Because there’s no housing shortage, among other reasons.

- the brand new apartments with the biggest discounts

- all time high of new apartment supply

- new units staying on the market longer (which is great news for renters)

- can’t squeeze rent increases from a stone (which explains some lumpiness in multifamily CMBS)

- another all time high (for not moving)

It’s a great time to look for a brand new 1BR apartment:

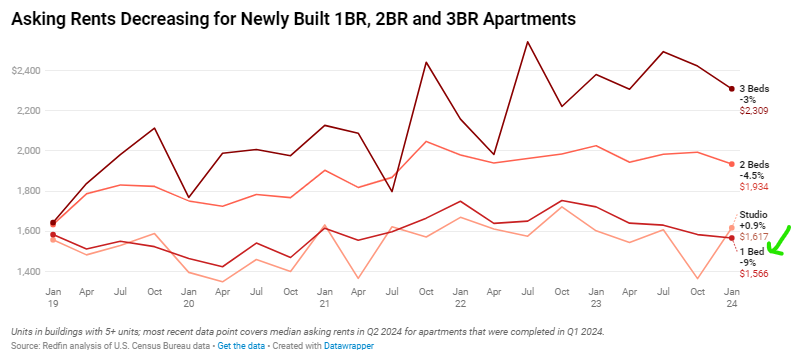

Asking rents for newly constructed apartments posted substantial YoY declines, with 1BR units dropping the most.

Brand new 1BR units are now cheaper to rent than they were in 2019. Let that sink in, for a moment.

Only studios got moderately more expensive (after a pretty substantial drop in the previous quarter), but studios are still barely more expensive than they were back when the pandemic began.

So much supply, we can’t afford to build more

More good news for renters!

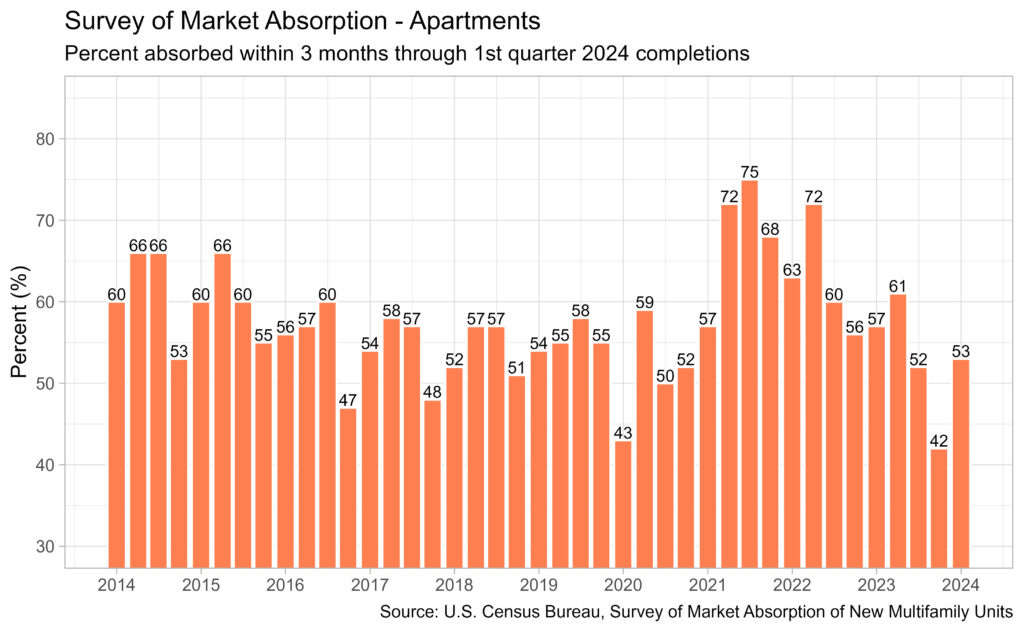

Unsurprisingly, it’s taking longer to lease new apartments, as well.

The absorption rate for new apartments is now slightly lower than what it was back before the pandemic.

~53% of new units are leased within 3 months of completion, which is the lowest rate since 2018 (excluding the peak pandemic months in 2020).

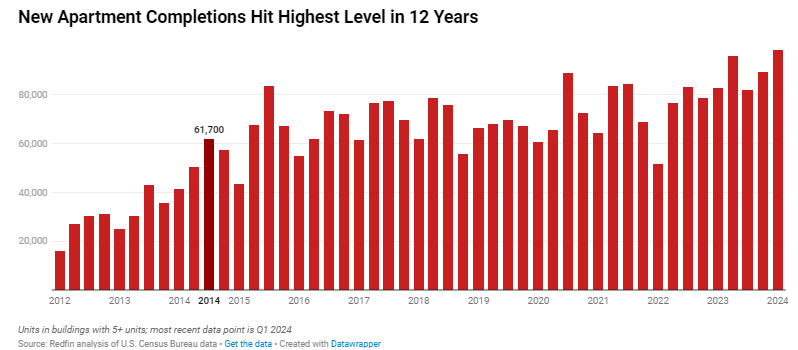

The reason that rents are coming down and apartments are staying vacant for longer is because there is no housing shortage—quite the opposite, there is an increasing abundance of supply.

New apartment completions hit a 12-year high in 2024:

Apartment completions have been about 75K for eight consecutive quarters now.

More supply (plus a slight erosion of relative demand, especially in core metros), means that prices come down. As Random Walk quipped long ago, my affordability is your deflation.

Basically, it’s become increasingly a buyer’s market out there, provided, of course, that you are buying from a builder and not an existing owner. That’s good news for renters.

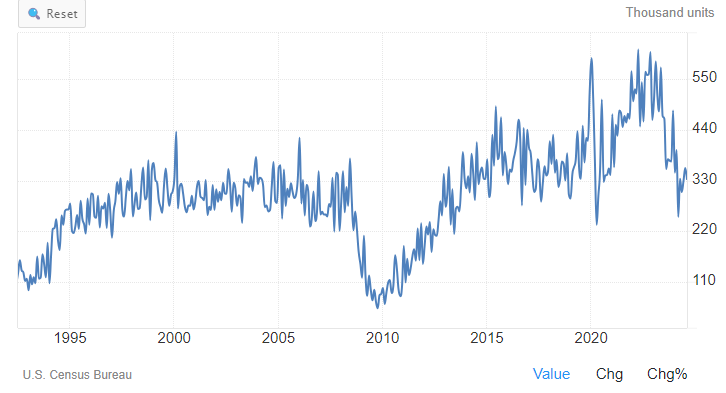

That the market has shifted in favor of renters is also why builders are now building less:

Census

After a ZIRP-driven pandemic boom, new multifamily starts have dropped substantially, and are now slightly below the pre-pandemic trend.

If you’re building anything, it’s not going to be multifamily (in the big scheme of things).

Can’t squeeze rent-juice from a stone

Look, it all makes sense.

Builders brought a ton of new inventory online (especially in high growth Sunbelt markets), and now it’s going to take some time for that new inventory to get absorbed. In the meantime, however, builders are going to dial back on new construction.

That’s somewhat bearish for the construction industry (and construction employment), and it’s somewhat bearish for anyone who bought multifamily at the pandemic peak, and is now trying to wrangle rising costs.

If supply is peaking, then you can’t raise rents to cover the additional costs of capital and labor (and insurance, which is the combined cost of capital and labor). In that case, you might just be in some trouble.

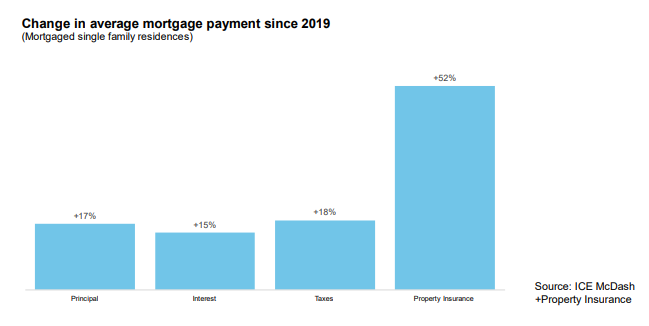

This is single family property insurance, but woh momma:

There’s been 52% increase on the average monthly home insurance payment since 2019.

‘But the CPI is up only 25%’, they said.

Anyways, back to the story.

Rising costs for builders/owners, but no room to raise rents, likely explains why it’s not just office loans that are experiencing higher delinquency:

Office gets all the headlines, but multifamily CMBS distress is now up over 11%.

Again, this is not a reason to panic, but it does mean that there are likely some more real estate-related investment losses on the way. Good news for the dry capital camp, and bad news for the recently-wet capital camp.

There is no housing shortage (reprise, ad infinitum)

It also means that there is no housing shortage, and certainly no acute housing shortage that would justify a substantial transfer of zoning authority to central planners (as per the hopes and dreams of the salivating fair-weather YIMBYs).

And yes, there is plenty of single family supply too.

Yes, I think so.

But adding density to those few towns isn’t going to make the problem better. In the ‘burbs, the lack of density is a feature, not a bug.

Even there, however, “prices” are very deceiving. Existing homes aren’t selling, so their price signal is weak, but new homes are selling like gangbusters, and they’re getting smaller and cheaper.3

Not to rehash all the old Random Walk ground, but what we have is “sticky prices” (and locked-in banks), and not an “affordability crisis”:

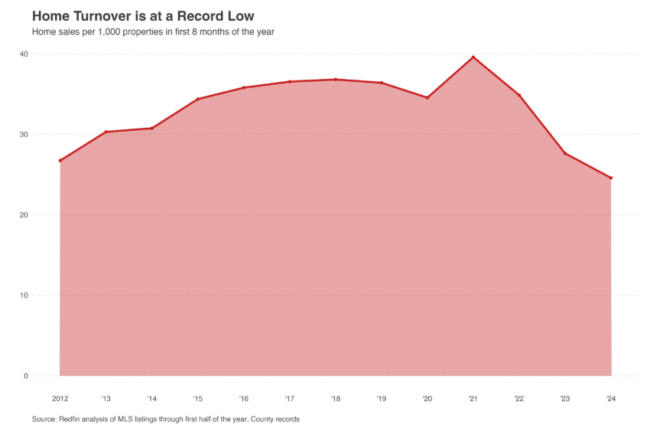

“Home turnover” is at a record low.

People aren’t selling because they don’t want to and don’t have to. That doesn’t mean that home values are going up.

Just consider what would happen if all 30 year mortgages were converted to floating rate loans. You’d see some pretty dramatic re-pricing in a hurry.

This article was originally posted in The Random Walk and is republished here with permission.