After the shock of COVID-19, the U.S. industrial market is expected to bounce back stronger than previously forecasted.

In fact, demand will more than triple the previous forecast based on new metrics that CBRE Econometric Advisors has developed using e-commerce data. Annual rent growth will be higher than it was pre-COVID-19 and this increased demand will generate more development going forward. E-commerce companies, food & beverage, consumer packaged goods, and major retailers are very active, which is driving the demand for space in markets around the country.

The overall vacancy rate for warehouse/distribution space was 4.9% at the end of Q1, nearly 2 percentage points below the cyclical average (2009-2020). Due to the tight market fundamentals, developers have responded in kind and are completing projects even amid COVID-19 challenges.

At the end of first quarter, a record 315 million sq. ft. of industrial inventory was under construction in the U.S. The general consensus among industry professionals was that the onset of COVID-19 would cause a dip in construction activity as developers take a “wait and see” approach due to a possible economic downturn. The inability of workers to be on site because of quarantines and the difficulty of transporting materials to job sites was also deemed to cause significant delays. Many projects continued although at a slightly lower pace for a variety of factors.

Heightened safety requirements slowed the development process

A range of social distancing guidelines are in place across the country, including the use of no more than four-person revolving teams, workers maintaining at least six feet of distance, taking temperatures of workers before they enter the site, provision of additional portable toilets (1 per every 10 workers), as well as on-site cleaning stations and sterilization of the site between shifts. Despite the lifting of quarantines, these guidelines remain in place today.

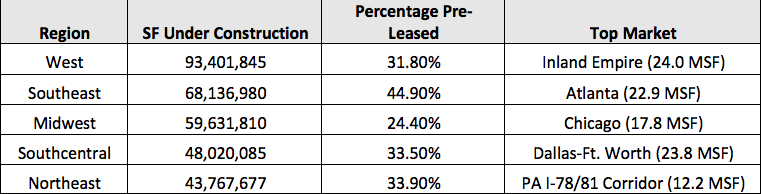

Total volume of buildings under construction ticked down to 298 million sq. ft. in April as some projects were delayed because of quarantine. As the country opened up so did construction sites, with under construction projects increasing to 313 million sq. ft. 33.2% of this space has already been leased, which is an indicator of strong demand. The west region has the most under construction at 93.4 million sq. ft., led by the Inland Empire. Other markets with a significant amount development include: Phoenix, Las Vegas, Denver and Salt Lake City—all these markets have over 5 million square feet under construction.

While the southeast region ranks second with 68.1 million sq. ft. in development, it has the most pre-leasing, with 45% already leased. Because of strong pre-leasing, development will have little effect on vacancy rates in the coming quarters. The southeast remains an in-demand market for modern warehouse space due to population growth, as well as a plethora of logistical advantages, including ports of Charleston and Savannah, a growing number of inland ports with exceptional rail capabilities, a robust workforce and general pro-business environment.

Figure 1: Industrial Development by Region

What is the next frontier for industrial development?

Although most of the buildings currently under construction are standard shell warehouses, there is evidence that there will be more amenities built into future facilities, with features like skylights, A/C, along with systems to improve ergonomics and safety for workers.

Automation will become more common to increase efficiencies for the user—automated storage and retrieval systems (ASRS), for example. This is especially true for cold storage facilities where efficiency is paramount for storing and distributing perishable food items across temperature-controlled areas.

More last mile/infill properties will be needed to support an omnichannel approach whereby retailers combine their brick-and-mortar store portfolios with their expanding real estate networks for e-commerce distribution and fulfilment.

Industrial developers will be busy into the foreseeable future.