But mortgage rates also continued to rise.

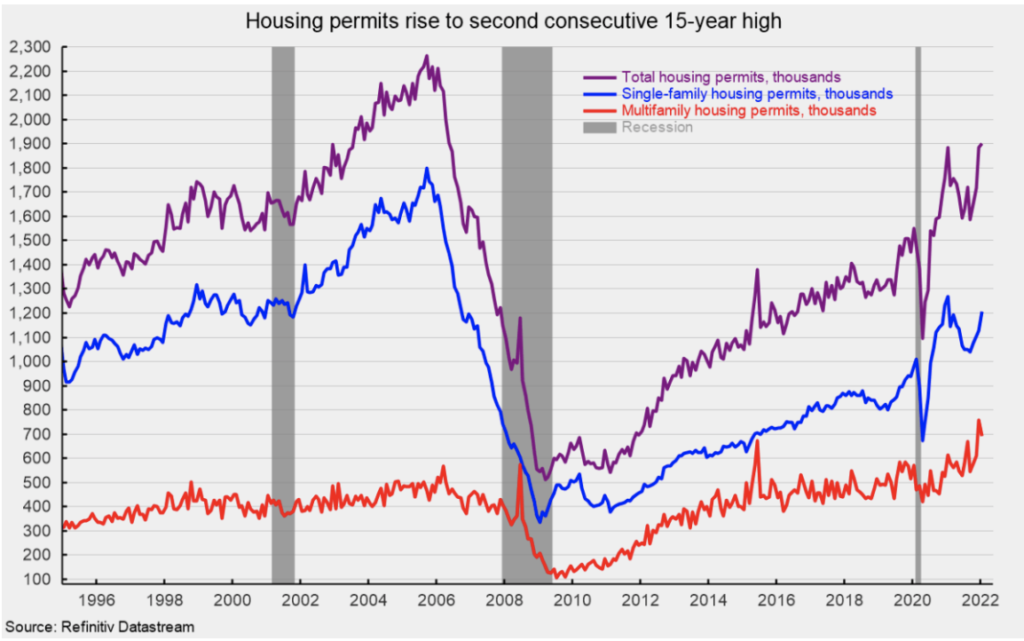

Total housing starts fell to a 1.638m annual rate in January from a 1.708m pace in December, a 4.1% decrease. From a year ago, total starts are up 0.8%. However, total housing permits were very strong again in January, posting a 0.7% gain to 1.899m versus 1.885m in December, the second consecutive 15-year high (see first chart). Total permits are up 0.8% from the January 2021 level.

Starts in the dominant single-family segment posted a rate of 1.116m in January versus 1.182m in December, a drop of 5.6% and are down 2.4% from a year ago. Single-family permits posted a 6.8% jump to 1.205m versus 1.128m in December (see first chart).

Starts of multifamily structures with five or more units decreased 2.1% to 510,000, but are up 8.7% over the past year, while starts for the two- to four-family-unit segment were up 140.0% at a 12,000-unit pace versus 5,000 in December. Combined, multifamily starts were off 0.8% to 522,000 in January and show a gain of 8.3% from a year ago.

Multifamily permits for the 5-or-more group fell 8.8% to 629,000, while permits for the two-to-four-unit category sank 3.0% to 65,000. Combined, multifamily permits were 694,000, off 8.3% for the month (see first chart), but up 12.8% from a year ago.

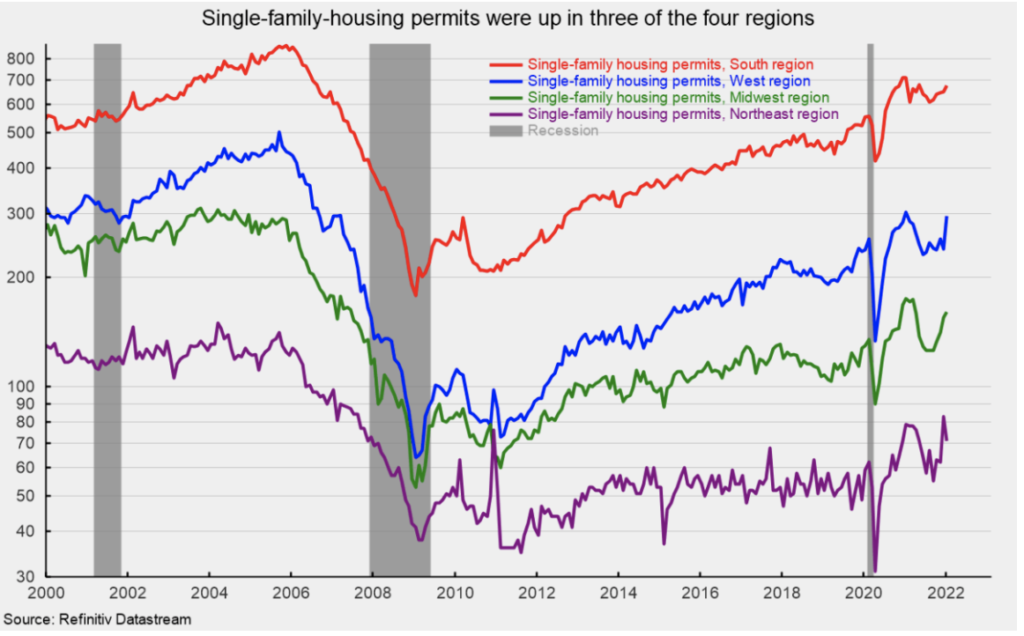

Regionally, single-family permits were up in three regions: the West saw a 23.3% surge to 296,000, while the South managed a 4.2% increase to 677,000, the Midwest gained 3.9% to 161,000, but the Northeast fell 14.5% to 71,000 in January (see second chart).

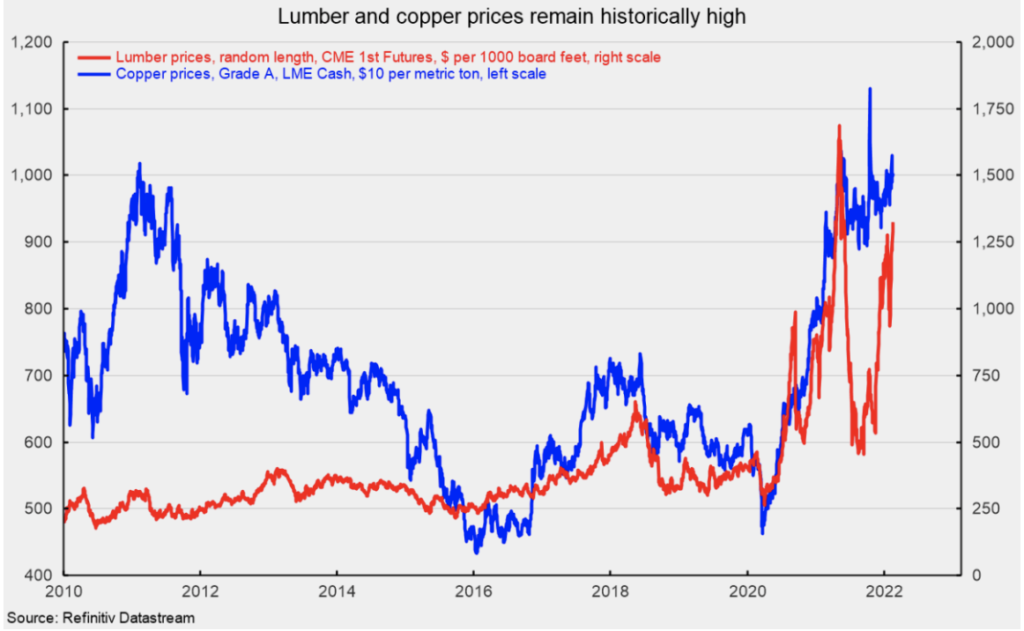

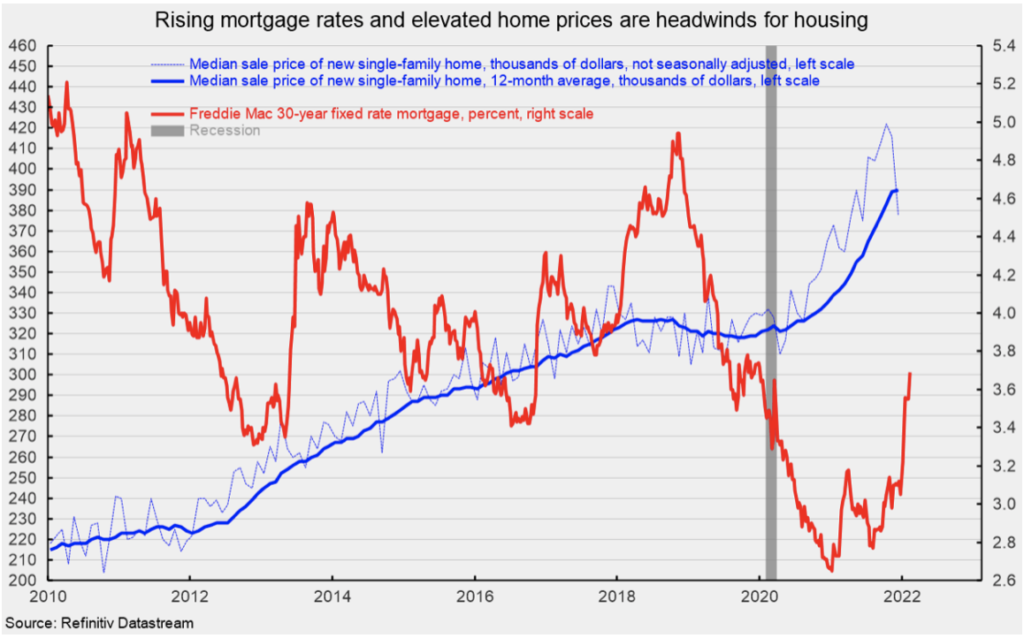

Input costs continue to soar, with lumber coming in at around $1,324 per 1,000 board feet in mid-February, while copper was just over $10,000 per metric ton (see third chart). The increases in input costs will pressure profits at builders and may lead to more price increases for new homes (see fourth chart).

Furthermore, mortgage rates have continued to rise, with the rate on a 30-year fixed rate mortgage hitting 3.70% in mid-February (see fifth chart). Higher home prices and higher mortgage rates are likely to weigh future housing activity.

After a pullback in activity in the first three quarters of 2021, single-family activity has shown renewed strength. While the implementation of permanent remote working arrangements for some employees may be providing continued support for housing demand, ongoing home price increases combined with the recent surge in mortgage rates may work to cool activity in coming months.

Originally published by The American Institute for Economic Research and reprinted here with permission.