“I’d rather be dumb and antifragile than extremely smart and fragile”

– Nassim Taleb, in Antifragile: Things That Gain from Disorder (2012), p4

Looking beyond covid-19 (see our previous article), the future performance of real estate assets cannot be judged without assessing the likely impact of extreme risk events. There will be winners and losers, as decision-making under uncertainty can offer real estate opportunities from disorder to exposing others to downside risk and extensive loss.

To improve agility and reduce susceptibility towards unpredictable major events, real estate strategies need to focus more on these adverse events. Concepts and measurements of fragility, vulnerability and resilience are important initial steps in decision-making as they can highlight the challenges that may lay ahead, such as preparing for climate change and managing emerging pandemic diseases, like the one we have just experienced.

The concept of antifragility is to gain from disorder: whereas most real estate companies struggle in a recession, a company with a strategy that enables it to thrive in a downturn would be antifragile. The nonlinearity can offer opportunities on how fragility can be detected, measured, and transformed. This antifragile concept can provide a blueprint for living in a world with extreme risk where an organisation recognises and embraces exposure to levels of variation and uncertainty and is prepared to manage the opportunities and so enhance comparative performance to competing organisations.

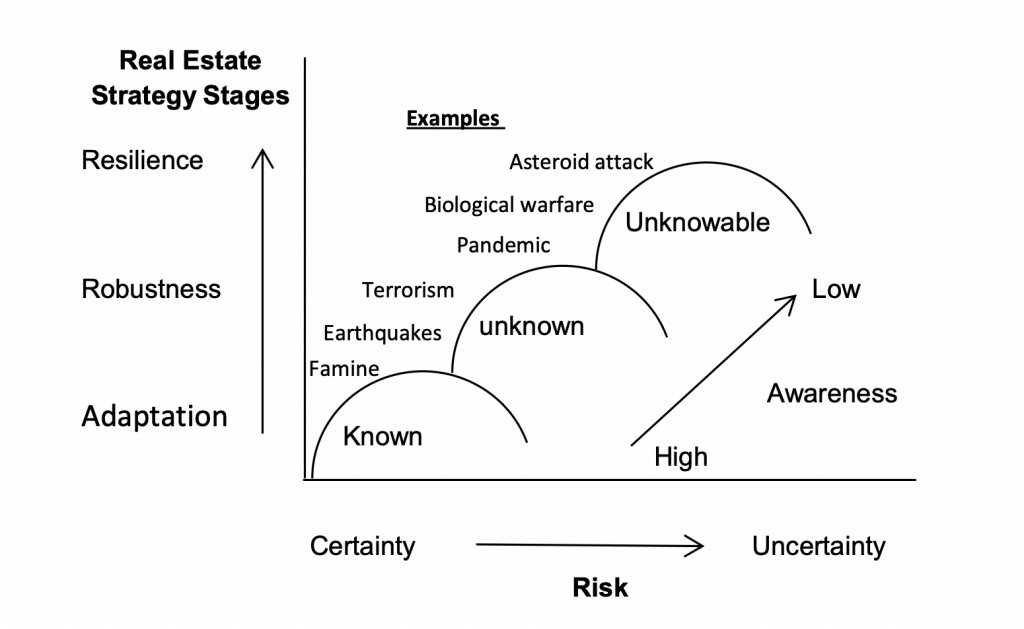

To look at this further, the classifications of known (K), unknown (u) and Unknowable (U) can be used to construct a framework to create a better understanding of uncertainty surrounding extreme unpredictable events. These KuU risk categories can form the platform for a three-stage real estate strategy as detailed in figure 1.

Figure 1: KuU events and real estate strategies

In figure 1, providing a systematic and broad guide to non-predictive decision-making under uncertainty, key approaches and real estate operational examples can be shown as follows:

- Adaptation: change the policy in response to the change in conditions. Designing for real estate flexibility means rearrangement of global real estate organisation’s structure and efficiency brings the workplace flexibility through modularity, agile planning approaches and limiting the project financing multiplier. If a KuU event occurs in one location, the system can be maintained in the alternative location to maintain continuity.

- Resistance: plan for the most pessimistic future scenario. Implementing safety barriers – a simple real estate approach is to standardise terminology and reporting processes. This one framework toolset and single vocabulary can improve knowledge-sharing across multinational real estate organisations.

- Resilience: make the assurance of recovery after a future occurrence. Global real estate partnerships can create operational teams that transcend geographic and temporal boundaries and so provide ideally flexibility with lower costs. The shared information is also advantageous, with improved management knowledge.

Where there are conditions of uncertainty, an interrelated strategy of adaption, resistance and resilience can reduce the impact and provide a response to KuU events. These three overlapping (not mutually exclusive) approaches can reduce vulnerability and offer improved knowledge on measurement and theory across the identified risk spectrum.

In summary, real estate practitioners need to be aware of the existence and distinction of K, u and U risks. This conceptual framework offers real estate decision-makers an opportunity to succeed in a world affected by increasingly large, highly improbable and unpredictable events where unprepared real estate operations will fail.

Contact: David Higgins david.higgins@bcu.ac.uk

Treshani Perera treshani.perera@rmit.edu.au

Further reading

Higgins, D and Perera, T (2018) “Advancing Real Estate Decisions Making: Understanding Known, Unknown and Unknowable Risks” in International Journal of Building Pathology and Adaptation, vol 36, issue 4, pp373-384

Higgins, D and Perera, T (2016) “Corporate Real Estate Black Swan Strategy: Beyond Probability and Resilience” in Corporate Real Estate Journal, vol 5, pp226-247