And where PRS and PBSA are.

Originally published January 2022.

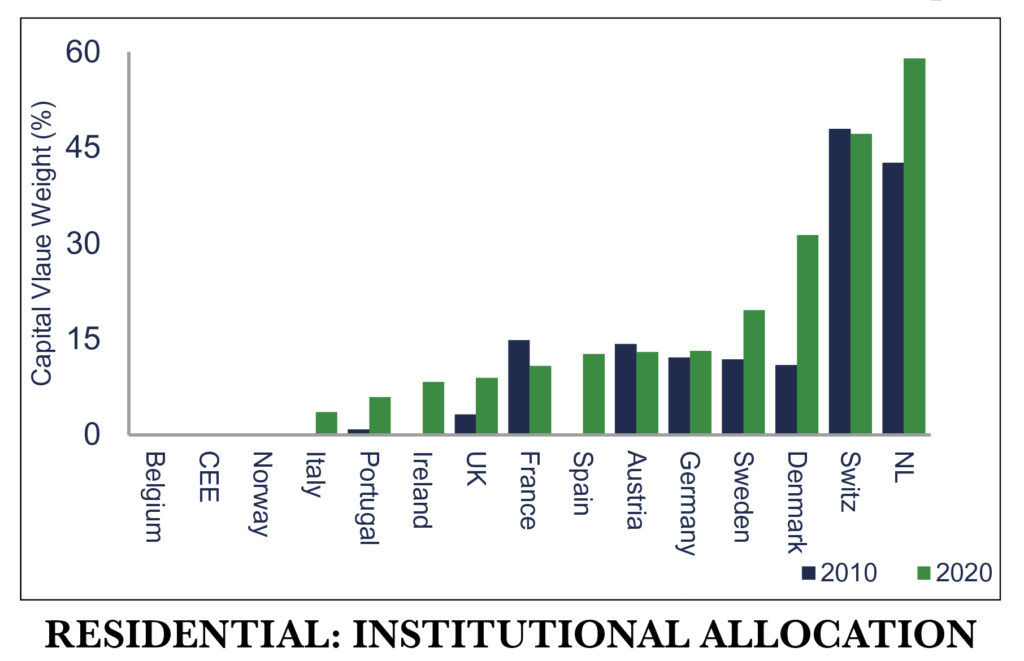

Across Europe, residential property is typically an emerging institutional asset class. Although at the national level, as is the case with many things in the ‘old world’, a more nuanced picture emerges. For example, the private rented sector (PRS) is the dominant sector in some institutional property markets (eg, Switzerland and the Netherlands), growing quickly in many others (Denmark, Sweden and the UK) and utterly non-existent in a number of others (Belgium). This highly uneven picture is simply a manifestation of the strong diversification benefits available from European property and one of the key draws for those seeking to build up an allocation in this part of the world.

The Institutionalisation of PRS varies across Europe

The countries (ie, Switzerland, the Netherlands) where PRS investment is most established tend to be physically smaller, but also very wealthy. This means there is a huge surplus of savings and relatively limited real estate investment opportunities in which to deploy investment capital. Population density and physical topographical constraints also make for a compelling residential investment thesis. Accordingly, institutional quality property assets are tightly held and market penetration for new entrants might be difficult to achieve in a meaningful way.

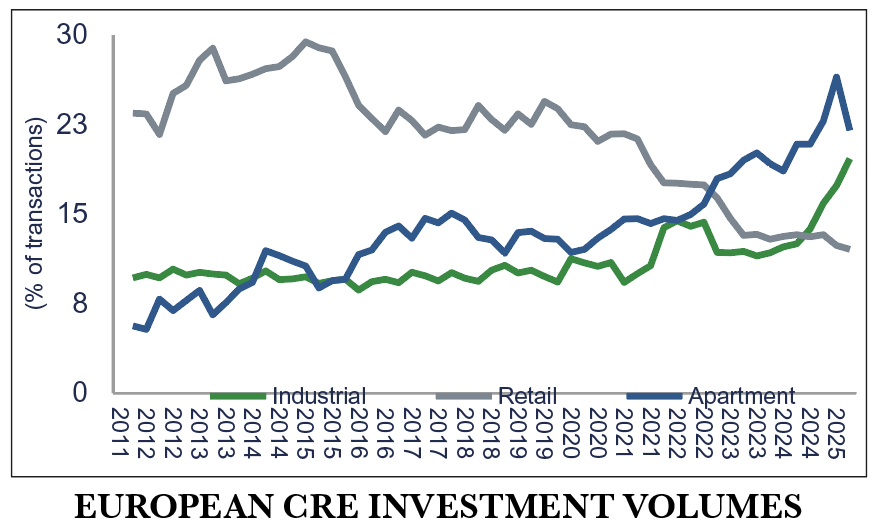

Where institutional capital sources have tended to shy away from investing in PRS in the past, one common refrain was that doing so is akin to doubling down the existing huge bet that all households have on the value of their homes upon retirement. However, the dark shadow of e-commerce overhanging physical retail, and thus contraction in the commercial property market’s investment universe, has driven a major rethink in recent years. Further pandemic anxiety around working from home (WFH) and the future of the office only heightens this.

While the very best offices and retail certainly have a future, probably a brighter one once the dust settles, European institutional property investors will continue to steadily refocus their capital flows towards residential and the wider ‘living’/accommodation subset. This will require commercial property asset managers to acquire new skills, to extract value from sectors that they may be unfamiliar with and were not initially trained in.

Plugging the retail investment gap

Investors can widen their investable residential universe through investing across the accommodation subsectors. This might include adding: hotels in their various guises (eg, business, leisure and resorts, apart-hotels, etc), purpose-built student accommodation (PBSA), senior living and mainstream PRS in its various forms (eg, build-to-rent, co-living, micro apartments). With the investment options near limitless to expand the opportunity set, the attractions are fairly obvious.

Amplified by the pandemic, but already at play beforehand, real estate investors are increasingly focusing on longer-term secular trends around demographics, technology and ESG. This is not only true for core investors, but also value-add investors who require exit liquidity via these same core investors. Therefore, both investor styles will be seeking appropriate locations and exposure to sectors with the strongest long-term rental income growth tailwinds. Successful stock selectors in the accommodation sectors still need to tap into strong structural drivers.

While mainstream multifamily/PRS and house prices are tied to the economic cycle via mortgage rates, wage growth and labour markets, the introduction of ‘a-cyclical’ PBSA and senior living bring massive diversification potential. Part of this diversity is because public policy is key to both the student accommodation and elderly care sectors. Overriding demographic structural trends operating across the accommodation sectors are also going to be highly distinct.

Mainstream PRS Low interest rates mean mortgage payments remain serviceable, but decades of strong house price growth and more stringent post-GFC bank lending criteria has massively increased deposit levels required by homebuyers. This has resulted in a significant rise in average first-time-buyer (FTB) age, meaning this frustrated buyer pool is a huge positive for PRS demand prospects. It also means that the key renter demographics has extended to a 25- to 39-year-old cohort. In this ‘young(er) worker’ age group, locations that are expected to see their number swell fastest include: the usual Dutch and Scandinavian demographic ‘superstar’ cities.

Senior living Ageing populations are a huge issue for most of Europe. Over the next decade, the number of over 65-year-olds is expected to significantly increase in over 90% of local European markets. That on its own suggests that market selection might be less discerning. However, local affluence to fund private care as well as the extent and standard of public sector care competition are key to spotting where gaps in provision exist.

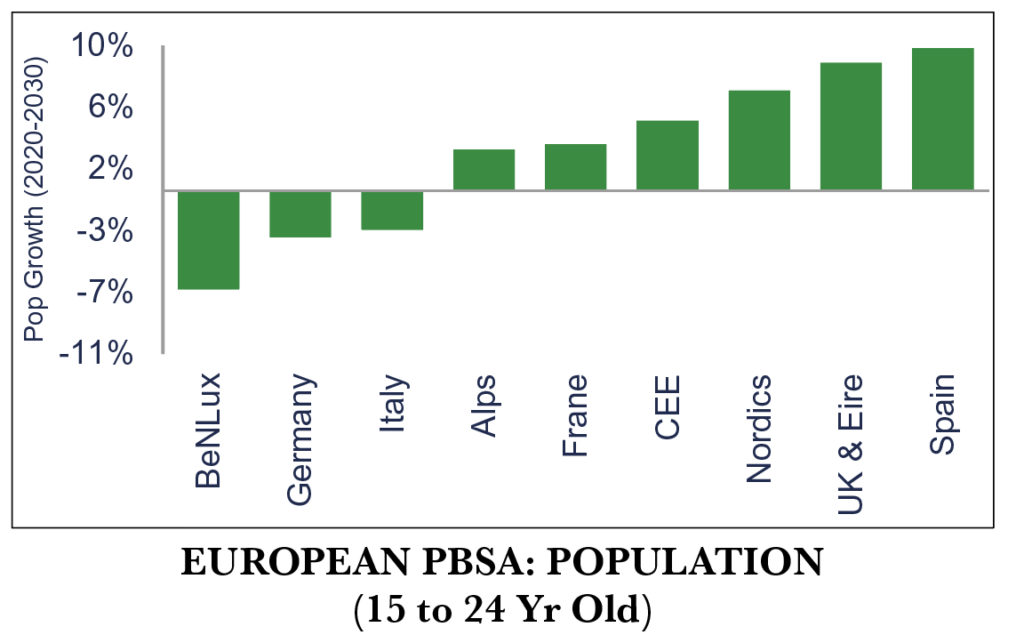

Student Overseas student numbers are considered vitally important to the PBSA market, as they are more likely to have the ability to pay the typically higher rents charged to access high specification modern schemes. The cache of an international education remains, so overseas numbers will return in due course as pandemic impacts fade. In terms of domestic student numbers, looking at projections for the key tertiary education 15- to 24-year-old age group will be instructive. In this instance, it is more informative to consider national trends, as a local student will be more likely to reside in the parental home.

Youth population growth drives domestic student numbers

In terms of the domestic student pool over the next decade, Spain is set to have the fastest expanding youth population, closely followed by the UK, Ireland and the Nordics. Perhaps surprisingly, Benelux actually scores relatively poorly.

Other considerations are going to apply, including the local PBSA provision rate (students per bed), the spread of English language taught curricula across Europe and, crucially, the ranking of the academic institution. The latter is already important, with the rise of online learning likely to impact elite universities less than more average quality ones.

With the demographic structural trends highly variable by accommodation sub-sector and location, they are a powerful tool for market selection. Assessing local supply conditions is the next filter to apply, ie, house-building rates, public v private retirement provision, students to bed provision, etc. Then a thorough understanding of local market practices and the legislation (eg, rent controls, local tax structures, etc) is next. This is all clearly complex and not the preserve of a central capital asset allocator. Only a manager with an extensive local office market network, and genuine local presence, is equipped to successfully navigate all of that!