – and not penalise – high-street activity.

By not considering the retail high street in the context of the people it serves, and in omitting these crucial needs, this strategy appears mostly a cosmetic one. It revolves around short-term lets for buildings, cleaner spaces (more bins) and street parties. We know recovery – and a sustainable high-street future – requires much more than that.

Originally published by The Conversation and reprinted here with permission.