Originally published April 2021.

Proptech is not new: a conversation with (above, from left to right) Jim Young, founder and CEO of Realcomm, Michael Beckerman, CEO of CREtech, and Matt Ellis, CEO of Measurabl.

Biographies

Jim Young is the founder of Realcomm Conference Group, an educational organisation that produces Realcomm, IBcon and CoRE Tech, with conferences on technology, automated business solutions, intelligent buildings and energy efficiency for the commercial and corporate real estate industry. Realcomm is probably the oldest conference forum to integrate technology and real estate, where some of the largest real estate operators discuss the most advanced and progressive next generation real estate projects. Here we talk about proptech and the future of real estate. See www.Realcomm.com

Michael Beckerman is a leader in the commercial real estate tech sector. He entered the sector in 2012 after a 25-year career in commercial real estate public relations. Michael now serves as CEO of CREtech, the largest event, consulting and content platform in the commercial real estate tech sector. Michael blogs at www.cretech.com/michael-beckerman/ and is active on the commercial real estate tech speaking circuit. See www.cretech.com

Before founding Measurabl Matt Ellis spent five years with CBRE, where he began his career as a real estate broker and went on to lead CBRE’s Sustainability Practice Group in the western US, implement CBRE’s industry-first global carbon neutrality programme, and serve as director of sustainability solutions. He was a member of CBRE’s global sustainability steering committee. See www.Measurabl.com

What is proptech?

Proptech (property technology) can be defined as any technology that impacts the built environment and has the potential to be disruptive in how we conduct business, in way analogous to fintech (financial technology) such as PayPal and Apple Pay and cryptocurrencies. With proptech being the buzzword in the last several years, it is fairly easy to assume that it is new to the real estate industry. However, when talking to Jim Young, the founder and CEO of Realcomm, a research and event company at the intersection of technology, innovation, and real estate operations, he indicated that contrary to popular belief, proptech is not new and has been around as early as the 1980s.

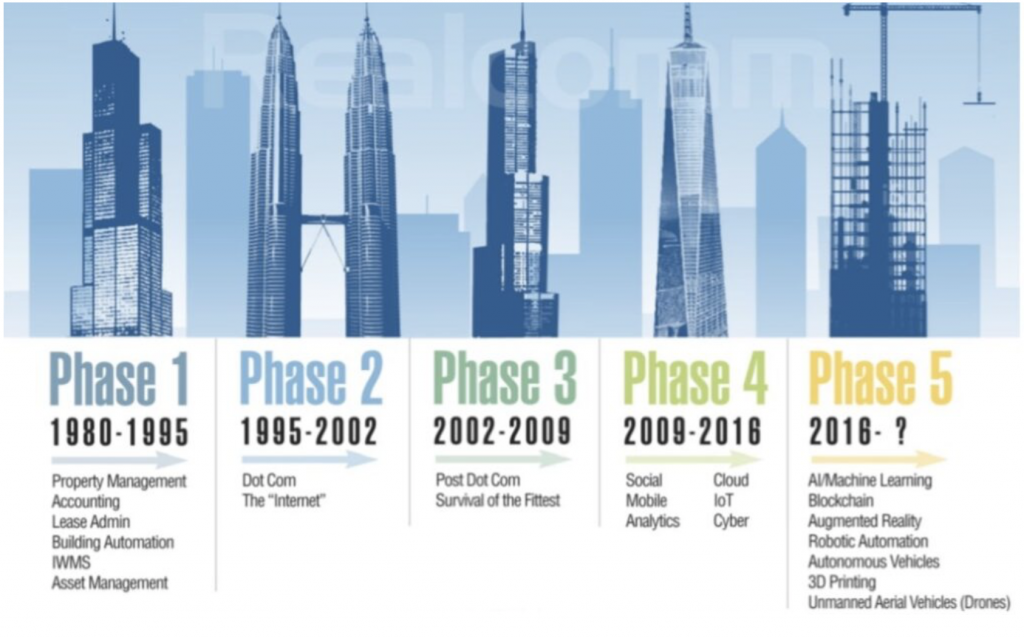

Jim suggested that it is crucial to understand the history of proptech in order to understand its present and future. Phase one of proptech, which began in the 1980s, focused on leasing, facilities management, building automation, and property management. Phase two was the dot-com era when everyone planned to invest a lot of money and change real estate forever. Phase three was after the dot-com era and cycled up and down, but some really good companies came out of it like Loopnet and CoStar. About 80% of the start-ups failed, but 20% succeeded in some way. Phase four started in 2009 after the financial collapse. Many companies created during this time are some of the most talked-about now. They created innovations on social mobile analytics, cloud IOT (internet of things) and cyberspace. Many thought proptech was brand-new (it was not). Phase five began in 2016 and features all the next-generation technologies like artificial intelligence (AI), machine learning, blockchain, and augmented reality. See figure 1 below.

Figure 1: The evolution of proptech

Michael Beckerman prefers the term ‘CRE tech’. He says: “Proptech is honestly not one of my favourite terms for the industry. It’s a very narrow definition in fact and doesn’t do justice to the scale of innovation happening in the real estate industry. When I think of how most people casually refer to our industry as ‘proptech’, they are excluding a huge swath of the sector. I would argue that the majority of start-ups are not focused on property-level innovations, but rather on the operating side of the business, such as data, analytics, financing, insurance, transactions etc. To me, proptech is a concept that is largely encompassing the building-level technology solutions where ‘real estate technology’ or ‘CRE tech’ encompasses every aspect of constructing, operating, analysing, managing, financing, insuring and transacting in the built world. It’s also why the name of our company is CREtech.com.”

Matt Ellis, founder and CEO of proptech firm Measurabl, agrees with Michael Beckerman that proptech is any technology-based (including tech-enabled services) solution for the property business. This broad term encompasses not only physical property, but also anything that interfaces with it: sustainability, finance, construction, insurance, brokerage, management etc. If the beneficiary of the technology is an owner or stakeholder of the box, it is proptech!

Jim Young cautions that evolutions take time. Jim has never seen a technology change the world in 24 months. Yes, proptech is being taken as seriously as ever and there is a lot of money being thrown at it, especially with covid and concerns about getting tenants back into buildings. Yet Jim points out he has not seen an acceleration of covid-specific technology. According to Jim, as an example, better technologies exist than just those currently used for taking a human temperature as a covid predictor or for eliminating the risks of covid. Some of these include scanners for heart rate and blood pressure, air conditioning with bipolar ionisation, microbial swabbing to test surfaces for covid, and even Ultraviolet C (UVC) robots to completely disinfect air and surfaces in a room. These are just starting to appear on the radar of progressive building owners.

Picking winners: How is a property owner or manager or broker to know which vendors to consider?

Some estimates (CREtech) say as much as $32bn, as of early 2021, has been invested in proptech start-ups. Jim Young has stopped counting. He finds it interesting that proptech start-ups that pitch new ideas very rarely mention established players like Yardi, CoStar, or RealPage. He says the reality is that most proptech survival transactions occur when these established companies buy new start-ups. Sometimes venture capitalists will purchase start-ups at various stages from each other, but most of the real activity he has seen in the last 24 to 36 months has been big companies buying little ones with promising applications.

“You would be hard-pressed to find any institutional real estate investor that would not consider technology as a top set of concerns,” says Matt Ellis emphatically. But how do real estate owners know which technologies to pursue? How do they understand how consumer, tenant or customer behaviour is shifting? There are so many proptech companies! These companies will lead to innovation. The survivors signal to real estate owners which technologies the market desires. The real estate industry as a whole is only just starting to adopt technology. Most of the smaller real estate firms are looking to others to show which features or applications are worth adopting. “There is very much a herd mentality with technology,” says Matt. “Therefore, is it incumbent upon the leading players with deeper pockets to take an assertive stance in identifying the best technologies so that the industry can follow.”

“You would be hard-pressed to find any institutional real estate investor that would not consider technology as a top set of concerns”

– Matt Ellis

Yet, the real estate sector has some unique characteristics. There are only a handful of dominant companies in any of the real estate verticals such as comparable transactions data and brokerage, for example. It would follow that a successful property technology company in one of these verticals would become exceptionally financially successful. Matt believes that any proptech company that is taking over $10m dollars in venture capital is expecting – or at least positioning – to go public. But any of those firms may be secretly hoping that an incumbent real estate company like CBRE or CoStar or RCA, or even a technology company like Zillow or Amazon, buys them out. Although real estate is the world’s largest asset class, proptech has not yet seen many of the spectacular exits that some Silicon Valley companies have had. These may be coming in the future. For instance, at the beginning of 2021, Tishman Speyer brought proptech company Latch public by way of its special purpose acquisition vehicle (SPAC), valuing the company at $1.56bn. Latch’s success suggests that more exits like this may be on the horizon.

Michael Beckerman concurs that covid has accelerated change. “We saw an explosion of new start-ups being launched from 2012 to 2019 with best guesstimates suggesting there were anywhere from 7,000 to 10,000 start-ups in the sector. The other important trend to note pre-covid was that capital being invested in the sector was accelerating at an extraordinary pace. However, the key metric to note was that adoption of these tools was still incredibly slow. For a great many reasons that was the case, but largely because there really weren’t any solutions that were a ‘must have’ as most were categorised as ‘nice to have’ and as the real estate industry as a whole was experiencing strong economic conditions, there simply wasn’t any great impetus to embrace technology. Covid helped changed the ‘nice to have’ to ‘must have’ for some applications.”

Michael Beckerman continues: “The work-from-home (WFH) phenomenon forced every business to adopt new technology in order to continue to manage their operations, perhaps none more so than commercial real estate companies who simply had not made the investments prior to covid to be able to operate remotely. Also, at the same time, it forced the industry to embrace tools that create healthier and safer working and living conditions throughout the built world. Through covid we saw a 10x growth in adoption within literally ten months in commercial real estate! And now that companies are seeing the benefits, the pace of adopting technology is only accelerating further.”

REConnect estimates that globally there are well over 8,000 firms now that could be considered proptech. Michael Beckerman’s firm (CREtech) suggests at least $32bn has been raised for start-ups, and he states, “The majority of dollars tracked in real estate tech refer to venture investments in technology companies. Most of the data is from either public sources or from companies that track this type of investment data, i.e. CrunchBase, CB Insights and, of course, companies like ours and others do their own research. So, if a company, whether it’s a VC or corporations like CBRE, Blackstone or Prologis, makes their investments public, it’s usually captured in the data. Mergers and acquisitions are typically not included in these types of analysis, but still are reported by other companies that track that kind of data separately.”

Picking winners will be hard and most will perish

According to Jim Young, a lot of the capital fuel for the proptech industry is driven by increased investor appetite from access to lots of capital and few places to invest it. “Broader capital markets are fuelling an increase in valuations with money channelled to good story-tellers. It is not clear that the fundamentals of the potential businesses or technologies themselves are being thoroughly evaluated. For the longest time, deals were done with the goal of achieving profitability or gaining market share. During the dot-com era, start-up business promised these goals could be achieved over an approximately two- to three-year horizon.” Jim sees current companies promising these goals over twice that time frame on average. “They are raising several investment rounds over this longer start-up time and are not proving the level of profitability or market share capture that has historically been required. This makes current start-up valuations inherently far riskier than those in the past. And as history would tell, the real estate industry is slow to change.”

Jim Young sees a disconnect between great ideas from start-ups and the actual implementation of those ideas by real estate businesses. An example, not specific to real estate, is the push to convert all electricity uses to renewable sources. While a very noble idea, a lot of time and investment needs to go into the infrastructure necessary to make this a reality. The same logic applies to proptech companies. Startups that promise this degree of change, especially over a short period, are not being realistic. It will take time for the industry to adopt the technologies.

“Broader capital markets are fuelling an increase in valuations with money channelled to good story-tellers. It is not clear that the fundamentals of the potential businesses or technologies themselves are being thoroughly evaluated”

– Jim Young

According to Jim, smart building technologies will be the winners. Examples of these include businesses that focus on operational and energy efficiency, occupant experience, safety and health. Jim sees these as problems that matter to real estate owners. From his vantage point, similar to Michael Beckerman, he concludes that covid has accelerated technological changes needed to manage buildings. Once covid hit, building engineers needed to manage buildings remotely. This required connecting existing building systems to an interface that allowed the engineer to monitor those systems – a prime example of a smart building technology. He thinks the proptech industry has overlooked some of these technologies because they are not as shiny as some other ideas, but he believes they serve a real need, and eventually the industry will come around to see this.

Michael Beckerman, while supporting proptechs, still admits it is an uphill road. “While I do not consider myself a tech investment expert by any stretch of the imagination, in the venture world they typically say that one-tenth are successful.”

Matt Ellis has a different view from Jim Young. From Matt’s point of view, “the smart building tech space has been a red ocean of death and destruction” full of many undifferentiated sensor-based analytics companies. None of them have scaled tremendously yet, and he does not believe they are likely to do so. Matt recognises that any participant in the proptech business needs to do some level of integration with in-place analogue (i.e. non-digital) building systems. This is relevant because existing buildings with legacy technologies make up the vast majority of the built environment. But this does not mean that smart building technologies that focus singularly on this issue will be successful.

Matt is watching out for a company that offers new services that create additional revenue by, for example, monitoring existing HVAC systems. A business that creates additional revenue is much more exciting than one that offers cost savings by promising less energy consumption based on totally new technology, for example. Most smart building technologies are working against the cost centre. This is a secondary focus of many real estate companies and a smaller piece of the equation for generating profit. It is a major headwind to smart building technologies. In many ways, the smart building technologies are solutions in search of a problem.

What about environmental, social and governance (ESG) factors and sustainability?

Despite the headwinds, there is a large conversation around smart buildings and energy efficient technology, especially as an owner elective versus a government mandate. Regulation will compel ownership to do more with technology or choose the next most affordable option to meet decarbonisation goals. If the requirements are too costly, owners will elect to pay whatever fine is imposed. Brendan Wallace, CEO of a proptech venture capital firm Fifth Wall, estimates $20bn in annual fines for New York landlords to comply with the Paris Agreement requirements, per a recent Walker and Dunlop podcast.

Matt Ellis acknowledges that New York is a large market but believes local municipalities are likely to all have their own regulatory approach to decarbonisation. He states that a blanket view across all geographies is not an accurate depiction for how property owners will approach this complex issue. In response to regulation, different strategies will be adopted by local operators based on whichever costs less: the fines, the technology, or the next best option. Yet, until technologies can give real estate operators a decisive financial competitive advantage, regulation may be the most effective tool for decarbonising.

Covid is as much of a tailwind for decarbonising as regulation. Crises accelerate and amplify pre-existing trends. This is clear when looking at some of the most discussed covid trends, such as the shift from permanent office spaces towards more flexible workspaces. This movement had already begun prior to covid along with a move towards more flexible co-working like WeWork. Similarly, many of the health and well-being issues that are now at the forefront (WELL and Fitwel certifications, indoor air quality, among others) are part of the ESG umbrella, which was a trend well under way prior to the pandemic. When the health crisis hit, large companies like Boston Properties Group turned to their director of sustainability to lead the task force on resiliency measures. “Covid became a sustainability issue, which elevated the sustainability function, and in turn accelerated and amplified the trend toward sustainability as a whole,” Matt Ellis explains.

Historically, a lot of sustainability measures were luxuries only the most well capitalised could afford. LEED Platinum or Outstanding BREEAM rated buildings are expensive to construct, and the high rents reflective of these costs are absorbed by blue-chip tenants. In the past, there were fewer green building features that mom-and-pop owners could reasonably financially offer. Matt Ellis believes that this is no longer the case and that the bar has been raised.

Any final thoughts?

Jim Young warns that with increased digitisation and smart building technologies, there will be a significant need for digital security. He described an example of an entire building that was highjacked by vulnerabilities in its parking gate. The smarter buildings get, the more important digital security will become. And with new technology will come a need for those who understand how to maintain it. Jim sees a shortage of IT-proficient engineers as a potential opportunity for an emerging workforce. “Historically, employees needed screwdrivers, now they need iPads and smartphones!” says Jim.

“The biggest issue remains that there are simply too many technology companies all converging on real estate companies. This makes it incredibly hard for the end users”

– Michael Beckerman

Jim provided the final closing statement on the global context of proptech as he sees it: “All of these conversations about proptech, innovation and adoption are great, but there is a much bigger conversation that needs to be had. For the last 20 years, under the guidance of a very big and specific strategy, China has been building an infrastructure to build not only smart buildings but smart cities, including energy, transportation, advanced telecommunications and more. The efficiency of this communist-led society is extraordinary and in order to compete we need a space race (think Russian moon shot) event in order to create a viable alternative under the framework of democracy!”

Michael Beckerman adds: “The biggest issue remains that there are simply too many technology companies all converging on real estate companies. This makes it incredibly hard for the end users, the real estate companies, to adopt so many siloed solutions. Therefore we are seeing many technology companies build end-to-end solutions to become the single-source provider for multiple solutions for their customers. Integration platforms will become increasingly valuable. Three areas I think have the biggest growth potential over the next five years will be climate tech/sustainability/ESG, construction tech and affordable housing tech. I have no doubt there will be an extraordinary amount of investment and start-ups emerging in these sectors reflecting the demand for innovative solutions to tackle some really challenging problems of market inefficiencies and societal trends.

In fact, we now have something called climate tech. We have recently launched our newest initiative at CREtech.com called CREtechClimate.com, which is exclusively focused on helping the real estate industry reduce its carbon footprint as well as promote sustainability/ESG initiatives. With the built world responsible for 40% of all carbon emissions globally, the industry has both the moral responsibility to address climate change but also the financial opportunity to lead the way in showing that you can profit and do good at the same time. There is an extraordinary business case for investing in climate tech as it is going to be, according to many experts, the single biggest investing opportunity perhaps ever as the entire world is starting to converge on addressing climate change.”

At the University of San Diego, we are starting a directory of proptech firms to make it easier to know who is out there and what they do. We also have included some white paper resources from Oxford University. There you will find several categories including: brokerage, asset management, capital sources, construction, data and analysis, valuation, transaction management and several others.If you are aware of a proptech firm not in the directory, please ask them to sign up and provide a free listing so the market can become aware of them.

Research assistance for this piece was provided by Alexander Allione – a part-time student in the University of San Diego’s Master of Science in Real Estate (MSRE) programme and a senior analyst on the asset management team at Kimco Realty Corporation, overseeing a portfolio of 116 shopping centers comprising over 25 million sq. ft – as well as by Tobias Lopez, a part-time student in the University of San Diego’s MSRE programme.