In the early years of my career, I wanted to start my own business. Stories of entrepreneurship in Silicon Valley captured my imagination, and in 1994 I took the plunge. In 2000 we sold our business to a public company, and promptly watched the stock we received in the acquisition drop by about 97% when the first internet bubble burst. I call this experience ‘the rollercoaster ride’ and it made me queasy, as I watched my net worth drop back to earth just as I had started a family and purchased our first home (with a mortgage).

I set out to find a business that I could learn from the founder, and being in Los Angeles, I stumbled into the commercial real estate investment field when I met a successful value investor named Sam Freshman. Once I realised that part of the job was researching and exploring cities and neighbourhoods, I was hooked. When the global financial crisis arrived, my mentor Sam began seeking opportunities to make short-term hard money loans to opportunistic real estate investors, as a low-risk way to generate income while remaining relatively liquid. Soon after that, I made some small loans to investors who were buying and renovating homes that had gone through foreclosure. In 2010 I started my first fund doing just this type of loan and little did I know that this modest undertaking would grow into the focus for the rest of my career.

After the GFC, banks largely walked away from making real estate bridge and renovation loans

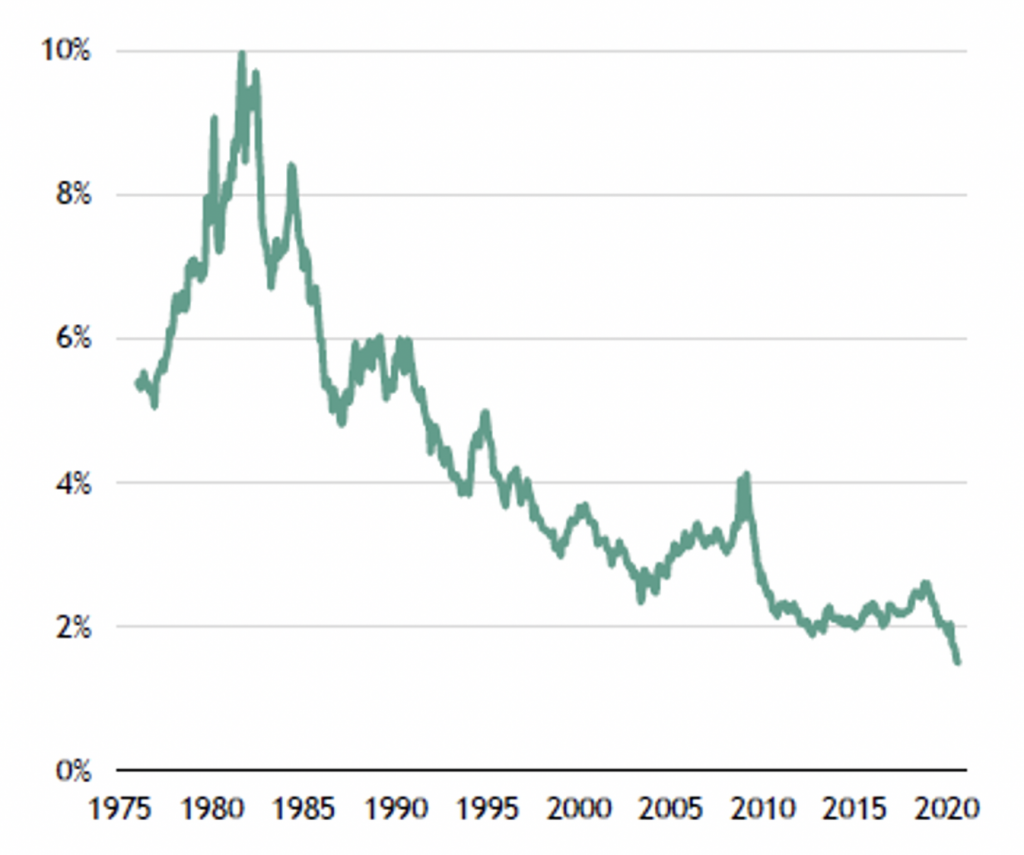

Eleven years later and after originating about 1,700 loans, the bigger picture has come into better focus. After the GFC, banks largely walked away from making real estate bridge and renovation loans to investors, leaving that market to start-up non-bank lenders and private debt funds. Meanwhile, yields on all types of investments have continued to plummet to all-time lows, as shown on the chart below.

Historical yield from a traditional portfolio of 60% equities and 40% bonds

Just as investors need income more than ever before, banks and their regulators appear to have provided investors with the perfect gift – fertile, relatively uncontested ground in which to make debt investments that generate relatively high current income.

Of course, nothing is as easy as it seems. While many investors can figure out how to buy income property, get tenants and collect rent, making real estate debt investments is more unusual, requiring a bit of know-how and the right network of professional contacts. This perceived challenge actually keeps yields significantly higher than they would otherwise be – and generally higher than the yields available from buying and operating rental property.

The most convenient way to access private debt is by investing in specialised funds that make these investments. Frequently these funds are ‘evergreen’ vehicles, allowing for investors to buy in or redeem out every month.

Banks and their regulators appear to have provided investors with the perfect gift – fertile, relatively uncontested ground

Private debt funds remain a mystery to most investors, for a number of reasons. The best-known alternative investment brands cannot easily deploy billions of dollars into many of the most interesting strategies, meaning that the companies behind the funds are often smaller and regional or local operators. Investors wanting to invest must be willing and able to conduct their own due diligence on the fund manager, their track record and the details of the fund’s strategy.

In other words, the very investors who are seeking safety and capital preservation are forced into the awkward position of needing to venture off the beaten path, trusting their own instincts and learning how to perform diligence of a fund manager. Registered investment advisers who might be better equipped to perform due diligence are often disinclined to do so, fearing the consequences if they make a mistake, and with little incentive to leave the safe world of index funds and maximum liquidity.

In summary, private debt funds offer many attractive features that are hard to find elsewhere, frequently including high current income, capital preservation and non-correlation with most other asset classes. They require some effort to understand, but the results can be well worth it.

The author’s recently published white paper on private debt funds is accessible here.