What will inflation be for 2021? Forecasts of inflation on the order of 3% or a bit more are common. They are low.

There are various measures of inflation, all with advantages and disadvantages. I use two here. The first is the Consumer Price Index. This is sometimes called the ‘headline inflation rate’, because it is the index in newspapers’ headlines. It is also the inflation rate used to adjust Social Security payments. The second is the Price Index for Personal Consumption Expenditures less food and energy. This is the measure that the Federal Reserve uses in its comparisons of inflation with targeted inflation and that it provides in its summary of forecasts by members of the Federal Reserve Open Market Committee (FOMC).

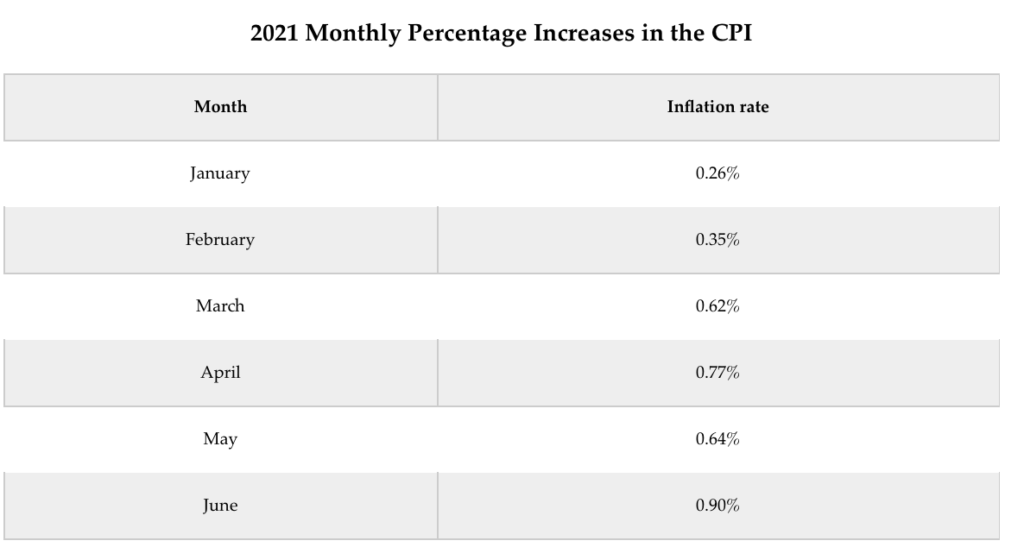

The monthly percentage changes in the Consumer Price Index (CPI) for the first half of 2021 are:

It’s not very often that people use monthly inflation rates, so it’s not obvious how to put these numbers in context. As Alan Reynolds notes, there are various ways of doing it, none entirely satisfactory.

A simple question to ask is: What is the inflation rate so far this year? Because these numbers are known and will not be revised, this will give a start on what the inflation rate will be this year. The percentage increase in the CPI so far this year is 3.34%. If prices did not increase at all for the rest of the year, the CPI inflation rate for 2021 would be 3.34%.

This 3.34% increase in the CPI can be compared with inflation rates of 2.47% in 2019 and 1.30% in 2020. Inflation in 2020 quite likely was lower than it would have been otherwise due to the pandemic and various responses to it. If inflation in 2021 turned out to be 3.34%, this inflation rate combined with the low inflation in 2020 would produce average inflation across the two years not much different from 2019.

Inflation, though, is unlikely to be zero for the rest of the year. The Federal Reserve Bank of Cleveland provides ‘nowcasts’ of inflation for July 2021 and the third quarter of 2021. They are nowcasts because they are forecasts of what inflation will be for the current period, ie, now. This estimate of the CPI measure of inflation for the third quarter is 6.42% at an annual rate, which is a 1.57% increase in the third quarter. This suggests that, at the end of September, prices will have increased 5.00% since the start of the year. If inflation continued at the same pace for the fourth quarter, the CPI would increase 6.6% for 2021.

A 6.6% inflation rate for 2021 certainly would be remarkable. And it is obvious that it cannot be ruled out. The CPI measure of inflation is likely to be headline worthy, whatever it is.

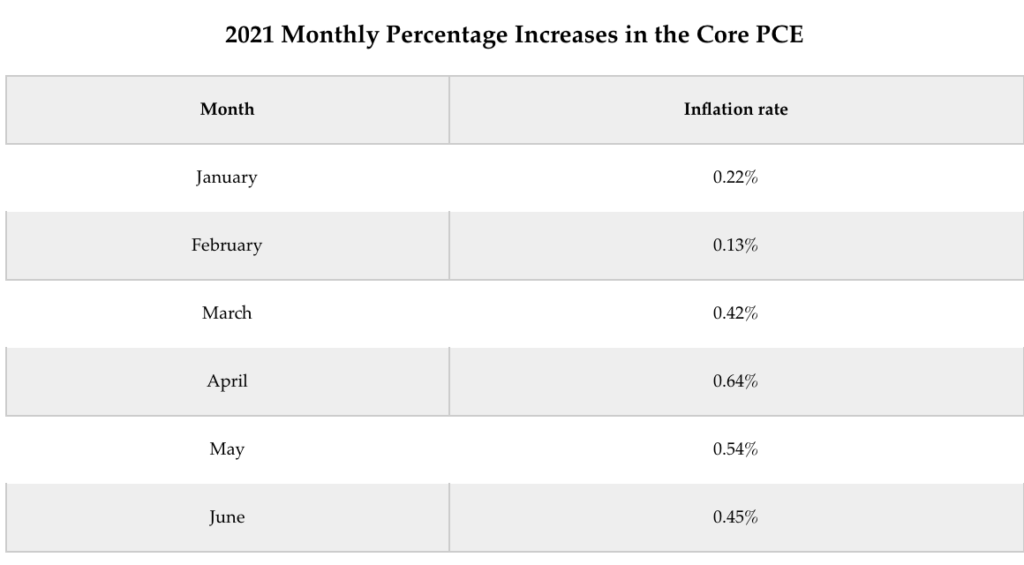

Does it make much difference if inflation is measured by the Federal Reserve’s preferred measure, the Price Index for Personal Consumption Expenditures less food and energy? The monthly percentage changes in the Personal Consumption Expenditure Price Index less Food and Energy (Core PCE) are:

These are uniformly lower than the values for the CPI, but the increase in the Core PCE inflation still is 2.20% in the first half of the year. The Federal Reserve has an explicit 2% average inflation target, but it does not specify the time period over which it aims to achieve 2% inflation on average. Unless this price index falls in the second half of the year, inflation will exceed 2% for the calendar year. How much higher is inflation likely to be?

The Federal Reserve Bank of Cleveland’s forecast of Core PCE inflation for the third quarter is 3.53% per year, or 0.9% for the quarter. This is a substantial decrease in the rate of inflation from that of March through June. If this forecast is realised, the Core PCE measure of prices for the first nine months of 2021 will be 3.1% higher than at the start of the year. If inflation in the fourth quarter continues at a similar pace, the core PCE measure of inflation will be about 4.0% for the calendar year.

Core PCE grew at a rate of 1.5% in 2020. A 4.0% inflation rate in 2021 would put the average inflation rate at 2.7% per year for 2020 and 2021. As noted above, the Federal Reserve does not specify the time period over which it aims to achieve 2% inflation on average. But a 2.7% annual inflation rate over a two-year period seems quite a bit above the 2.0% average.

A less attractive possibility for inflation is that core PCE inflation for the rest of the year will not decrease and will be similar to the rates in March through June, which had average core PCE inflation of about 0.5% per month. If that occurs, the annual inflation rate will be about 5.3% for the calendar year 2021. The average annual rate for 2020 and 2021 in that case would be nearly 3.4%.

Inflation will be noticeably higher in 2021 than it has been in some time. An important question is whether it will be followed by the widely predicted lower inflation or by higher inflation in subsequent years.

Originally published by the American Institute for Economic Research and reprinted here with permission.