Rising interest rates are of concern for global economists and practitioners, as an increasing level of government bonds have been employed throughout the world during the Covid pandemic. To read my forecast of the incremental interest rates, see my recent journal article and PhD thesis.

Details of the varying magnitude of interest rate sensitivity for different types of REITs across the Pacific Rim region was assessed in these analyses and the findings are essential for institutional investors seeking real estate exposure in the post-Covid environment. This is particularly so with the growth of refinancing capital and newly troubled loans during the pandemic, according to Real Capital Analytics reports.

End of historically low interest rates?

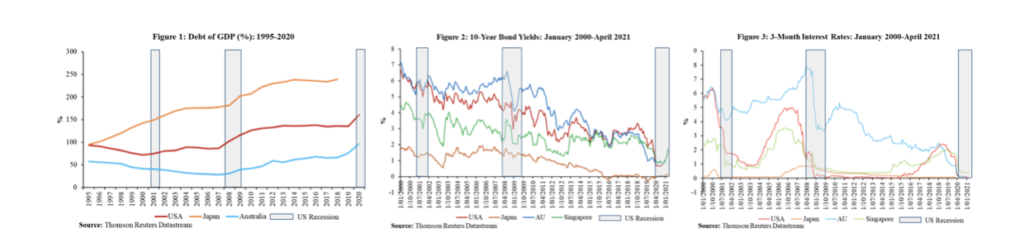

To overcome economic obstacles (eg, high unemployment rates) and lift economic growth during the Covid crisis, an increasing level of government bonds (government spending) have been utilised by governments throughout the world. This has led the percentage of debt to GDP across the Pacific Rim region to reach the highest level in 25 years (see figure 1).

International economists and practitioners have been concerned that a persistently elevated supply of government bonds could lift the equilibrium interest rate, particularly following the historically low interest rates since the GFC. In the Pacific Rim region, 10-year bond yields have increased 97 bps in the US, 83 bps in Australia, 78 bps in Singapore and 8 bps in Japan since October 2020 (see figures 2 and 3). There has also been a surge of 10-year bond yields across Europe (eg, in Germany and Italy).

In May 2021, US Treasury Secretary Janet Yellen conceded that short-term interest rates might rise to control an overheated economy resulting from the trillions of dollars in government stimulus spending. This is despite the US Federal Reserve pledge to keep interest rates near zero until 2023. Singapore has taken the first step to raising short-term interest rates by 3 bps since October 2020 (see figure 3). In the emerging markets, China, Russia, Turkey and Brazil have hiked short-term interest rates in a bid to stem accelerating inflation in early 2021.

Scenario 1: Impacts of US monetary policy on Pacific Rim REITs by sector

According to the recent US Federal Reserve statement regarding rising interest rates, the impact of US monetary policy on various types of REITs across the Pacific Rim region were assessed for the first time. This is particularly important for real estate investors who may have international portfolios.

In Australia, industrial and residential REITs were empirically sensitive to changes in both US 3-month and 10-year interest rates. In Singapore, diversified, office and residential REITs were susceptible to both US 3-month and 10-year interest rate movements. By contrast, all types of REITs in Japan were immune to US interest rates.

Scenario 2: Influence of domestic interest rates on Pacific Rim REITs by sector

In light of the spillover effect of US monetary policy detected by international scholars and practitioners, rising interest rates are expected to occur across the Pacific Rim region (eg, the US, Japan, Australia, Singapore) once the US Treasury has finished the task of implementing rising interest rates decisions.

Pacific Rim diversified REITs were empirically more sensitive to movements in domestic interest rate series than specialised REITs. This may be attributed to a diversified REIT portfolio, including multiple real estate sectors (eg, office, retail, industrial, residential, hotel, healthcare, data centre, infrastructure). Regarding Pacific Rim specialised REITs, retail and residential REITs were the most vulnerable sector to domestic interest rate fluctuations across the region.

What next?

The research findings have several significant real estate investment implications:

1. The first scenario results may be attributed to those REITs that often constitute global real estate portfolios, such as Goodman (Australia; logistics real estate in the USA, Europe, Japan, Australia, Singapore and China), US Masters Residential Property Fund (Australia, residential real estate in the US), Manulife US REIT (Singapore, office real estate in the US) and Ascott Residence Trust (Singapore; residential real estate in the USA, Europe, Japan, Australia and Singapore).

2. Real estate investors should acknowledge that diversified REITs were empirically more sensitive to interest rate changes than specialised REITs in the Pacific Rim region, albeit it is a common misconception that a diversified REIT portfolio can often diversify the investment risk.

3. The second scenario findings may be attributed to real estate lease structures, terms and lengths. Specifically, residential real estate is leased on a short-term basis, while office, retail and industrial sectors are leased on a long-term basis. Retail real estate is more volatile than office and industrial sectors, due to the existence of percentage rent in retail real estate leasing. These may result in retail and residential REITs being more sensitive to domestic interest rate fluctuations than the other types of REITs across the region.

4. While real estate investment via a non-listed vehicle is the main route for institutional investors (eg, REMFs, PE Funds, insurers, pension funds and SWFs), REITs and direct real estate have responded to the same market fundamentals conceded by real estate scholars. This analysis of interest rate sensitivity with multiple types of REITs across various Pacific Rim markets should enhance real estate investors and lenders’ understanding of interest rate risk management for various types of REITs in local, regional and international investment portfolios.

All research findings were sourced from my recent journal article entitled ‘Varying interest rate sensitivity of different real estate sectors: cross-country evidence from REITs’ in the Journal of Property Investment & Finance here. This journal paper is based on my PhD thesis entitled ‘The risk and return characteristics of sector-specific real estate investment trusts in the Asia-Pacific’ (here) and collaborated with Associate Professor Chyi Lin Lee (University of New South Wales) and Professor Graeme Newell (Western Sydney University).