Originally published January 2021.

A few months ago I came up with a simple way to categorise companies and their shares based on their most important attributes.

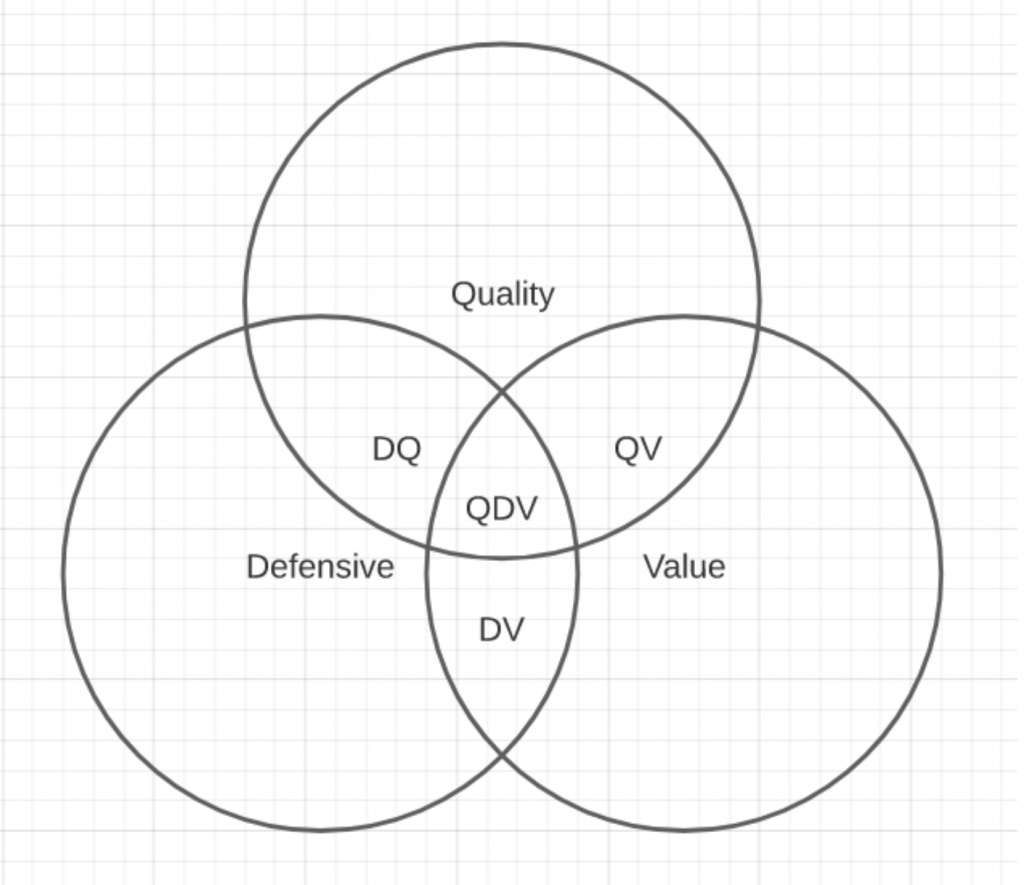

For me, those most important attributes are quality, defensiveness and value.

When combined in various ways these attributes give rise to eight overlapping categories, as shown in the diagram below.

Stocks can be defined by their combination of quality, defensiveness and value

From best to worst, at least from my point of view as an income and growth investor, these categories are:

- Quality defensive value

- Quality value

- Defensive value

- Quality defensive

- Quality

- Defensive

- Value

- No attractive attributes

The first three categories (in green) include companies I’m interested in buying. These are companies with good prospects which are attractively priced.

The next four (in amber) are companies I wouldn’t buy, but I might hold onto if I already owned them (at least until something more attractive turned up).

The final category (in red) contains companies I wouldn’t buy and would sell as soon as possible. The only exception would be situations where I choose to hold on for a while to learn more about what went wrong.

Of course, quality, defensiveness and value are just words. To have any meaning they need definitions, so here’s a brief overview of how I define each of these terms.

Quality companies use competitive strengths to fuel consistently high returns and sustainable growth

The primary attributes of a quality company are a) consistently high returns on capital employed and b) the ability to reinvest some of those returns at equally high rates to drive sustainable growth.

Both of these features only exist when a company has durable competitive advantages.

To flesh the definition out a bit more, here are the questions I ask when assessing a company’s quality (remember: not all quality companies will answer yes to all of these questions):

- Does the company have a highly focused core business?

- Has it had the same core business for over a decade?

- Has it had broadly the same goal and strategy for over a decade?

- Has it earned consistently high returns on capital employed?

- Has it produced consistent and sustainable growth?

- Does it have a culture of evolution rather than revolution?

- Has it avoided excessively rapid expansion?

- Has most of its growth been organic rather than through acquisitions?

- Does it have at least one of these durable competitive advantages:

network effects?

valuable and hard to replicate assets?

market leadership?

switching costs?

If want to know more about these questions then take a look at my investment checklist. It includes an editable template which you can use next time you’re analysing a company.

Defensive companies are robust and operate in non-cyclical markets

A defensive company is one that can generate consistent sales, profits and dividends regardless of the economic environment or other volatile factors. They usually operate in markets where supply, demand, income and expenses are relatively stable in good times and bad.

Of course there’s more to it than that, so here’s the full list of questions I use to assess defensiveness:

- Is the company’s core market defensive?

- Is the core market expected to grow over the next decade?

- Is the core market relatively free from regulatory risk?

- Is the core market unlikely to be disrupted?

- Is the company free from significant concentration risk?

- Is it free from significant product or patent risk?

- Is it largely unaffected by commodity prices?

- Does it have prudent financial liabilities?

Value: a low price relative to expected future dividends

In theory value investing is simple because there are only two things that matter:

- a company’s current share price;

- the amount and timing of all future cash returns (mostly dividends) from the company between now and the end of time (or more likely, until it’s taken over or goes bust)

If the price is low enough then those future cash returns will provide above-average returns, and that’s why value investors like to buy at low prices.

There are many ways to estimate future cash flows from a company, but personally I like to use the somewhat simplistic dividend yield-plus-growth model as a starting point.

In other words, I start by assuming an investment’s total rate of return will equal the current dividend yield plus the estimated long-term dividend growth rate.

To help me estimate a company’s long-term dividend growth rate and therefore its potential total returns, I use the following three questions:

- Is the company free from current problems that could materially damage its long-term prospects?

- Is the company likely to grow over the next 20 years, and if so, how fast? (Obviously this is an estimate.)

- Do you think this investment is likely to outperform over the next ten years?

Again, if you want more of the details behind these questions, please see my investment checklist.

Having analysed a company’s quality, defensive and value credentials, the next step is to find out where it fits into the overall picture. As a reminder, here’s that picture again:

There are eight categories in total so let’s take a quick walk through each of them.

Quality defensive value: the gold standard

Unfortunately, companies that combine quality and defensiveness have become increasingly popular since the global financial crisis more than ten years ago.

This popularity is unfortunate because they’re now rarely available at prices that offer good value. But there are some out there.

Currently 11 of the 34 holdings in my portfolio are quality defensive value stocks, and collectively they make up about a third of the portfolio in cash terms.

Of these quality defensive value holdings my favourite is Admiral, the car insurance giant. It’s a company I’ve owned for many years and written about many times, e.g. “Why Admiral is my favourite dividend growth stock”.

Quality? YES: Admiral is a quality company because it has consistently earned returns on capital north of 30% and is a market leader in the UK.

Defensive? YES: It’s defensive because people have to buy car insurance if they want to drive. While there is some cyclicality in premium pricing and therefore profits within the industry, Admiral doesn’t chase premium volumes at the expense of profitability so its financial performance is unusually consistent.

Value? YES: With a share price of around 2,850p, I think Admiral is good value because it combines a historic dividend growth rate of 7% with a dividend yield of 5%, suggesting potential total annualised returns in the region of 12% (assuming it can continue to grow at that pace).

A 12% annualised return sounds like a lot for a defensive FTSE 100 company, but since I bought Admiral in 2013 it’s produced annualised returns of 18% per year, so it is possible.

Quality value: the most attractive cyclical companies

The next best thing to a quality defensive value stock is a quality cyclical trading at an attractive price.

One thing to note is that while these companies are not defensive, they still have to operate with relatively little debt and in markets that are expected to grow.

Without those characteristics it would be hard to say they’re good value at any price. Here’s an analogy:

A Ferrari may be a quality car, but regardless of price it probably won’t be good value if it has a large ticking time bomb attached to it.

I have 12 quality value holdings in my portfolio, making up about 40% of its cash value.

One of those holdings is Next, which is a somewhat borderline example of a quality value stock.

Quality? YES: Next is a quality company because it has consistently produced returns on capital (including leased stores) of almost 20% over the last decade. That’s impressive for a company operating in the fiercely competitive high-street fashion retail business.

Defensive? NO: Next is cyclical because demand for clothing goes up and down with the overall economy.

Value? YES: After a recent post-vaccine share price surge to 6,700p, I’d say Next is at the high end of what I’d consider good value, with a dividend yield (based on a pre-covid dividend of 165p) of around 2.4%.

A 2.4% dividend yield is a bit low for an income-focused investor like me, but before the pandemic Next had a dividend growth rate of almost 9% per year, so it may still be good value if it can get close to that growth rate post-pandemic.

However, that requires some optimism and I don’t like to be optimistic about companies, so there is a small question mark over Next’s value credentials.

Defensive value: regulated monopolies at attractive prices

Companies that are truly defensive and yet lack quality (i.e. don’t earn consistently high returns on capital) tend to be at least partially regulated monopolies like Royal Mail or National Grid.

These companies provide services that are needed in all economic weathers and this makes them very steady businesses. However, they’re also typically low-quality businesses producing weak returns on capital, and the only thing that stops potential competitors from eating them alive is their regulated monopoly status.

Another group of defensive companies that lack quality are ex-monopolies like Centrica, SSE and BT. However, I wouldn’t call these companies defensive as they’re often competitively weak and use large amounts of debt to fuel growth, both of which make them fragile. And fragile companies can never be truly defensive.

There are also smaller, younger companies operating in defensive markets, perhaps notably in the defensive energy supply market in the UK.

Many of these companies lack quality, so I wouldn’t call them defensive. They could be wiped out by higher-quality competitors at any moment, and in fact 24 energy suppliers went bust in the UK in 2019. Most of these were young companies offering energy prices below the cost of supply to attract new customers, and that is not a very defensive strategy.

Mediocre or low-quality defensive companies can make good investments if:

- they are truly defensive (at least partially regulated monopolies); and

- the share price is low enough to offset the risks that come with a lack of quality (the most important being high debts and low growth).

Many years ago I owned a few low-quality ‘defensive’ companies at what seemed like attractive valuations, including SSE, Centrica and Vodafone. But I have long since learned the importance of quality and competitive strength, so I try to avoid non-quality defensives as much as possible.

My portfolio has a couple of legacy holdings which more or less fit into this category. One is Mitie, the UK’s leading facilities management company.

Quality? NO: Mitie lacks obvious quality because it hasn’t been able to generate anything like double-digit returns on capital for many years. That said, it is the market leader so this may change once its turnaround project ends in a few years.

Defensive? YES/MAYBE: Mitie’s core services are the provision of security guards and cleaners to corporate and government clients. These services are required during both booms and busts, so Mitie is defensive in that regard. However, high debts and weak profitability undermine its defensive credentials, as does its reliance on winning large temporary contracts.

Value? YES: At its current share price of 41p Mitie may turn out to be good value if its multi-year turnaround can be completed successfully, and if it can assimilate the recently acquired Interserve Facilities Management without too many problems.

Using some mildly pessimistic assumptions, Mitie could return its dividend to 3.2p or so within a few years, which would give it an 8% yield at today’s 41p share price. With even just a 2% expected dividend growth rate that would be an attractive proposition, so I think Mitie may be good value today.

However, I wouldn’t buy Mitie today for various reasons, and in general I would be reluctant to buy a low-quality defensive value stock, even if the price was very attractive. The risk is that the lack of quality will cause the company to stumble even if it’s a partial regulated monopoly like Royal Mail.

Quality defensive: the right companies at the wrong price

These are the same high-quality defensive companies that live in the quality defensive value group, but without the attractive valuation.

In other words, these are companies I would happily buy, but not at their current price.

If I happen to own one of these then I will either continue to hold or sell if something significantly more attractive comes along.

None of my current holdings fit this description at the moment, so instead I’ll choose an example that I don’t own. That company is Cranswick, a leading producer of meat-based foods.

Quality? YES: Cranswick is a quality company as it has produced near double-digit sustainable growth driven by consistent double-digit returns on capital.

Defensive? YES: Cranswick is defensive because it’s a food producer and demand for food doesn’t change much regardless of the economic environment. It’s also defensive because it doesn’t use much debt, although it does operate in the shrinking meat-based food market, which is a potential problem.

Value? NO: With a share price of 3,430p, Cranswick has a dividend yield of just 1.8% and an earnings yield of just 5%. With a historic dividend growth rate of almost 10%, a simple yield-plus-growth total return estimate would be almost 12% per year.

However, that relies almost entirely on continued double-digit growth over the next 10 to 20 years, and I think that’s a very optimistic outlook for any company, especially one operating in what seems to be a declining industry.

Personally I would say that Cranswick doesn’t seem to be good value at its current price.

And if I owned Cranswick today then I would be happy to hold, but I would also be looking to sell to fund the purchase of a more attractive and higher-yielding alternative.

Quality: quality cyclicals at non-value prices

These are good, solid cyclical business that I would happily buy at the right price. And in fact I’m happy to hold these as long as the price doesn’t seem really excessive.

My portfolio holds four quality cyclicals where there’s a question mark over their value credentials. One example is XP Power, a leading power converter business.

Quality? YES: XP leverages various competitive advantages, from the industry’s largest technical sales force to low-cost manufacturing facilities in Vietnam, to produce consistent double-digit returns on capital and double-digit growth.

Defensive? NO: While some of XP’s markets are defensive, such as the healthcare market, other markets like industrial and technology are potentially very cyclical.

Value? NO/MAYBE: XP’s share price of 4,400p makes me feel a little uneasy. Using the 2019 dividend (the 2020 was reduced by covid-19) XP Power has a dividend yield of just 2% and an earnings yield of just 3.5%. Those are low yields, so almost all of the returns from this stock will have to come from growth.

Admittedly XP Power has grown its dividend by about 10% per year over more than a decade, but to produce a 10% yield-plus-growth return going forward it will have to grow the dividend by 8% or more, on average, over at least the next 10 to 20 years.

That may be possible, but it would still mean getting a measly 2% yield for at least the next decade, and that’s not much if you’re trying to live off your dividend income.

Defensive: defensive companies lacking both quality and an attractive valuation

If I owned any stocks that were truly defensive but lacked quality and value then they would definitely be walking the plank sooner rather than later.

National Grid is a potential example of a heavily regulated defensive company that lacks both quality and an attractive valuation.

Quality? NO: I wouldn’t call National Grid a quality company. It produces steady returns, but terrible returns on capital. Regulation protects it from competition to a large extent, but it also restricts what the company can earn.

Defensive? YES/MAYBE: National Grid is a very defensive business. It operates and develops electricity and gas infrastructure in the UK and parts of the US, and demand for those services doesn’t depend on the economic environment.

However, weak returns on capital force the company to fund growth with huge amounts of debt, and that undermines its defensive credentials to some extent.

Value? NO: National Grid’s dividend growth rate averaged 1.5% over the last decade and the current dividend yield (at a share price of 880p) is 5.5%.

That gives an expected total return (very simplistically) of 7%, which is no better than (and possibly below) the expected return of the overall UK stock market, as measured by the FTSE All-Share.

If the expected return is no better than the market average then it’s hard to describe National Grid as good value at 880p. But it I don’t think it’s horribly overpriced either, and if I owned it (which I don’t) them I might hang onto it until something better came along.

Value: mediocre cyclicals trading at very low prices

Good-value stocks that lack quality and defensiveness are often owned by classic or old-school value investors.

This is where I started my active investing career back in the mid to late 2000s.

If the price really is attractive, and the risk of bankruptcy, slow decline or massively dilutive rights issues is small, then pure value stocks can make great investments.

But pure value investing takes a particular mindset, and you have to be comfortable investing in companies that are either a) facing extremely dangerous short-term problems or b) going through a multi-year turnaround process.

After a few years of doing that, I realised I prefer investing in companies where the news is generally good, so I started focusing on buying high-quality, relatively defensive companies at attractive prices instead.

The only example of a pure value stock in my portfolio is Standard Life Aberdeen (which I’ll call SLA to add brevity).

Quality? NO: I bought SLA a few years ago when it was Aberdeen Asset Management, before it merged with Standard Life. My investment criteria have evolved since then and I no longer think SLA is a quality company, or at least it isn’t obviously high quality.

But that doesn’t mean it’s terrible either, and its average returns on capital are very close to my target of 10%. I just don’t understand what its durable competitive advantages are, and without those I can’t call it a high-quality business.

Defensive? NO: SLA is an asset manager so it charges fees as a percentage of assets under management, and those go up and down cyclically with global investment markets.

Value? YES/MAYBE: With a current share price of 280p SLA has a divided yield of almost 8%, so investors aren’t expecting much growth. To produce good returns all it needs to do is maintain that yield and at some point investors are likely to drive the price up and the yield down to more normal levels.

Alternatively the dividend will be cut, and if it is I will probably sell up, reinforce the appropriate lessons about sticking to quality businesses and move on.

No attractive attributes: overpriced low-quality cyclicals

Low-quality cyclicals with unattractive prices are the complete opposite of what I and probably most long-term investors are after.

These are companies I wouldn’t touch with a barge pole at any price, although hardcore value investors might.

After re-analysing some of my weakest holdings, I think I have one that lacks quality, defensiveness and value, and it makes up 0.2% of my portfolio.

The company in question is Hyve, and it operates in the cyclical and heavily covid-hit corporate events industry.

Quality? NO: When I bought Hyve in 2015 it was called ITE, and by my current standards it was a ho-hum Russia-focused events business. Today the business is much improved, but it lacks the long and consistent track record of high returns that are necessary for a company to earn the quality label.

Defensive? NO: The corporate events industry is cyclical, with demand from exhibitors and visitors increasing and decreasing with the overall economy and the cyclical swings of event-specific industries.

Value? NO: Hyve’s dividend is currently suspended and it recently carried out several rights issues to make acquisitions and to see it through the pandemic. Both make valuing the company more difficult.

If I make a few pessimistic assumptions then it looks like Hyve could pay a dividend of 8p or so within a few years. That would give it a yield of just over 7% at its current 115p share price, and that seems attractive.

But there are huge uncertainties baked into those assumptions, given the ongoing impact of covid-19 and the company’s acquisition and rights issue driven growth strategy.

And those uncertainties are enough to make me think I don’t have a good grasp on what fair value is for this company, so I cannot say it’s attractively valued with any confidence.

Given that Hyve seems to lack any of the features I’m looking for in an investment, it currently sits near the top of my sell list. So keep your eyes peeled for a post-sale write-up in the next few months.

Quality, defensiveness and value: a simple framework for analysing stocks

I like the idea of categorising companies as some combination of quality, defensive and/or value, so I’m planning on using and developing this framework over the next few years.

Hopefully, it will help me achieve my long-term goal, which is to grow this portfolio to a million pounds within 30 years.

And if you’d like to use this approach with your own investments, please have a look at the investment checklist and spreadsheet which I use almost every day to analyse companies.

This article was originally published by UK Value Investor and is here republished with permission.