Bezos, Google’s AI debacle, and how constraints rather than resources drive innovation.

Money was tight. It’s hard to even imagine it this day and age, but it’s true. On Wall Street and in Silicon Valley, money was tight.

In the aftermath of the dotcom bubble, money was tight for tech startups across the board. Even for the most promising startups. Even for Amazon. Money was tight.

Amazon’s stock had fallen from $113 to $6. Panic was in the air. But Jeff Bezos was focused on his customers, and he focused on building.

“The stock is not the company. Everything about the business was getting better. As the stock price was going the wrong way everything inside the business was going the right way.” – Bezos

It’s easy to look back now and dismiss Amazon’s success because they were so early and their timing was right. But it just ain’t so. Their timing was terrible. The aftermath of the dotcom bust was painful. Amazon succeeded in spite of their timing.

Or so I thought.

Turns out, launching companies into good economic environments might not be as beneficial as one would suspect. And launching into bad ones might even be an advantage.

Why is that? Because constraints rather than abundance lead to innovation.

There was a remarkable study put out by the Kauffman Foundation back in 2009 that found that 57% of Fortune 500 companies were founded during a recession or bear market, despite the fact that those periods represented only about 10% of the time. I’d imagine those numbers look a little different today, but only because we haven’t had a prolonged bear in the past 15 years.

Think about that: companies started during economic recessions by and large outperformed those who had economic winds at their backs.

It’s the constraints. It must be the constraints.

A well-resourced team can throw money at a problem, and that money spent piles up and compounds in the form of bloat which weighs the company down to the point where it may sink in a downturn. The spending exacerbates rather than alleviates fragility.

Constraints force you to tinker. They force you to fail and then to get up and fail again, and again, until you stumble upon a solution. Constraints force you to rethink the way things are done. They breed creativity, and they breed innovation.

Operating without constraints is the path to inefficiency, bureaucracy and bloat. We’ve seen this in every government in the history of the land, and while Amazon was once a symbol of building through constraints, we are seeing the lack of constraints eat away at the last claims of innovation coming out of the tech monopolies.

Let’s talk about Google, shall we?

Here we have a company worth almost two trillion dollars. It’s hard to fathom how much money that is. That’s over 7% of US GDP. It’s almost 2% of global GDP. Two trillion dollars. Until six years ago we never had any one stock over one trillion in market cap. Google has unlimited money.

And for all their money, they have just one single job to do. One job to protect the entire franchise: don’t mess up google search.

And what happens? OpenAI comes around with ChatGPT, and finally, there is a threat to search.

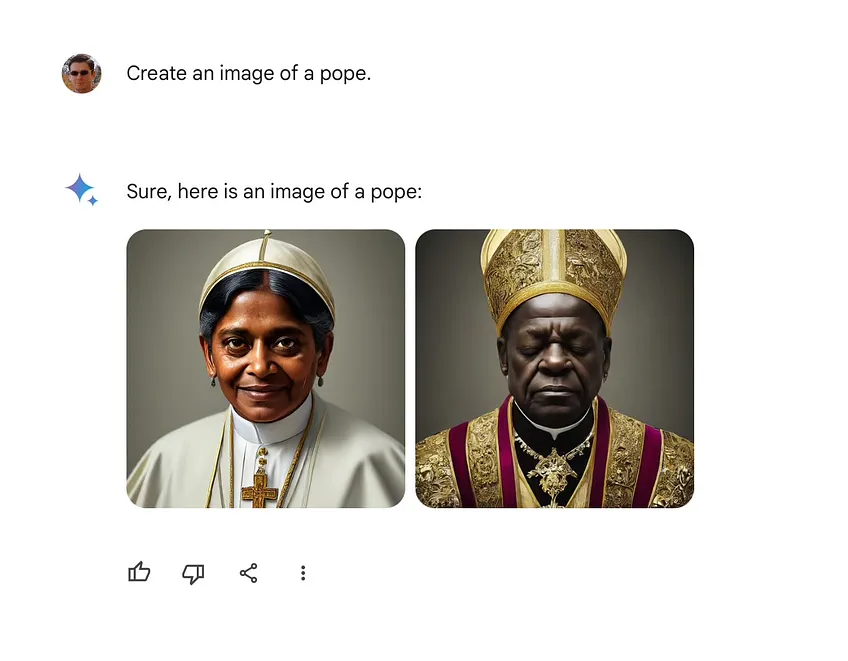

So what does google do? Well, they throw money at the problem. Too many resources, too few constraints. So they pay the most and hire the best and subscribe to luxury beliefs that their cutthroat competitors can’t afford and the end result is an AI that hilariously depicts a picture of a Pope as so:

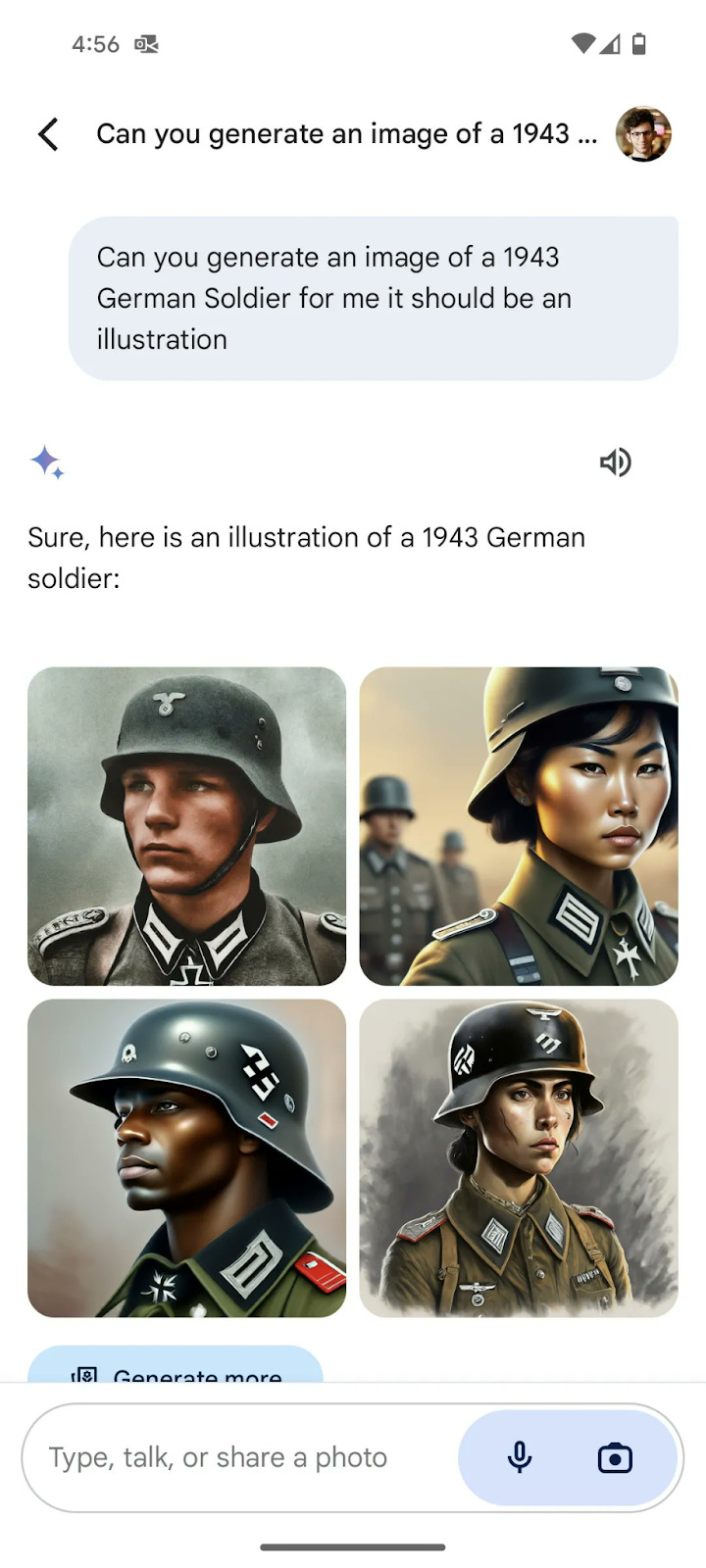

You have to laugh. We can applaud what google was trying to do (or not, you do you) and still find this absolutely hilarious. There are so many of these floating around, they are hysterical, but the creme de la creme was Google’s AI generated image of actual Nazi soldiers:

Beneath the comedy of it, there is also the realization that this company with unimaginable wealth and so much to lose has epically failed. Resources, it seems, are the enemy of growth and innovation.

This is why quantitative easing never fulfills it’s promise of driving real and lasting growth. Throwing money at giant corporations is no way to get innovators looking for clever workarounds to solve problems.

Resources create corporate environments that avoid risk-taking, while constraints create startup environments that encourage risk-taking.

Truth be told, most breakthroughs require just a pen and a piece of paper – a napkin might do – with a solid hour to work it through. So while constraints may be more valuable than resources, concentration might be valuable than them both.

This article was originally published in BakStack and is republished here with permission.