China is close to launching nine infrastructure REITs to finance national infrastructure projects (eg, industrial parks, warehouses, tollways, sewage plants) for the first time, with an estimated market capitalisation of US$4.7b by May 2021. These nine China REITs (C-REITs) are allowed to be sold and traded on both the Shanghai Stock Exchange (five REIT equities) and Shenzhen Stock Exchange (four) by the green light of the China Securities Regulatory Commission (CSRC).

According to EPRA and CIA reports, the size of China’s commercial real estate market was over US$4.5tn in 2020, with strong population demographics (1.4b), urbanisation (62.5%), GDP growth (6.1%), high consumption and solid real estate market fundamentals. Hence, the size of a broader C-REIT market was estimated to reach over US$3tn by Goldman Sachs, being approximately 2.5 times larger than US-REITs (US$1.2tn in 2020) and the world’s largest.

These have seen a positive market outlook of the C-REIT market, albeit with several challenges, such as legal and tax issues. Going forward, more C-REIT equities are expected to be released in the future. The next question is “How can China learn from global REIT sub-sector market trends?” Specialised real estate is a better investment strategy, the core of my doctoral thesis and recent journal publications (links are available below).

Dominant role of sector-specific REITs globally

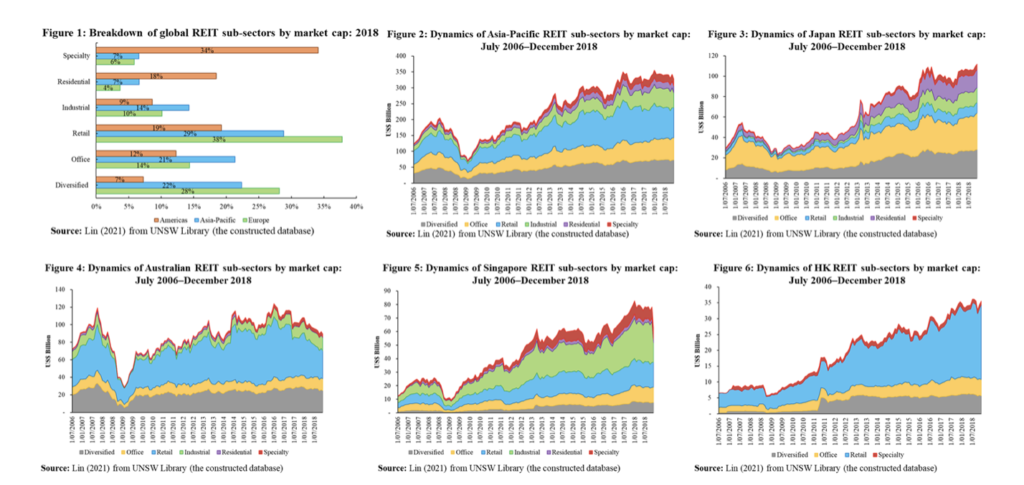

Sector-specific REITs have played a prominent role across the Americas (the percentage of sector-specific REITs to composite REITs was 93%), Asia-Pacific (78%) and Europe (72%) (see Figure 1). As the largest regional REIT market, the Americas (US$1,061.60b) highly concentrated on the specialty sector (eg, infrastructure, data centres, healthcare, hotel; 34% of the size of American REITs) in 2018, followed by retail (19%), residential (18%), office (12%) and industrial sectors (9%). Simultaneously, the Asia-Pacific had a strong preference for retail (29% of the size of Asia-Pacific REITs), office (21%) and industrial sectors (14%). It is noteworthy that Asia-Pacific had a higher ratio of the industrial sector to composite REITs by market capitalisation than other regional REIT markets.

Figure 2 portrays the dynamics of Asia-Pacific REIT sub-sectors between July 2006 and December 2018. The most rapid growth in market capitalisation was in the specialty sector, with an 8.8 times increase since 2006. It was trailed by residential (4.7), industrial (3.2), office (2.5), diversified (2.3) and retail sectors (2.2). As a proportion of the market, however, the retail sector has averagely contributed 34.1% of the size of Asia-Pacific REITs over the past 12 years, followed by office (21.7%), industrial (12.8%), residential (5.3%) and specialty sectors (4.3%).

At a country level, a dominant role of sector-specific REITs has also been witnessed across Japan (75.2%), Australia (74.1%), Singapore (91.9%) and Hong Kong (83.5%) over the past 12 years. Specifically, the office sector (eg, Nippon Building Fund) has been the largest REIT sector in Japan, while the industrial sector (eg, Ascendas REIT) has been the preferable REIT sector in Singapore. Meanwhile, the retail sector (eg, Scentre Group, Link REIT) has been the favourable REIT structure in both Australia and Hong Kong (see Figures 3, 4, 5 and 6). These statistics are sourced from my constructed database published in my doctoral thesis.

Why sector-specific REITs are attractive

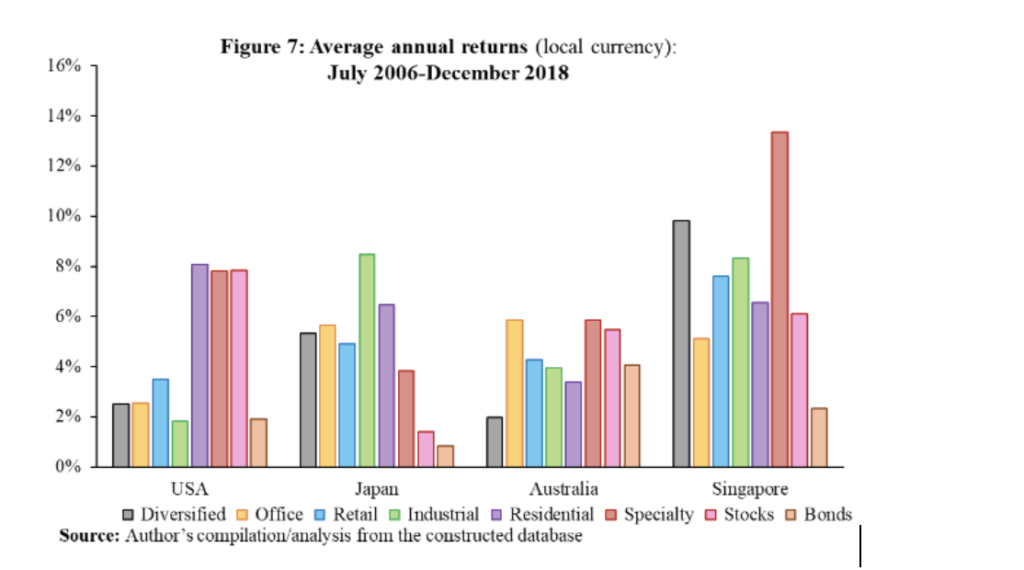

Sector-specific REITs offered higher average annual returns and lower annual risk than diversified REITs across the Asia-Pacific region over the past 12 years (see Figure 7). In the domestic and regional multi-asset portfolios, sector-specific REITs played a more significant role than their diversified counterparts. The strong performance of sector-specific REITs was also validated by the US-REIT market. These results are based on a new analysis in my doctoral thesis, as well as 2019 and 2020 journal articles.

In terms of the interest rate risk management, sector-specific REITs were empirically less sensitive to changes in both three-month and 10-year interest rates than diversified REITs across the Asia-Pacific region and the US. The insignificant exposure to interest rate risk of sector-specific REITs may imply a strong interest rate risk aversion and hedging benefits, particularly for office and specialty sectors. The findings are sourced from my 2021 journal article.

Briefly, these research findings have confirmed the added-value role of Asia-Pacific sector-specific REITs in domestic and region multi-asset portfolios, with strong portfolio diversification benefits and interest rate risk aversion for international real estate investors seeking listed real estate exposure in the Asia-Pacific region.

What next?

Policymakers and fund managers of Chinese REITs can learn from the global REIT sub-sector trajectory by:

- Mainstream sector-specific REITs across the Americas, Asia-Pacific and Europe that are aligned with the validation of REIT specialisation value in the Asia-Pacific region and the US from both investment and interest rate risk management dimensions. These imply that institutional investors (eg, real estate mutual funds, private equity funds, insurers, pension funds and sovereign wealth funds) seeking listed real estate investment exposure prefer sector-specific REITs, rather than their diversified counterparts, in their local, regional and international portfolios.

- While there is a misconception that a diversified REIT portfolio can often diversify the investment risk, diversified REITs were empirically more susceptible to interest rate changes than sector-specific REITs in the Asia-Pacific region and the US. This may suggest that sector-specific REITs had strong interest rate risk aversion and hedging benefits, particularly for office and specialty sectors. The findings are crucial for institutional investors seeking real estate exposure in the post-Covid environment, particularly with the growth of refinancing capitals and newly troubled loans during the pandemic, according to RCA reports.

- As of 2021, China has had 14 cities with over five million populations (eg Shanghai, Beijing, Chongqing, Tianjin, Guangzhou, Shenzhen), while there have been eight in the US and three in Japan, according to CIA reports. These have seen the strong demand of retail, residential healthcare and infrastructure real estate space in China, thereby making retail, residential (eg, BTR), healthcare and infrastructure REITs increasingly significant real estate sectors in China going forward. Details on the strong performance of Japan BTR are available in my 2019 journal article here.

- With high-speed internet connection, high internet penetrations, social media platforms (eg, WeChat, Sina Weibo) and e-retailers (eg, Tmall, JD.com, Pinduoduo, Kaola) in China, the strong growth of e-commerce sales have increased logistics and data centre real estate space demand, and have offered a strong real estate investment context for these two REIT sectors going forward, as denoted by my 2020 journal article regarding the Pacific Rim logistics sector.

All research findings were sourced from my PhD thesis entitled ‘The risk and return characteristics of sector-specific real estate investment trusts in the Asia-Pacific’ here. Details on the varying magnitude of interest rate sensitivity for different real estate sectors and REIT specialisation value in Australia are available in my recent journal articles entitled ‘Varying interest rate sensitivity of different property sectors: cross-country evidence from REITs’ in the Journal of Property Investment & Finance here, and ‘The value-added role of sector-specific REITs in Australia’ in the Pacific Rim Property Research Journal here.