Assessing value is no easy task, even in normal times. But we believe that assessing the relative value of commercial property against a range of alternative asset classes, including government and corporate bonds, and equities, is a useful approach. To do this, we consider current property pricing in the context of its relationship with alternative asset pricing over the last ten years. For the UK, we have run an initial round of analysis, based on data up to Q2 2020. So, is UK commercial property currently fair value?

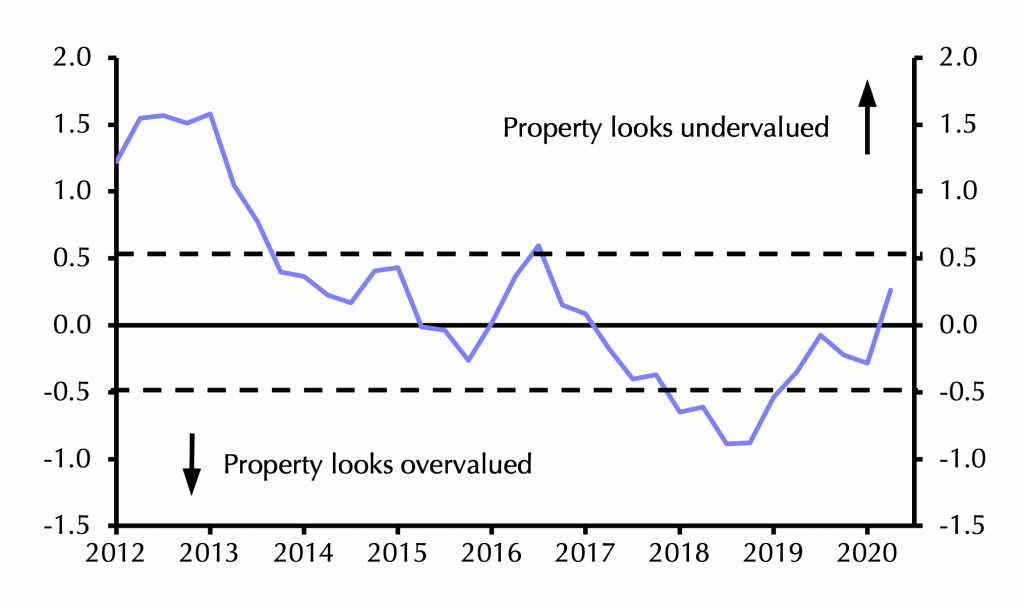

In recent years, our valuation scores suggest that the UK, in line with many other European markets, was looking expensive as strong investment activity drove yields to cyclical lows (see chart). But, ahead of covid-19, UK valuations started to turn as yield declines slowed, or reversed in the case of retail. Since then, there has been a steady improvement in all-property valuation scores.

Capital Economics’ All-Property Valuation Score

On the back of rises in property yields and a sharp fall in gilt yields this year, UK commercial property valuations improved in Q2. This was also supported by a recovery in equity prices, which led to a decline in dividend yields, improving property’s valuation against equities.

In the second quarter, valuations improved across all three of the main property sectors – retail, offices and industrial. What’s more, retail now looks undervalued by our measure. But further falls in retail occupancy and rental values are likely to temper any influx of investment into the sector. As such, we expect valuations to improve further in H2, as prices continue to correct and yields rise further. With more modest rises in yields this year, offices moved firmly to fair value in Q2. Meanwhile, industrial continues to look slightly expensive, which is a reflection of the unprecedented downward movement in industrial yields over the last decade. These sector results are broadly in line with the rankings of our scores for Europe and the US.

Commercial property valuations will probably improve further in the coming quarters. While gilt yields have risen by around 18bps over the past month or so, they are likely to remain low for the foreseeable future. More importantly, with rental prospects weak, we have pencilled in further property yield rises in the second half of this year and the start of 2021, particularly in the retail and office sectors.

Property Chronicle · Prohad Khan Audio

Overall, our analysis suggests that UK commercial property is fairly valued when compared with the pricing of alternative assets. However, that finding is based on the assumption that current income streams are sustained. Accordingly, until investors can regain some confidence in property cash flows and yields show signs of reaching their ceiling, valuations based on historic income streams are unlikely to entice buyers back to the market en masse.