Gold is immutable and permanent. It is exactly as it was when the solar system was formed billions of years ago. It does not change. It doesn’t corrode, it does not tarnish. There is no other substance that is as constant as gold, and that is why it makes such a brilliant unit of account.

Those who study the subject will know that one of the key functions of money, as well to be a store of value and a medium of exchange, is to be a unit of account. There is no point noting that something costs ten dollars/pounds today, cost five dollars/pounds 15 years ago and two dollars/pounds 50 years ago, because the unit of account – the pound/dollar – is not the same today as it was 15 or 50 years ago. It keeps changing and getting weaker. You have to use inflation-adjusted pounds/dollars, which don’t work because the inflation rate itself is disputed. Just because a central bank says inflation is 3% or 5%, doesn’t mean it is actually 3% or 5%. Central banks don’t factor in money supply, house prices, or numerous other key prices into their measures.

So only reason we do use pounds/dollars/euros as a unit of account is because we have to report and pay taxes in pounds/dollars/euros. In doing so, we are just succumbing to the money illusion.

Gold, being constant, is a much better unit of account, particularly over time. We should use gold as our measure. It tells truths where fiat lies.

That is what we are going to do today. We are going to look at some key prices – wages, house prices, energy – but measured in gold. The truths exposed are telling.

Wages, But Measured in Gold

I want to start with a ratio you do not often see – and my thanks go to Andrew Wilshire and Keith Wiener of Monetary Metals for their help cobbling together these charts – and that is US and UK average salaries measured in gold.

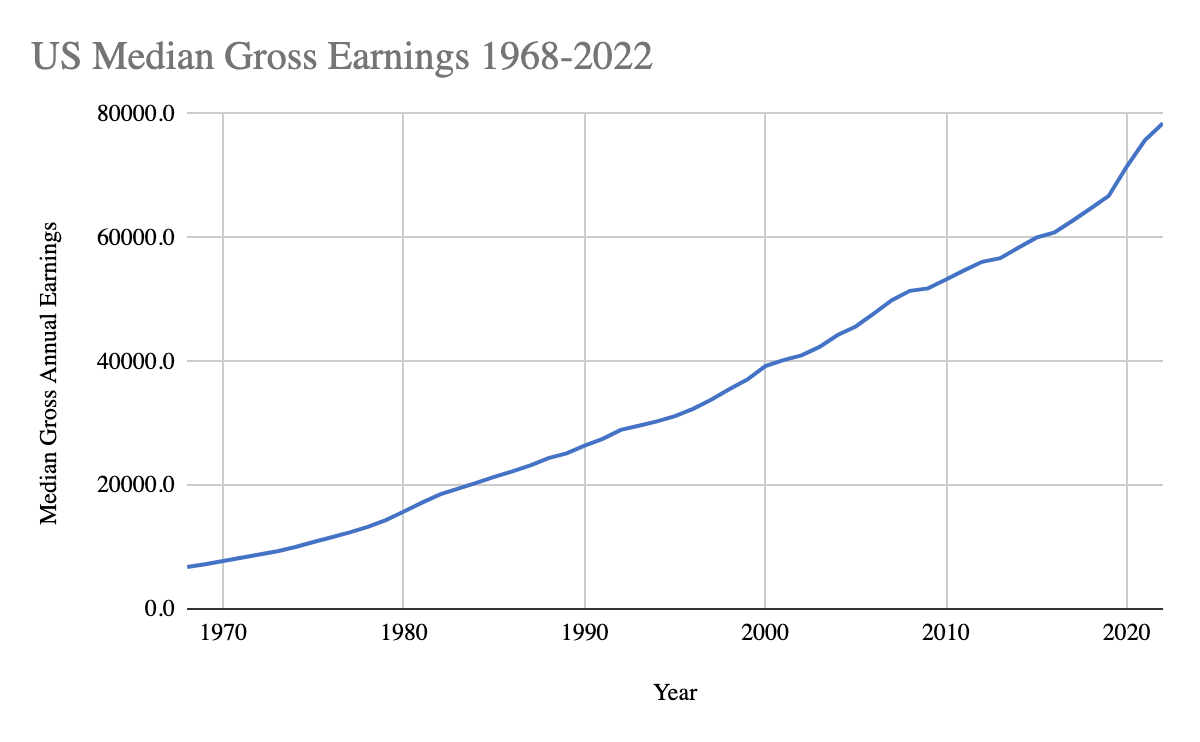

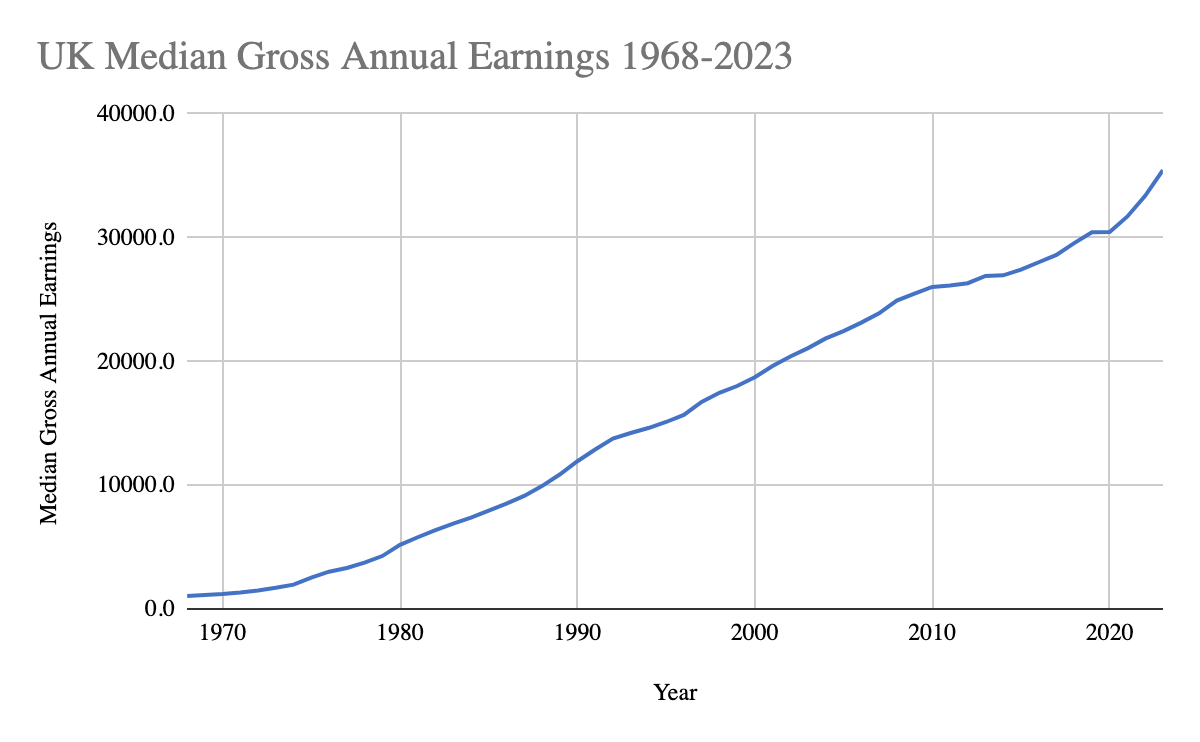

Here are average US and UK salaries measured in pounds and dollars. They keep rising.

We have never earned so much, right?

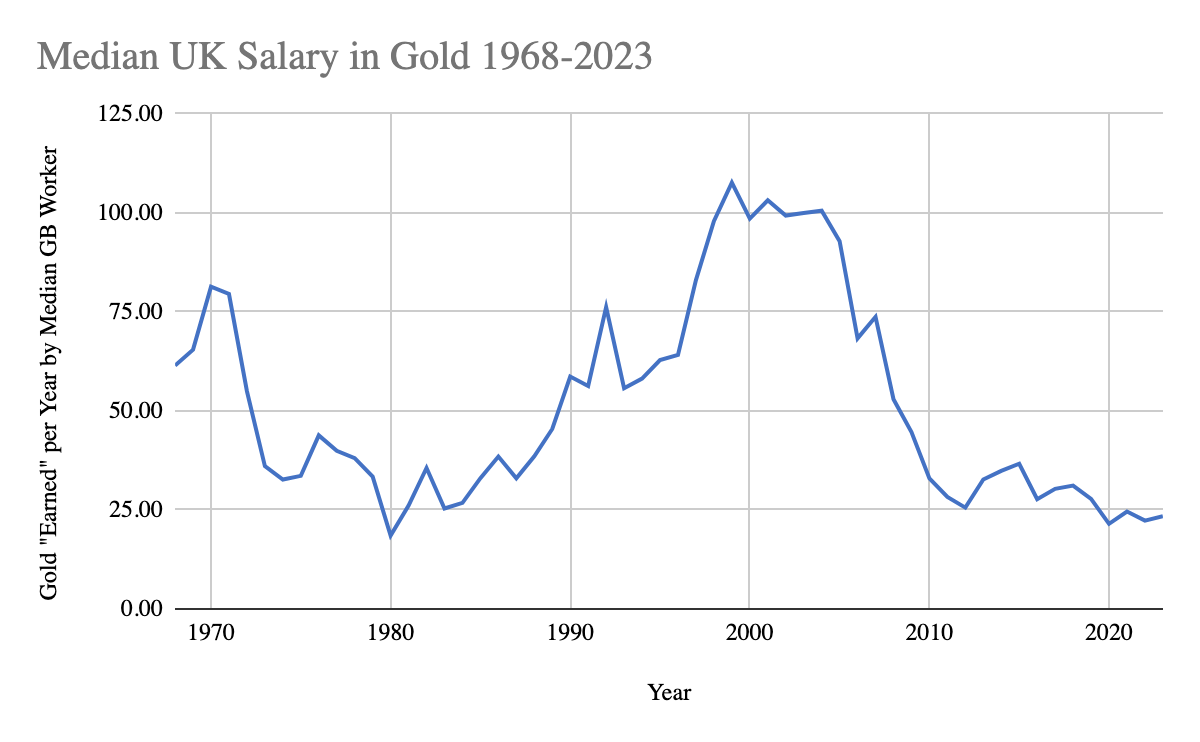

Now here they are in gold.

The data here only goes to 2022 and 2023. Were it to include 2024, when the gold price has been strong, you would see that average wages are now at their lowest level in modern history.

House Prices in Gold

One of the many things the modern worker can no longer afford is accommodation, so let’s take a look at house prices next.

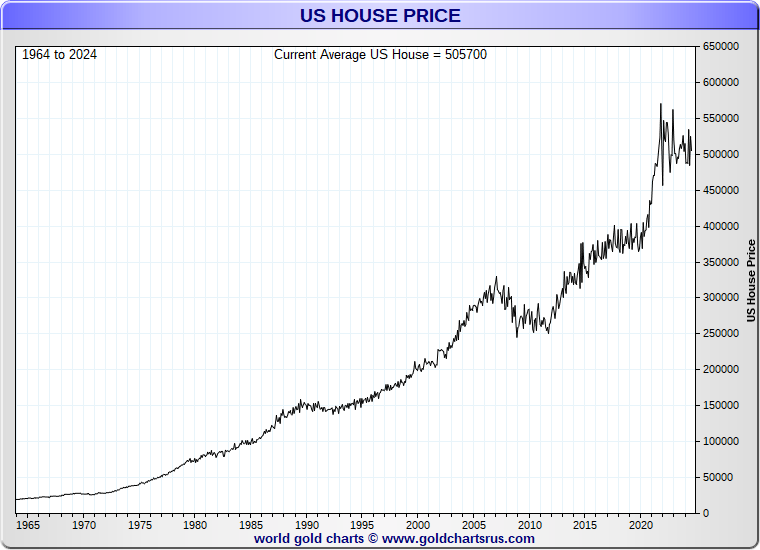

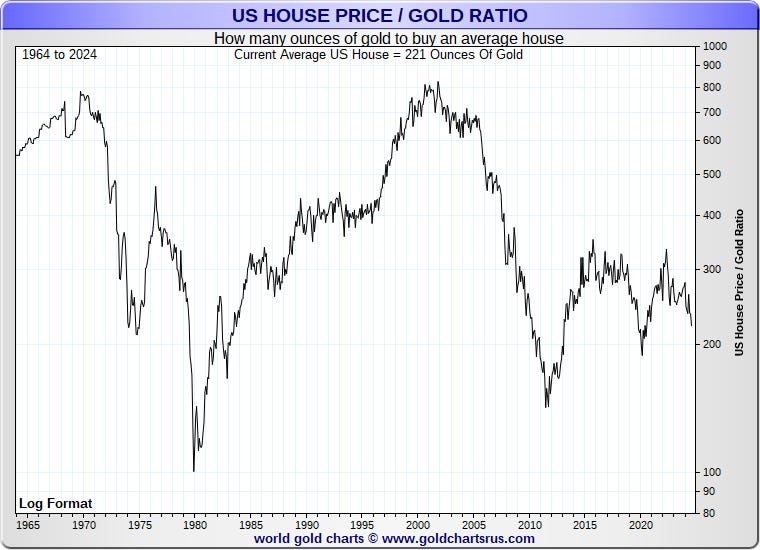

Here we see the average price of a US house since 1964. You can see how house prices have risen relentlessly. Whereas in the 1950s and 1960s the average US house was affordable with just one salary and relatively low levels of debt, today it typically takes two salaries and a lot more debt to buy a home. People have smaller families as a result. House price to earnings ratios have reached, in the past 10 years, levels never before seen in history, while housing unaffordability is one of the biggest issues for young Americans. It is a huge factor in the rise of nihilism: many feel they will never be able to afford a home, so what is the point?

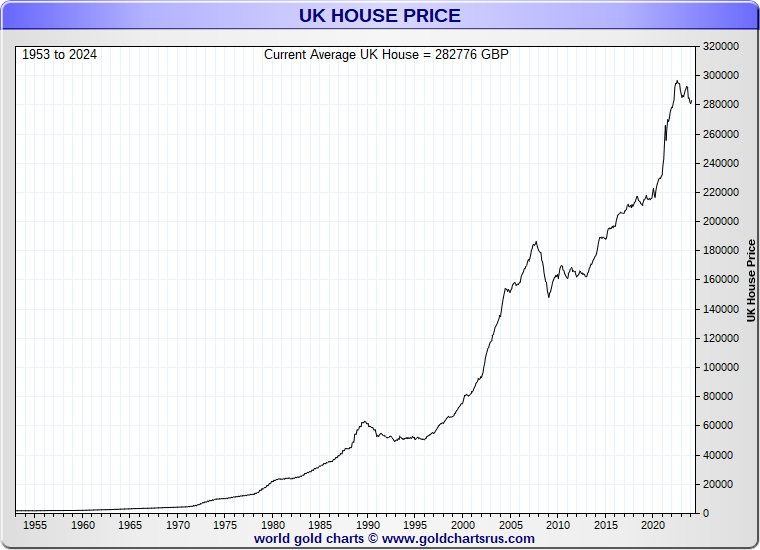

Here is the average UK home since 1953. As with US houses, UK houses have risen relentlessly in price with the same consequences of unaffordability, smaller families later in life, and nihilism amongst the young. Housing unaffordability, especially in desirable urban locations, is a huge issue. House price to earnings ratios in the UK, at more than 9, are at the highest point they have ever been in the modern era.1

Both have, of course, risen inexorably. The crashes of 1989-94 and 2008 now mere blips.

Now for the truth machine. Here are those same house prices but priced in gold.

Amazingly, the average US home is cheaper than it was in the 1960s, and indeed the 1980s and 1990s.

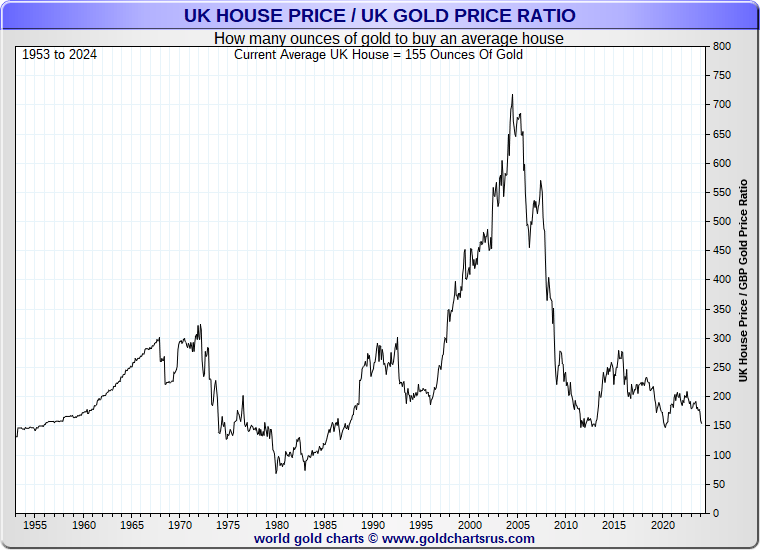

And then we look at those same UK houses, but priced in gold.

Amazingly, the average UK house, for all the inflation that has taken place, is the same price it was at in the 1950s.

You can do the same with energy, stocks (the S&P500 broke out to new highs yesterday, don’t you know), even food and clothing and you will discover the same thing. Priced in gold, they are the same price they were decades ago.

Bottom line: Fiat is a lie and you are being robbed. Save in gold and bitcoin.

This article was originally published in The Flying Frisby and is republished here with permission. You can sign up for their newsletter here.