The S&P 500 has dropped considerably since the advent of COVID-19 although well off the lows. Although the economy is slowly starting to open up, it seems inevitable that we will have at least a short-term recession. This differs from past recessions such as the “Great Recession” because it has been an “engineered” recession to try to show down the spread of the virus. In contrast, the Great Recession was a result of a financial crisis due to too much leverage in the economy. At this time, it is hard to know how this will impact commercial real estate in general and different property sectors in particular. The question is how far property values might fall? No one really knows, but we can look at the Great Recession to give us some clues as to what might happen under a worst case scenario.

A recent note from UBS Financial Services, Inc. looked at the impact of past recessions on stocks. For the most recent financial crisis leading to what has been termed the Great Recession, the calendar year return was as low as a negative 33% and there was an intra-year downturn of as much as 48% during 2008. Should we expect a similar decline in the value of

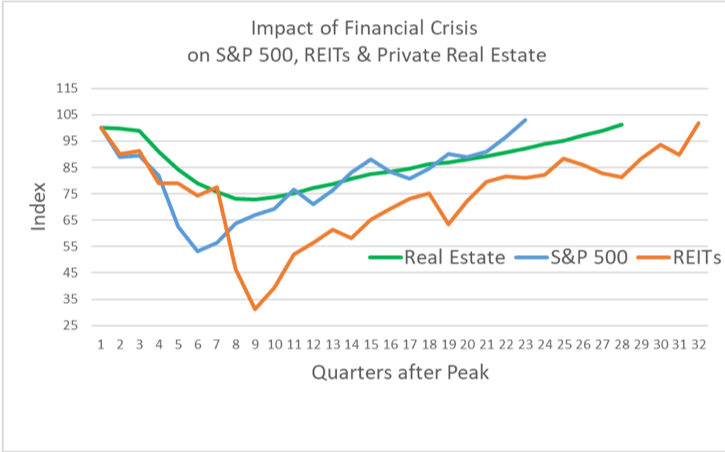

The exhibit shows the decline in value and number of quarters until private real estate, the S&P 500 and publicly traded REITs recovered to their pre-recession value. We see that private real estate had the least decline in value at about 25% whereas the S&P dropped by about 45% and REITs dropped by slightly over 65%. The recovery of private real estate was about 4 quarters behind the S&P 500 but about 4 quarters before REITs.

While we can’t say that history will necessarily repeat itself, this may give us some clue as to what to expect for commercial real estate depending on what happens to the stock market over the next year. The drop we have seen so far for stocks has been somewhat similar to that of the financial crisis. But we don’t have much evidence yet as to where real estate values will end up in the coming months since transaction activity as dried up making price discovery difficult. What seems clear is that there will be a “new normal” for commercial real estate.