Total housing starts fell to a 1.421 million annual rate from a 1.584 million pace in January, a 10.3% decrease. Month-to-month volatility in housing construction can be influenced by weather conditions and conditions in significant portions of the country were unfavourable in February. From a year ago, total starts are off 9.3%.

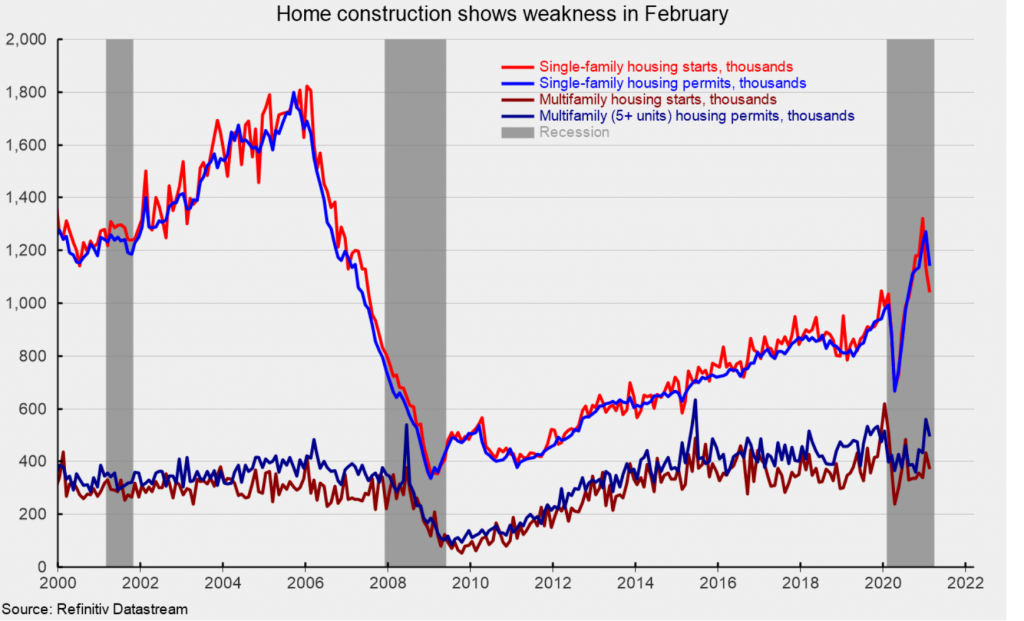

The dominant single-family segment fell 8.5% for the month to a rate of 1.040 million. Despite the drop, single-family starts are up 0.6% from a year ago. Starts of multifamily structures with five or more units fell 14.5% to 372,000 and are off 27.6% over the past year.

Total starts and single-family starts were down in three of the four regions in February with only the West region posting gains.

For housing permits, total permits fell 10.8% to 1.682 million in February. Total permits are 17.0% above the February 2020 level. Single-family permits were off 10.0% at 1.143 million while permits for two- to four-family units dropped 21.4% to 44,000 and permits for five or more units sank 11.6% to 495,000.

Home construction has been one of the strongest parts of the economy over the past year and excluding the plunge in activity during the government-enforced lockdowns in early 2020, single-family housing activity has been on an upswing since early 2019 (see first chart).

The post-lockdown recovery has been supported by a surge in demand as consumers sought less dense housing. The surge has also been supported by low mortgage rates. However, conditions may be starting to change. Mortgage rates have been rising over the past several weeks (see top of second chart) while the surge in demand and activity has accelerated the pace of rise for home prices (see bottom of second chart).

Furthermore, the surge in demand and activity has sent lumber prices soaring (see third chart). The increase in lumber prices is pressuring profit margins for homebuilders. The National Association of Home Builders’ Housing Market Index, a measure of homebuilder sentiment, fell in March. The drop reflects surging materials costs and rising mortgage rates but is offset by low inventory and continued demand for housing. Overall sentiment remains relatively high (see third chart).

The Housing Market Index fell to 82 in March, down from 84 in February. The three components of the index had mixed results in the latest month but generally remained at favourable levels. The current single-family sales index fell to 87 from 90 in the prior month, the expected single-family sales index rose to 83 from 80, and the traffic of prospective buyers index was unchanged at 72. On a regional basis, the four regions also had generally weaker results in March but were also still at historically favourable levels. The Northeast index fell to 86 from 87, the Midwest index fell to 78 from 81, the South index was unchanged at 82, and the West index fell to 88 from 91.

Housing may have enough momentum to grow at a solid pace in 2021 but the combination of rising mortgage rates and rapidly rising home prices will likely lead to some cooling. For the homebuilders, fundamentals remain sound but rising materials costs and labuor difficulties are creating challenges.

This article was originally published by the American Institute for Economic Research and is here republished with permission.