The real estate industry, traditionally characterised by its cautious adoption of new technologies, is now at a pivotal juncture. The emergence of generative artificial intelligence or gen AI (which I will refer to simply as ‘AI’ from here on), with its open-ended and self-evolving nature, promises to fundamentally change the way we live, work and play.

Investors, managers, and occupiers find themselves sitting atop mountains of proprietary and third-party data, about properties, communities, and market dynamics. Gen AI allows this wealth of information can be harnessed to tailor AI tools for real estate-specific tasks. Imagine lightning-fast identification of investment opportunities, efficient analysis of ESG data, revolutionary building and interior design, personalised marketing materials, and seamless customer journeys.

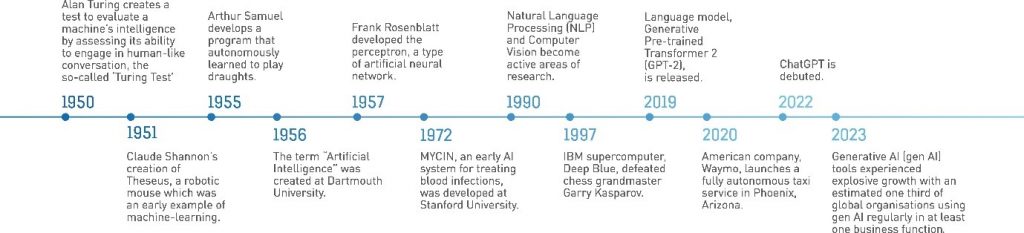

Figure 1: The development of AI

Source: Cromwell Property Group Q2 2024

AI is already being used to streamline processes, improve accuracy, and enable data-driven decisions. As the technology becomes more sophisticated and widely adopted it will have a substantial influence on occupier behaviour and impact the evolution of their space usage and demand. Understanding shifts in occupier location, asset type and amenity preferences is crucial to optimising investment allocation decisions and driving returns. The impact of AI will vary by real estate segment so lets explore the main considerations investors should consider.

Offices: white collar role changes

One key concern of investors (and workers) is AI’s impact on white collar employment and thus office demand. Whilst this is understandable, a long list of historical examples of technological advancements and their impacts on the workforce shows that the reality is always more complex. There should be no doubt that the composition of the labour force will change, and the nature of many roles will fundamentally shift, but AI is unlikely to cause the demise of large numbers of white-collar roles and a collapse in office demand.

AI’s capabilities have improved dramatically, but it is still less proficient than humans when it comes to relationship management, innovation, and strategic decision-making. White collar roles will become more focused on collaboration, face-to-face discussion and creativity which will reinforcing the post-pandemic shift of office space towards flexible, amenitised space.

Organisations will continue striving to make their office footprint as efficient as possible. AI will help ensure dynamic desk management that brings employees together and reduces energy consumption based on real time use, providing additional “smarts” to further optimise existing systems.

Ultimately though the ingredients for success will remain largely unchanged. Offices in the best central locations, offering diverse amenity and high-quality space for a suitable price, will outperform those that are misaligned to increasingly demanding occupier requirements.

Logistics and Industrial: increased complexity

Many logistics and industrial occupiers are already leveraging AI in their facilities, for example by using intelligent autonomous robots to store and pick items, or by calculating optimised routes for human workers trying to navigate thousands of products. Given the pre-existing utilisation of automation and AI, we do not foresee recent advancements driving major changes to occupier space requirements at the asset level. That said it will mean wider adoption of AI-powered management and operations and faster obsolesce of ageing stock which is unfit-for-purpose due to design, inadequate slab strength or power capacity.

The most significant implications are likely to be locational, stemming from supply chain management improvements. Demand forecasting, inventory requirements and transport routes will all be enhanced by AI’s ability to process vast amounts of data from various sources in real-time and advise accordingly. This could lead to footprint rationalisation, whereby occupiers prioritise large, centralised warehouses combined with smaller urban logistics units near customers, with less reliance on medium-sized, intermediate facilities from more accurate demand prediction. This type of model, which historically would have been challenging due to its complexity and inability to respond to local supply or demand shocks, could provide the scale and control benefits of a centralised hub with the agility and speed-to-customer of last mile fulfilment.

An important byproduct of a more intelligent and efficient supply chain is cost reduction. The pandemic highlighted the shortcomings of global supply chains, however, most are still aligned to the lowest cost countries. As AI-driven efficiency lowers supply chain costs and reduces reliance on cheap human labour, more western-based occupiers may onshore production, boosting industrial real estate demand.

Retail: physical and digital converge

AI will further narrow the gap between shopping channels. It will improve online product discovery by delivering to shoppers personalised recommendations and engaging conversations with digital shop assistants. Virtual product trial will improve as augmented reality and AI technology combine to showcase furniture in your own home, or a new outfit as you move around.

The success of a physical retail store in an AI-enabled world will require having a genuine point of difference and leveraging inherent strengths which cannot be replicated online. For large shopping centres, this means providing tactile, immersive social experiences – being a leisure destination for people to connect, rather than just shop. Typically, larger assets with leading brands and the latest store formats, a night-time economy and higher foot traffic volumes are better placed to succeed in this experiential segment of the market.

For convenience-oriented centres, the value of an asset as a last-mile fulfilment node will become more important, in addition to its strength of connection to the local community. Assets that can double as a retail shopfront and local fulfilment centre, with proximity to customers, access to transport networks and a conducive physical structure and land envelope, will be preferred.

Enabling infrastructure: digital storage and power demand

While all non-traditional real estate sectors will be influenced by AI, data centres are the most directly intertwined. The explosion of data storage and computing power required to enable AI will mean exponentially greater demand for data centres. Low latency (i.e. the response time or speed between data generation and data processing/response) becomes more critical for some use cases. Thus, there will be greater demand for edge data centres within or adjacent to large urban areas where the most data is being generated, as well as large hyperscale data centres elsewhere.

AI: a paradigm shift

AI will fundamentally reshape operational approaches, elevate customer experiences, improve occupier retention, and enable more intelligent asset selection. The type of physical space that occupiers want will evolve, causing significant demand shifts. While greater demand for data centres is well-known implication, there are opportunities and threats across every commercial real estate segment to target footprint bifurcations and align to changing occupier trends. Investors must understand these changes to optimise allocation decisions and increase investment returns as well as mitigating the downside risks. The ascent of AI is not a passing trend but a paradigm shift that will define the future of real estate.