Here at CBRE Global Investors we are knee-deep in our semi-annual ‘global house views’ process, where we update all our real assets forecasts, risk-adjusted returns, model portfolios and preferred strategies. In the pre-covid days, the process started with a comprehensive set of national to sub-market macro-economic forecasts. But now, we have to start with a view on where we are in the pandemic waves in each of the markets we invest in, and perhaps even more importantly, where we are headed.

To do this, real assets researchers have had to add new strings to their bow. At the most basic level, we’ve had to find and understand datasets of covid record cases, infections and – sadly – mortality. Next, we’ve had to develop methods to estimate R – the all-important statistic that tells us where infection rates are rising, and where we should expect local lockdowns to take place. And finally, in a world where even month-old economic statistics look very out of date, we’ve had to dig into new real-time data sources that tell us how far people are moving around the economy again. From our perspective, the most useful of all these have been the World Health Organization covid stats; the Oxford Blavatnik School of Government’s lockdown stringency index; and mobility stats from Google. All of these are available globally and daily.

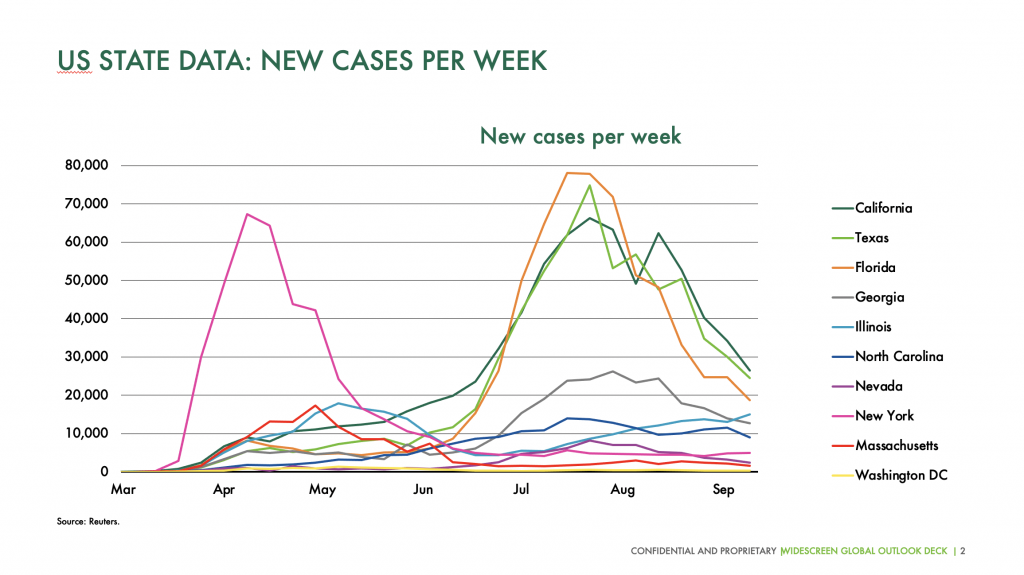

So, putting them all together, what do we take away? We have summarised where we think countries are in their covid waves in the first chart here. The US finally seems to be on the downward slope of its first wave of the pandemic, with Florida, Texas and California most prominent among the states later in their curve (as shown in the second chart). Europe is actually the least locked-down region, as it has successfully passed its first wave and is only just rising up the second wave of the virus. That said, there should be no complacency here. Australia is a great example of a country that dealt successfully with its first wave, but where the second wave, particularly in Melbourne, was far worse and long-lived, with a consequent impact on economic and real estate activity.

Monitoring this data by day and week gives us an invaluable insight into where real estate markets are opening or where they are likely to close down, and feeds into our near-term forecasts for the macro-economy and real assets markets. Accordingly, we have been consistent in our view that the global economy would see a ‘Nike swoosh’-shaped recovery after its savage recession in the first half of 2020. We continue to believe that the recovery in the second half of 2020 and into 2021 will be halting, as we slowly reopen – and then perhaps locally close – sectors and cities to manage the second and third waves of the virus in the absence of a mass vaccination programme.

However, by the second half of 2021 we are forecasting a stronger phase of the recovery, contingent on the expectation that we will have a mass vaccination programme in place. We believe that our economies and asset markets will only truly recover when people feel that they can move around their workplaces, leisure activities and travel destinations with confidence.

Our view on the vaccination timeline is shaped by detailed monitoring of the tens of vaccines that are currently in development, with a laser focus on those already in Phase 3 trials. By clearly plotting progress on a timeline, as well as understanding the probabilities of successfully moving from one phase to another, we gain some comfort from the clustering of potential vaccines ending Phase 3 trials around the turn of the year. One can only hope that a few of them are successfully approved for roll-out in the first half of 2021.

That said, we recognise that there is huge contingency around the progress of the vaccine trials, as the news from AstraZeneca earlier this month goes to show. And even beyond the pandemic, there are huge uncertainties out there on the policy front, not least around the US election outcome, and whether and what kind of Brexit deal is achieved. As a result we are running base case, upside AND downside vaccine, macro and real assets forecasts to help our investment professionals and clients have a better real-time understanding of the risks and opportunities in the market.