INVESTMENT CONCLUSION

The UK housing bubble is a myth. Current price declines are principally function of Brexit-related uncertainty. While you’d have to be mad to buy until this fog lifts, this means there is pent-up demand to stabilise the market on a smooth transition out of the EU. The risk of a hard Brexit is inherently bad: it would likely lead to a broader economic recession and house price slump. But even then, we think misunderstood housing fundamentals mean fair value is higher than the doomsters suggest and would look to buy UK residential real estate on the first sign of economic stabilisation.

ANALYSIS

Ever since the 2016 EU referendum, the UK housing market has been slowing. Unsurprisingly, the deceleration was led by London, where price rises had outstripped those of the rest of the UK by a large margin, matched only by some idyllic pockets of the south east commuter belt. The UK’s ‘housing complex’ rose in tandem with prices, taking the blame for all manner of social and inter-generational problems.

Critics were quick to attribute rising prices to the buy-to-let phenomenon and a shortage of housing stock – a function of nimbyism (not in my backyard) which restricted access to development land, preventing the building of ‘much needed’ new homes. But these factors seem to be significantly exaggerated when looking at the data.

Real expensive, or not?

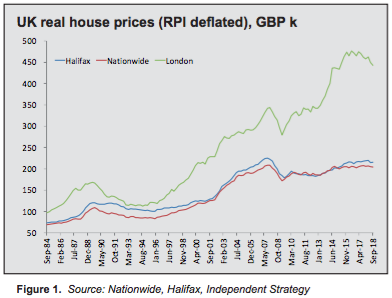

The focus on the level of real house prices is the classic example (Figure 1). One can’t dispute that the price of a house has risen sharply in real terms. But housing is not priced off inflation rates, or even wages. The price is built on the cost of acquisition and the mortgage repayments (cost of capital) that need to be made to remain in situ and pay down the debt outright. How expensive they are relative to a tin of beans is entirely irrelevant.

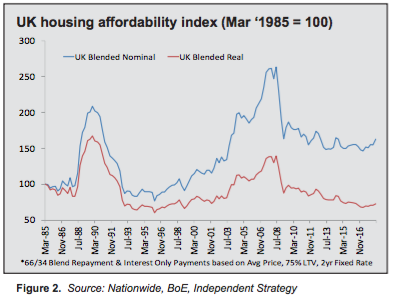

Looking at simple affordability, housing only looks expensive in London. And even then, it’s still below the levels seen at previous peaks, notably the late 1980s boom and coming into the global financial crisis (GFC). Indeed, for the UK as a whole, affordability matches the levels seen in the mid-1990s, when housing was cheap (Figure 2). That’s despite a doubling of house prices in real terms since then. So what gives between the narrative of priced-out ‘generation rent’ and the parallel reality of reasonable affordability?

Crisis frictions & political solutions

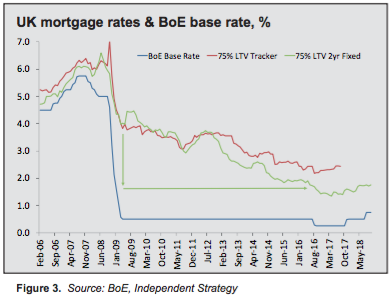

A good chunk of this is psychological and comes back to the GFC and the drop in house prices that followed. Like all assets, those that depreciate lose favour and the gloss housing had running into the boom (and had again until the Brexit vote) rubbed off. Tied up with shrinking credit availability, via the death of 100% – and even 110% – mortgages and generally sticky lending rates (Figure 3), it was perceived to be a bad time to buy.

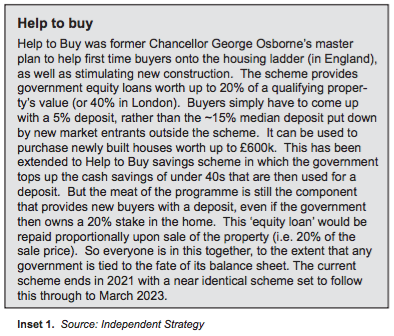

The price boom only resumed when the Bank of England (via its Funding for Lending programme) and then the government (using “Help to Buy”, Inset 1) tried to rekindle demand. The latter scheme did so to excellent effect. House prices were immediately marked up, reflecting the impact the government’s equity contribution would have on purchasing power, and continued to rise until the start of 2016.

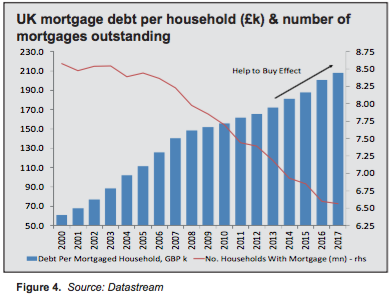

Despite continued modest turnover in house sales, these schemes had quite a transformative impact on lending. Even though the overall number of mortgages outstanding continued to shrink, new mortgagees filled the gap with ever-larger borrowings, increasing the concentration of this debt (Figure 4).

Higher debt, but maybe less risk

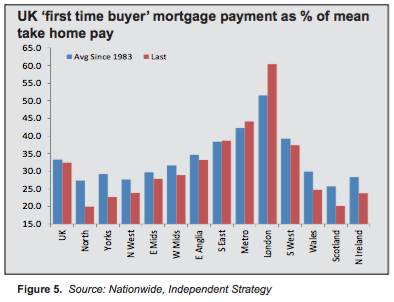

Even so, it doesn’t look particularly tight for first time buyers (FTBs), at least outside of London, which is the only area of the country where mortgage costs for this cohort are significantly above the longer-term average (Figure 5).

Not only has the cost of servicing this debt declined, but there has been a shift towards fixing rates for longer periods. Obviously, these borrowers, given higher debt, have a greater sensitivity to any secular rise in interest rates. But in the past buyers were generally at the mercy of lenders’ variable rates. It has become far easier to smooth these risks as the mortgage market has developed in recent years. Not only can fixed terms be extended for longer (5-year fixes are increasing in popularity and you can fix for a decade if inclined), but with rates so low the capital repayment element is more smoothly distributed, meaning debt is paid down more quickly than in the past. For example a £200k, 2% fixed repayment mortgage would reduce to £167k after 5 years whereas with rates at 5% that would have only fallen to £176k and going back to the heady days of the 1980s, when rates were in double digits, five years in and you’d have still owed the bank £187k.

This should mitigate some of the risks that have marked earlier busts, notably the persistence of negative equity. Assuming a 10% deposit, a FTB would need to see nominal house prices fall more than quarter over a five year period to suffer this fate. That’s never happened before across the UK as a whole and was only exceeded slightly in London during 1994, reflecting the drawn-out effects of the collapse of the late 1980s bubble.

Stock shortage?

It has been said that home prices are high due to property shortages. But evidence of this is hardly convincing. Indeed, housing stock has risen fast- er than the population over the past two decades with 23 million homes standing in the UK at present, up 15.3% over the past 20 years compared to population growth of 13%.

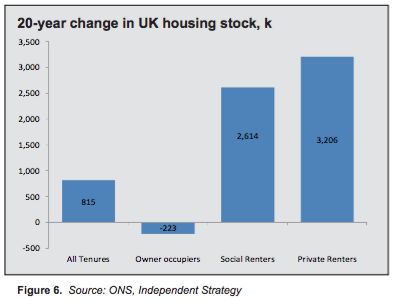

This does mask a number of distortions. Owner occupiers tend to have excessive space while at the bottom end of the ladder, and among migrant families, household sizes are much larger. So ‘space’ inequality has certainly widened. There have also been shifts in the structure of occupancy, notably the surge in private rented accommodation (Figure 6), which accounts for over 80% of the net housing stock added over the past 20 years or so. This is the bugbear of generation rent who attribute the rise in prices to being outbid by the landlord generation.

This certainly seemed to be the case following the crisis when there was a significant increase in private rental properties. But it’s worth noting that the largest change over the past five years is among householders classed as owner-occupiers without a mortgage. So you can’t pin it entirely on hobby landlords. Indeed, much of their decision making has been good fortune, having been encouraged into property in fits and starts, first by the deregulation of the mortgage market, then by two large equity bear markets alongside the secular decline in interest rates which dimmed the outlook for savings income.

GFC hangover

The single biggest influence is probably the hangover from the GFC itself. As is normal during recessions, while affordability appeared to improve, credit conditions tightened and the labour market and confidence deteriorated. That made entry into a market (at the sweet spot of the cycle) both practically and psychologically difficult. The post-crisis period was also marked out by persistent weakness in wages and higher inflation rates. So not only did people suffer in terms of labour opportunities, but falling real incomes compounded this effect.

The current ‘generation rent’ has also been disadvantaged by fiscal changes, most notably the large hike in student loans. The latest estimates suggest a graduate after a three year degree course will be £57k in debt. While there is an income threshold before repayments kick in, any income over £25k effectively incurs an additional tax of 9% as repayments are deducted straight from salary cheques. The impact of this is notably worse in London where living costs are higher and graduates are also likely to be earning a salary above these hurdle rates. To add insult to injury, the student loans agency charges interest of up to RPI + 3% (on a progressive scale – the more you earn, the higher the rate of interest) for the privilege. This is penal in two ways. First, RPI is an elevated inflation measure – this index has risen 70% since 2000 compared to 48% for CPI and 44% for the GDP deflator. Second, the loan rates far exceed those available on pretty much any other loan product, secured or unsecured. This feeds back into purchasing power with lenders also factoring these loan repayment cashflows into the amount they can lend.

Deposit blues

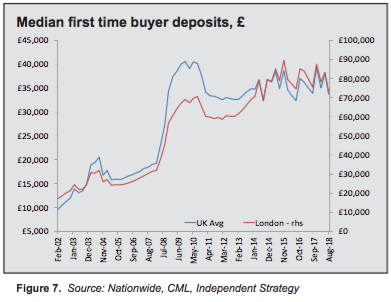

Even if affordability looks good there are other problems, notably being able to save sufficient funds for a deposit. Prior to the crisis the median FTB was putting down just £19k; that jumped to over £40k after the crunch. While lending conditions have thawed since then, the impact of rising prices means that they still need £36k. And that’s across the UK as a whole. For London the deposit levels started at £31k, leapt to £69k and have risen from there to an eye watering £80k, having peaked just shy of £90k at the end of 2015 (Figure 7). This compares to median wages of £29k in the UK and £37k in London. So UK deposits are 1.2x gross income while in London you’d need to squirrel away over two years of your total pay to hit this mark.

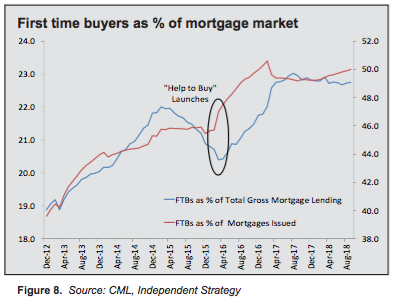

This actually seems to be the main barrier to property ownership and one the Help to Buy does meaningfully address. While the scheme has contributed to some distortions, it has boosted FTB participation (Figure 8) as well as contributing to a pick-up in house construction. Indeed, housing completions hit 160k in H2 2018 up from 142k in 2015 which was coincidentally also the average since 1990 and only a shade lower than the pre-crisis peak.

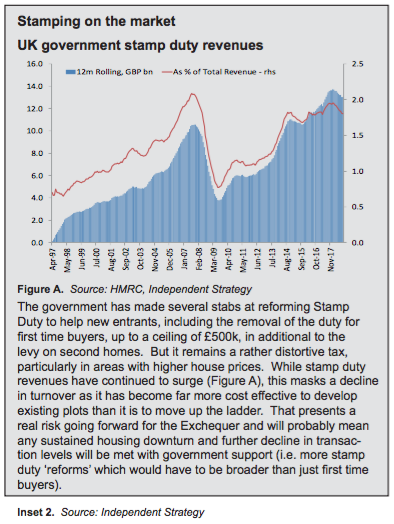

The other side of this pincer is legislative changes that impact small-scale landlords (who are not incorporated), which includes scaling back interest tax deductibility and removing some allowances that reduce capital gains. On top of that, the government has reformed stamp duty, adding an additional 3% levy for second home purchases (Inset 2), giving FTBs some competitive advantage. That has encouraged some of the more marginal landlords – late entrants – into selling.

Social shifts raise prices

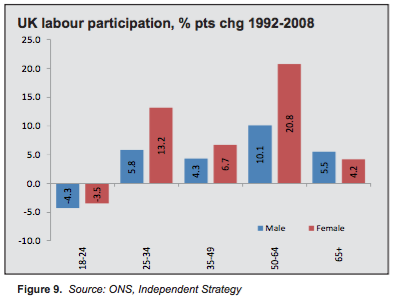

There are a number of other structural factors that have contributed to the cost of housing. Most of these are social and not linked to population growth per se. There have been radical shifts in society that have coincided with the secular decline of interest rates. The labour force has been transformed by rising female participation (Figure 9). That has increased household disposable incomes but has also fed through into increased purchasing power and home prices.

The age at which households form has also increased, as has the age at which people start families. The average age of mothers has risen from 27.3 in 1985 to 30.3 as of 2013, a sizeable jump in a relatively short period. That means the incomes of those getting on the ladder is higher than it has historically been, which again becomes a rather self-defeating achievement as it boosts purchasing power for everyone and with it, prices. These trends are both long-term and unrelated to overall swings in house prices.

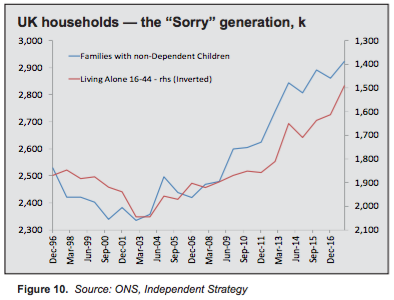

Then there are those factors that mix the social and demographic, notably the increase in single households – up from 6.6 million in 1996 to 7.7 million today – amid increased divorce rates and population ageing. Both of these inhibit market efficiency with their general reluctance to downsize. The flip-side of this seems to be the large rise in those families living with non-dependent children (Figure 10).

There are other variables that are more macro/political and can help explain some of the London froth. London’s higher living costs are a drag but there are some offsets to higher housing expenses. For example, cheaper commuting, which is a substantial expenditure item for those that live outside the capital. City dwellers also have more flexibility in terms of skipping the purchase of big-ticket items, notably a car. The cost of the two could finance an extra £100-150k on a repayment mortgage, bridging more than half the gap between London and UK average house prices, or paring the gap to around £50k if you compare London to the South East commuter belt.

Is the “bubble” in trouble?

So the general perception that there is a housing bubble looks wrong. There are social reasons why houses trade at higher levels than they have historically and, more importantly, there is the cost of capital which determines the level buyers can bid at. As the data show, in terms of disposable income mortgage repayments even for FTBs are not stretched overall. And when you factor the outperformance of household purchasing power over general wage growth, affordability is actually still pretty good. Tolerance for borrowing larger amounts should also be higher given that interest rates can be fixed for longer periods, which tempers buyer risks. So the main obstacle is the deposit level – which the Help to Buy schemes are helping with, along with the “bank of mum and dad” for select others.

INVESTMENT OUTLOOK

The extension of the current drop in UK house prices is entirely contingent on how the economy fares post-Brexit (see our report UK – Mediocrity exposed, 16 November 2018). Given the UK’s productivity/supply-side problems, there is a good argument that UK rates will have to rise if the Bank of England is go- ing to meet its inflation target over the medium-term, something the central bank’s hawks will only too keenly tell you about. And any change in the cost of capital would lead to a repricing of the assets priced off them. The UK has never (at least in recent memory) had a housing bust that hasn’t been entwined with a recession (Figure 11). So even if prices do decline, the general complaint that younger buyers are locked out of the market is likely to remain. It would simply kick off a cycle of deteriorating labour market conditions, tighter lending standards and confidence in the idea that housing is a “one-way bet” would swiftly disappear.

A hard Brexit would meet the conditions for the dip in house prices to turn into a significant slump, most likely leading to a 15% to 20% price decline in he short-term. But underlying market dynamics mean fair value is high- er than most believe and the market is likely to recover faster than might appear probable. From international investors’ perspective, any such drop, overlaid against a corresponding fall in sterling, would leave UK property looking cheap. A smoother departure, on the other hand, would be enough to stabilise the market as those buyers that have been waiting for some clarity slowly return.

Report available on instrategy.com (subscription or login required).