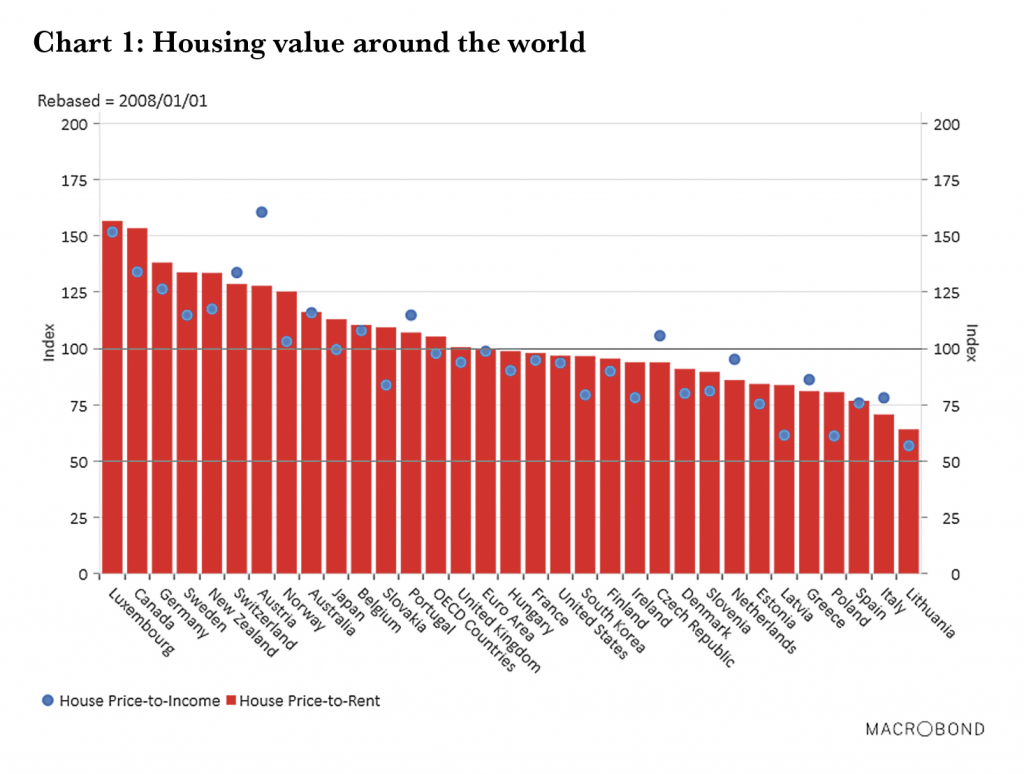

Considering that the present crisis is likely to burst inflated bubbles, it’s especially relevant to look at overvalued assets now. The first chart below compares the current housing market in various countries around the world. Using data from the OECD Economic Outlook, I estimated how much housing is overvalued in terms of house prices relative to rents and relative to incomes, with ratios rebased in 2008.

In chart 1, we can see that Luxembourg is the country with the most overvalued housing market in terms of rental costs, with an increase of more than 50% since 1 January 2008. In terms of income, Austria’s housing is the most overvalued, with a 60% increase, followed by Luxemburg, Switzerland and Canada. At the other end of the spectrum, southern Europe, central and eastern Europe and the Baltic countries have seen decreases in both house-price-to-income and house-price-to-rent ratios in the past decade. Yet as the coronavirus pandemic continues to pummel economic growth in many countries, the drop in income will render housing even less affordable than before.

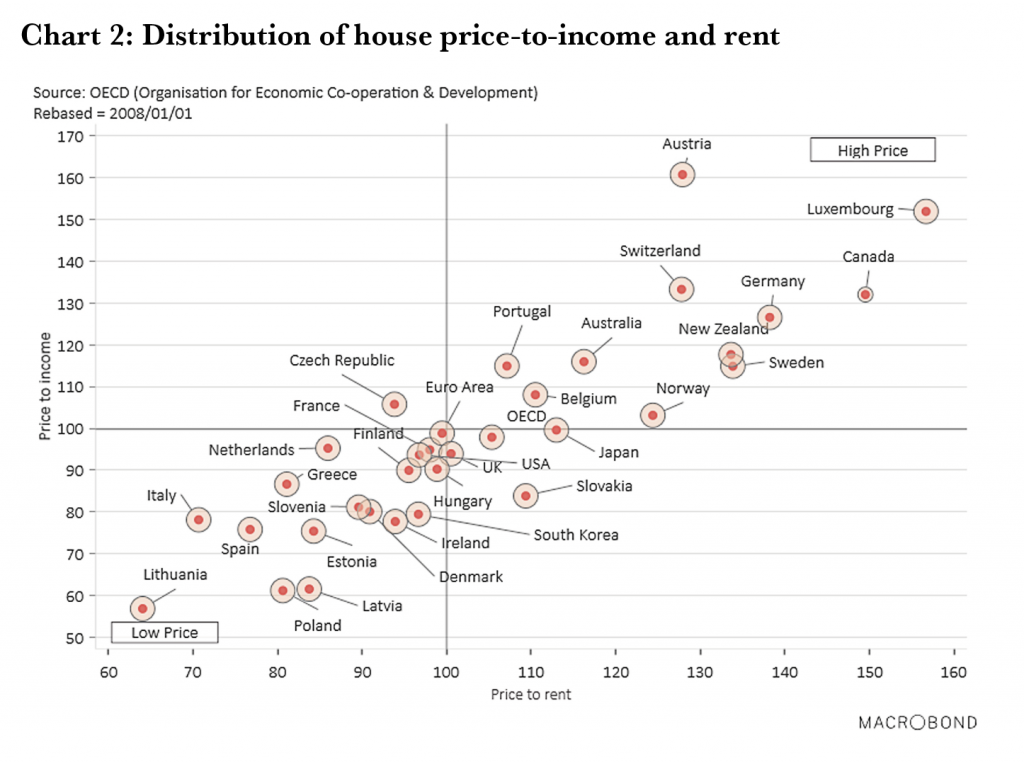

The second chart displays the countries’ distribution on a scatter chart according to their house-price-to-income and house-price-to-rent ratios. Countries in the upper right section have high house prices against both rents and incomes, while those in the bottom left section have the opposite.

As we might expect, there is a positive linear relationship where an increase in house prices in relation to incomes implies higher prices in relation to rental costs as well, but it’s interesting to look at the outliers. Austria has had a greater increase in house prices relative to incomes than relative to rents, meaning buying became less affordable, but it did not translate into renting becoming more affordable, as seen in other countries. In Slovakia, Japan and Norway we see the opposite effect, as buying is becoming more affordable and renting less so.

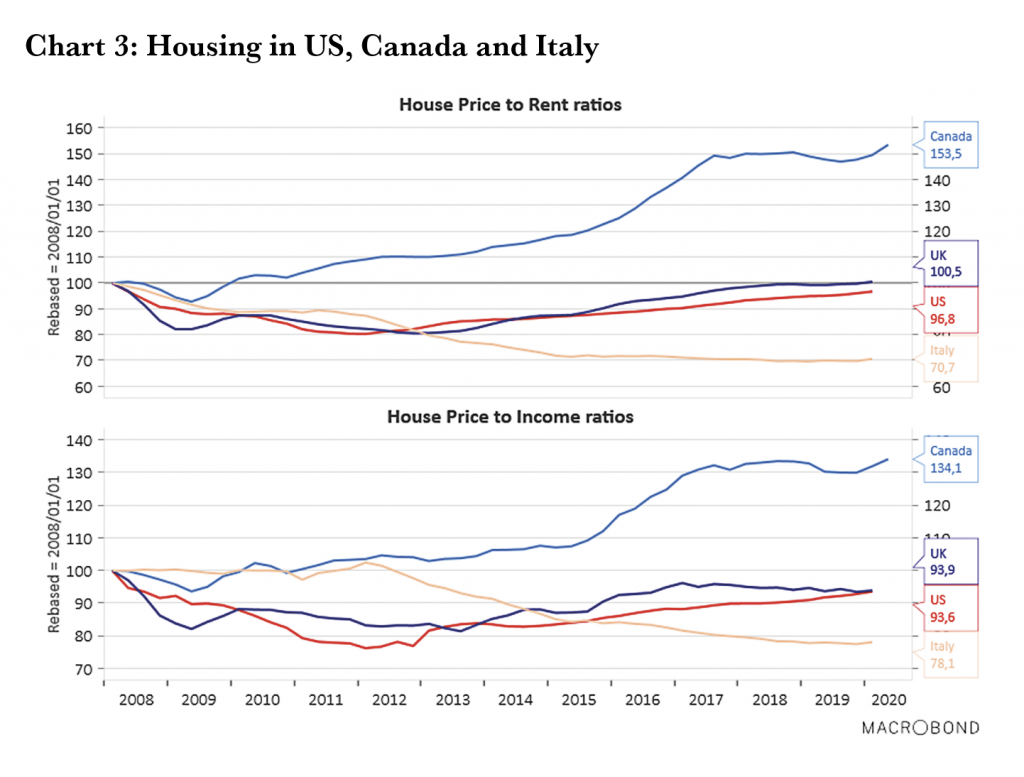

Lastly, I wanted to examine the historical development of these ratios in a subset of countries in North America and Europe – namely the US, Canada, the UK and Italy. This is shown in the third chart.

All the series in this chart are rebased to 100 with a starting date of January 2008. Canada, the UK and the US have seen house prices rise in relation to both incomes and rental costs, after an initial drop between 2008 and 2009. House prices in Italy, on the other hand, have been decreasing in terms of income levels and rent prices since 2012. The latest data shows both the US and the UK hovering around the 100 mark and below, indicating that price-to-income and price-to-rent ratios remain approximately at the same level as they were in 2008. House prices in Canada have been growing quite dramatically by comparison.

There is an additional factor in the risk of a housing crisis in Canada, which was already a hot topic before the pandemic, which is that purchasing power is expected to decline, increasing the price-to-income ratio even further. These are charts I will continue to go back to and hit ‘refresh’ to see the impact of the coronavirus pandemic on housing both in Canada and around the world.