By Richard Barkham, Global Chief Economist; Neil Blake, Global Head of Forecasting; Wei Luo, Associate Director, CBRE.

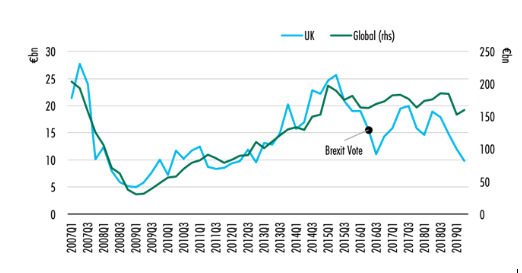

The UK’s long-term average share of global real estate investment is about 13%. Until early 2016, the level of UK investment moved in sync with the global total (Figure 1).

A divergence appeared around Q2 2016 in the run up to the UK’s historic Brexit vote (June 23, 2016). Investment fell sharply, and then fell further after the referendum.

As with British political life, it has been a bit up and down since. Investor confidence has improved a couple of times as expectations of a smooth transition have risen. More recently, as uncertainties have increased, UK investment has been notably lower than the long run average would imply. Year to date, the market has experienced a substantial deterioration in transaction volume.

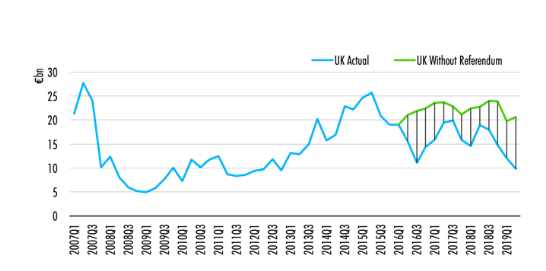

This makes it interesting to ask the counterfactual question: assuming the long-run synchronization between UK and world real estate investment would have held, what level of investment could the UK have expected if no referendum had occurred?

We estimate that if the UK had maintained its 13% share of the global investment from Q2 2016 to Q2 2019, an additional €90 billion worth of real estate would have been transacted in the last three years. That’s an average of nearly €7 billion each quarter (Figure 2). Given that UK investment was running above trend in 2014 and 2015, this approach probably under-estimates transactions forgone as a result of Brexit. But we choose to side with the cautious approach.

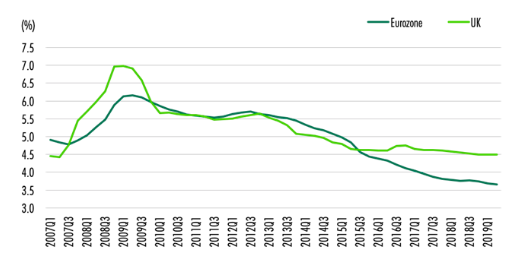

Over the last four years, yield compression has knocked 200 bps off prospective income returns in the Eurozone, from which trend the UK has been immune (Figure 3). This yield stability is new to the UK, as UK prime yields have historically been quite cyclical.

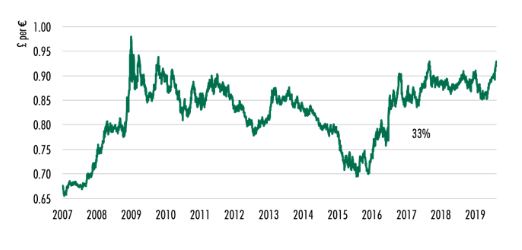

This differential means that prime offices in the UK are trading at substantial discounts or offering favorable investment yields compared to similar assets elsewhere. This positions UK property well for a rebound in activity once the Brexit dust settles, particularly for Euro investors who can benefit from Sterling’s significant depreciation (Figure 4). Savvy investors with a longer-term perspective might see this as a once-in-a-generation opportunity to buy assets in the world’s fifth largest economy.

The lack of yield compression and depreciated Sterling may turn out to be a ‘blessing in disguise’, at least for UK real estate. If the global economy sails into trouble, Britain’s assets are much better priced to weather the storm. Moreover, Brexit uncertainties will pass, and investors may find good bargains if they shop early. Transactions that were lost earlier are likely to come back at a later date.