The statement has become almost cliché by this point, but when looking more closely at the indices that are commonly referred to as ‘the stock market’, one finds a more nuanced view.

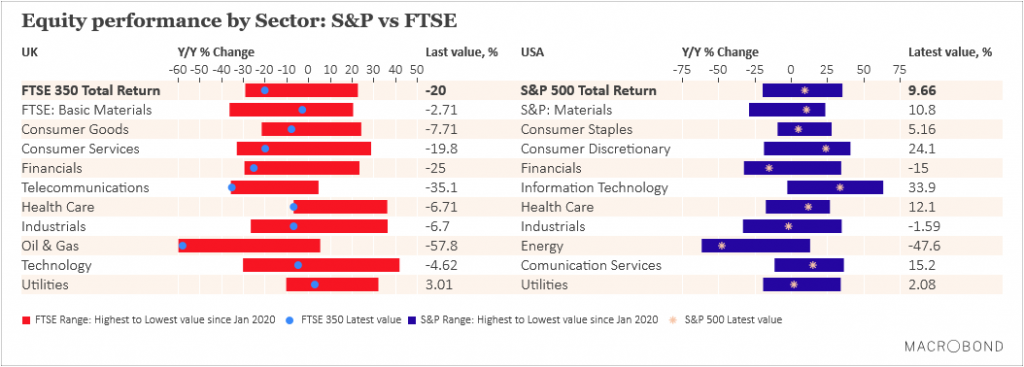

True, the S&P 500 has performed uncannily well since the coronavirus crisis started, but this cannot be said for all its sectors. Even though information technology, notably containing the FANG firms, has performed extraordinarily well, the same cannot be said about energy (read: negative oil prices).

It can also not be said at all for the UK equivalent: the FTSE has lost value significantly compared with last year. Although the basic materials sector such as Antofagasta copper mining is trudging along reliably, oil and gas has slumped remarkably, dragging the whole index with it.

Therefore, when saying the stock market has performed well during the pandemic, sector matters. And if the stock market is tightly knit to the real economy, this has direct consequences for the unemployment rate, possibly for years to come.