Originally published May 2022.

Everything follows a cycle, says this writer.

Cycles are vital in nature. The carbon cycle, the nitrogen cycle, the hydrological cycle, planetary orbits, the phases of the moon and ocean tides – all are cyclical and linked to the process of sustainable renewal. These natural phenomena, when operating in balance, generally follow regular patterns and are highly repetitive. The business world is also subject to cycles, with economic output, capital flows and investment fluctuating over time. Unlike nature, business cycles do not display the same regularity, making them much harder to predict.

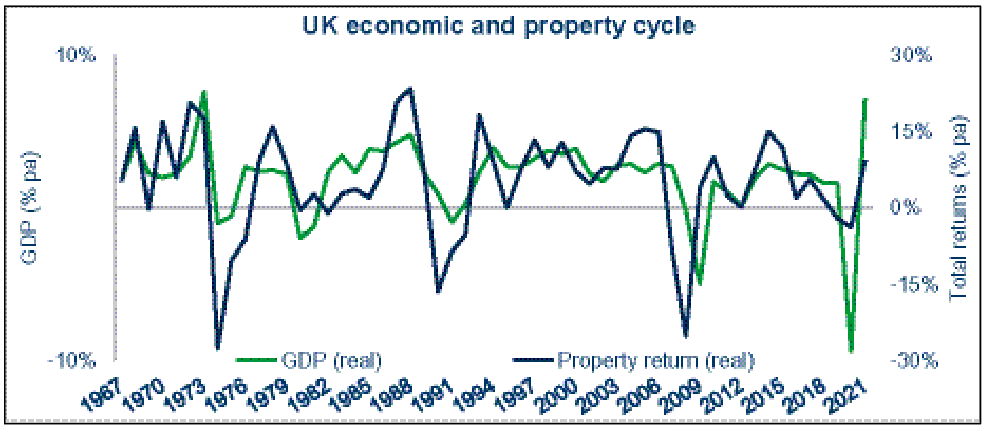

The real estate industry is held up as a textbook example of a highly cyclical business. When comparing long-run UK real GDP to long-run UK real property returns, the link between economic and property cycles is self-evident.

In theory, property should lag the economy, reflecting that demand is derived from the shelter it provides and the economic activities it facilitates. However, in practice, property can actually lead the economy, such as during the GFC. At other times, it can be more concurrent, with turning points in the business cycle. That explains why the statistical correlation is a little lower (+0.5) than the chart suggests – it simply reflects that the relationship between property and the economy is not static.

Perhaps most interesting of all, there have been five sizeable UK recessions, but only three property slumps since 1967. Some economic contractions have been milder, while the property market downswings have been much sharper. In contrast, the recent pandemic lockdowns led to an unprecedented GDP contraction, but the UK property market was able to coast through relatively unscathed. Without a doubt, a huge reason for recent resilience lies in the magnitude of fiscal and monetary pandemic policy support. However, other factors are also in play, and understanding this and previous reactions of the UK property market to the economy requires a little theory.

Getting on the same wavelength

Reflecting the underlying structure of the property market, the oscillations inherent in real estate are actually the confluence of three highly interrelated cycles:

Occupational cycle. Fluctuations in wider economic activity and therefore the pace of lettings (take-up/absorption), against expected/current vacancy levels, ultimately drive changes in rental growth expectations.

Development cycle. Fluctuations in planning applications, new construction starts and ultimately new supply/completions operating with the normal development lag of between 1-3 years. This inability of supply (inelasticity) to respond rapidly to demand is often critical in understanding why some property markets can be more cyclical, even when exposed to similar economic conditions.

Investment cycle. Fluctuations in rental growth expectations (a product of the above) and their interaction with exogenous capital market factors including: expectations around the cost of capital (interest and risk-free rates); the availability of debt; and the overall weight of capital targeting the property sector (investment volumes). Changes in yields/cap rates, and ultimately property prices and returns are the outcome.

The cycle in property returns is the one that really matters to investors. Investment is about setting expectations. The problem for forecasters looking for precise answers is that these expectations – be it for rents, the cost of debt, GDP, etc – are constantly shifting.

A bad dose of real estate logic?

These three property cycles interact against and/or coalesce with each other in ways that can depend on the prevalent economic climate at a given time. For example, rising rents and lower interest rates equal a rising property market. On the downswing, falling rents and rising rates are obviously a toxic combination for property valuations. However, a fall in economic activity (rental cycle) can also mean a fall in interest rate expectations (credit cycle). Should these powerful investment/credit cyclical forces overpower occupier supply and demand fundamentals, and they often do, the apparent paradox of falling prime yields and rising core property prices during an economic slowdown are not a bad dose of real estate logic.

Are theory and practice the same?

Albert Einstein said they are not and who am I to argue? While not cyclical in a strict scientific fashion, astute property investors realise that multiple cyclical factors are at play, which inter relate with one another, and can thus alter the amplitude and frequency of property cycles.

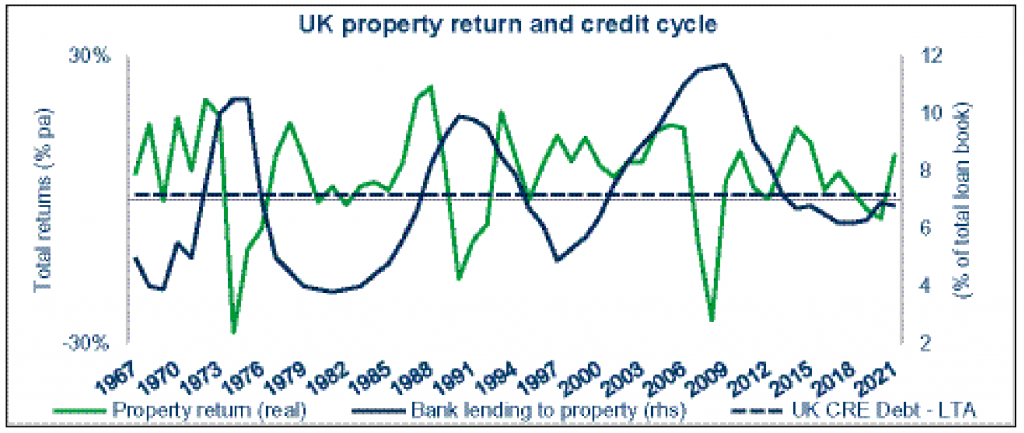

Let us return to our UK property cycle data (discussed earlier), but this time compare it to appetite among banks to lend to the sector over the very long term.

First, lending to the UK property sector typically operates on at least double the frequency (circa 15-20 years) to the cycle in property market real returns (circa 7-10 years). Further, it is no coincidence that the three UK property slumps tend to be associated with the ramping up of property debt levels beforehand. Sometimes debt will stoke a speculative construction boom, like in the late 1980s/early 1990s (development cycle). While in the GFC property cycle, easy credit (investment cycle) flooded the market for existing income producing assets. Then lax lending on unsustainably high LTVs actually helped precipitate the subsequent economic recession. That explains how the tail (property) managed to wag the dog (the economy) – with property leading the economic downswing.

Understanding property cycles will not suddenly bestow instant clairvoyant foresight on anyone. However, fund managers wise to the exact nature of the current property cycle will tend to allocate their capital on a superior risk adjusted basis. They will recognise which cyclical forces are currently driving the property market – meaning they are best placed to optionally allocate to core, value-add or more opportunistic plays at the appropriate point in the cycle – perhaps even ‘benching’ higher risk strategies in some cycles. Similarly, decisions to apply appropriate levels of leverage and portfolio allocations to more cyclical markets and sectors will also be better informed. This is an approach to cyclical investing likely to be highly compelling to sophisticated multi-asset global capital sources.