Pricing vintage comics isn’t just about scarcity and quality – the characters are the key to value.

This article was originally published in November 2019.

“Comic books to me are fairy tales for grown-ups.” So said renowned comic publisher Stan Lee in a 2014 interview. And while there is definite investment potential in comics, for many collectors it’s still all about the stories.

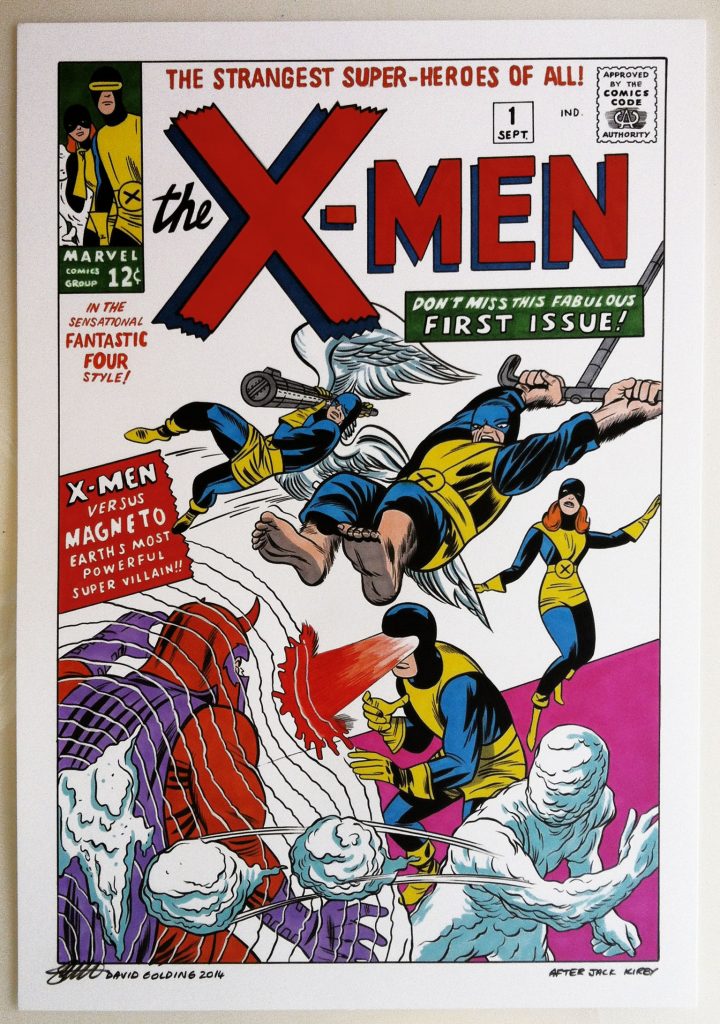

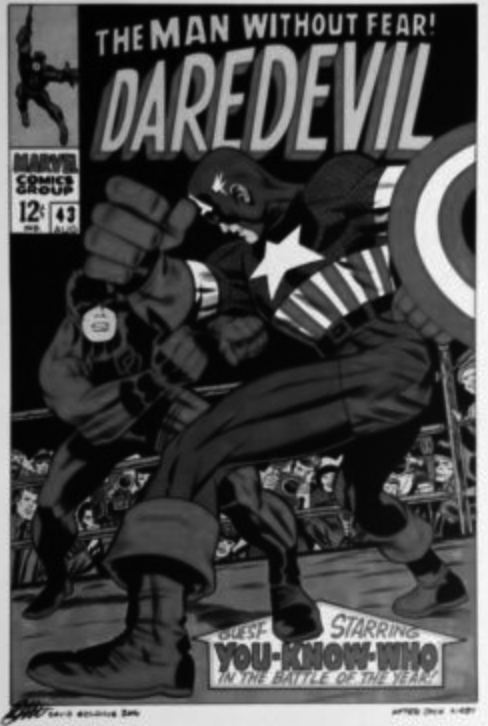

When I first started collecting comics, I simply wanted to have as many as possible. I was very lucky to start collecting before comics became an industry: in the late 1960s and 1970s, you could only find them in newsagents. Initially, I devoured UK comics such as The Beano and The Dandy, only for them to be usurped in my affections by the British black-and-white reprints of Spider-man, the X-men, Daredevil, the Avengers and all of Stan Lee’s amazing creations from Marvel Comics in the early 1960s. These reprints, in comics such as Fantastic, Terrific and Pow, changed my life from that point forward.

I loved these comics and I wanted every issue, every Christmas annual, every holiday special. Then something more amazing happened: I was on holiday in Galway with my parents and for the first time saw original colour issues from DC Comics. Superman, the Justice League and Wonder Woman entered my life, never to depart.

The reason that I had to go to Ireland to find the US copies was that they were not distributed formally to the British Isles but arrived more or less accidentally. In the 1960s, American comics were used as ballast on planes (and sometimes boats). Random packages of these old and new comics trickled down to newsagents who were enterprising enough to try to sell them. For the reader, it was an experience as unpredictable as collecting stickers. They appeared in no particular order, so I would often read the conclusion of a story before finding the earlier issues which began that plot. From this experience was born in me the pleasure of completing a short run of issues without a gap.

It was an odd time, but so rewarding. During the 1970s and 1980s, things began to change, and the distribution of new comics on or close to their original publication date slowly became the norm. As demand increased, specialised comic shops were established. In short, comics in this period enjoyed their halcyon days: they were as important to many children as computer games are today.

A few more epiphanies would come my way during my comic collecting journey, not least the publication of my all-time favourite superhero character, Captain Britain, in 1976. A year later, the iconic UK comic 2000AD was published for the first time – and it is still being published today. Collecting is important to me, but it is still secondary to the enjoyment of reading comics. I remember those issues not because they can now be sold for prices much higher than their original high-street price, but because the stories were important to me.

This is illustrated in TV’s ‘The Big Bang Theory’, where you will notice that while the male protagonists all have their comics carefully sealed in plastic bags with strong backing boards to save them from being bent, the plot of many an episode centres on them going to a comic shop to buy and read the latest editions.

Like toy collecting, collecting comics is a phenomenon of the 20th century. It is part of our culture and, as for other antiques and chattels, value is determined partly by scarcity. Before the cult of collecting was established, comics were throwaway commodities. You read them, you passed them on to your mates, and then they were eventually thrown out. The early comics did not survive in great numbers, so those that remain now command high prices. Price is affected by quality as well as scarcity, of course, and for comics there is a globally accepted grading system.

For example, the 1962 edition of Amazing Fantasy features the first appearance of Spider-man. It cost 12c originally, but a perfect copy today will sell for around $500,000. That would be considered a phenomenal return in any form of investing. But the truth is that seldom does a single individual benefit from the whole of that gain, as most copies will have changed hands numerous times before reaching such a high price. At some point in the process, the comic stops being a comic and becomes a commodity. Many collectors will never open the comic to read it but will simply put it in a bank vault with the intention of selling it on later for another capital gain. Unsurprisingly, when a comic becomes an investment, the collector is often not a comic fan. Investors see opportunities and store their money in comics that will probably increase in value.

But such opportunities apply only to certain key issues, which possess a significant trigger increasing demand: the first Superman comic; the first issue of a particular character drawn by a fan favourite; the first appearance of a favourite character but not in their own title. Demand is driven by the profile of the comic character; it isn’t only about the age or indeed the scarcity of the comic. There are numerous comics of the 1960s that can be bought relatively cheaply because their characters are considered important. The stories may have been great, the art might have been wonderful, but if the character didn’t capture the zeitgeist at the time, or later, then those comics aren’t in demand.

Today, the most important trigger for increased demand is the spin-off films of the characters. For example, Aquaman by DC Comics was always considered a minor character and was never a fan favourite until the success of the 2018 film of the same name catapulted him onto the comic radar. Back issues of Aquaman doubled in value due to simple supply and demand.

So, are comics a good investment? It depends upon the motivations of the collector. There is a distinct split in the market: most comics are still in the domain of the collector, the person whose yearning to own a particular issue is primarily motivated by wanting to read it or to have a complete run of that character’s comic. Or someone who is seeking out the work of a particular artist or writer. These are the motivations of the collector. On the other hand, many investors don’t care about the comic in and of itself; they just care about the scarcity of the back issue and the potential for demand and prices increasing in the future.

Of course, there can be overlap in these distinct markets and some of the fan favourites of today will, in time, become potential investments of the future. But I would like to think that there is still the possibility of a young child walking into a newsagent, picking up a comic for the first time and finding their life changed forever.