With the recent interest in Mars’ mineral resources, how far are we really from realising interplanetary living?

I’ll admit, I did listen to the Bowie classic to get some inspiration for this article. Although the lyrics seemed to be more about small town dramas than interplanetary living.

Amidst the mutterings and speculation about whether there is a profit to be made on Mars from its ore resources, further extraterrestrial exploration is looking increasingly possible. With thanks to commercial space companies becoming more successful, and China initiating a new space race with the USA, the prospect of life on Mars becomes that much more realistic.

But, how would real estate markets on the red planet really work? There are some things that we can take from our own past here on Earth, and some things that are, as yet, unknown.

The history of world exploration and its subsequent real estate markets, I believe, has a lot to tell us in this regard. This is particularly true for the colonisation of the Americas. With space as our last frontier, the way in which we may go about settling on Mars in future generations might bear a resemblance to the first wave, or European, colonisation of America – or even the settlement of the American West. What America was to people of the 1600s, extraterrestrial planets are to us: entirely unknown landmasses, far away from life as we know it. Settlers in these brave new worlds would have access to a basic level of life-sustaining technology, but little in the way of production. While they face numerous perils and threats, there is also the potential for great wealth, freedom and other such goals.

Two significant differences between 1600s America and present-day Mars are, of course, that there is not an indigenous population on Mars being displaced or eradicated, and that the level of technology today (and in the near future) is far more advanced than that of the 1700s and 1800s.

It is also probably important to note that the successful settlement of another world by a particular group of people will likely shape the culture, politics, economics and affiliations of that world for the rest of civilisation.

So, who’s got a one-way ticket to Mars? Well, the first people to move to a new area are those ultimately looking for something better than where they came from. They will have the resources to do so and the belief that they can make good of it. The first settlers of the Americas were sent by the states of their time, often privately financed, by kingdoms and profiteers looking for gold and glory. In much the same way, the first settlers of new planets will be sent by various states and companies to seek out resources. These missions will be done with two equal goals: to find a way to transport those resources back to Earth, and to ensure that the colony has some core resources for its own use. Whether or not anything does eventually get sent back to Earth would depend entirely on the commercials of spaceflight and the value of the resources at the time.

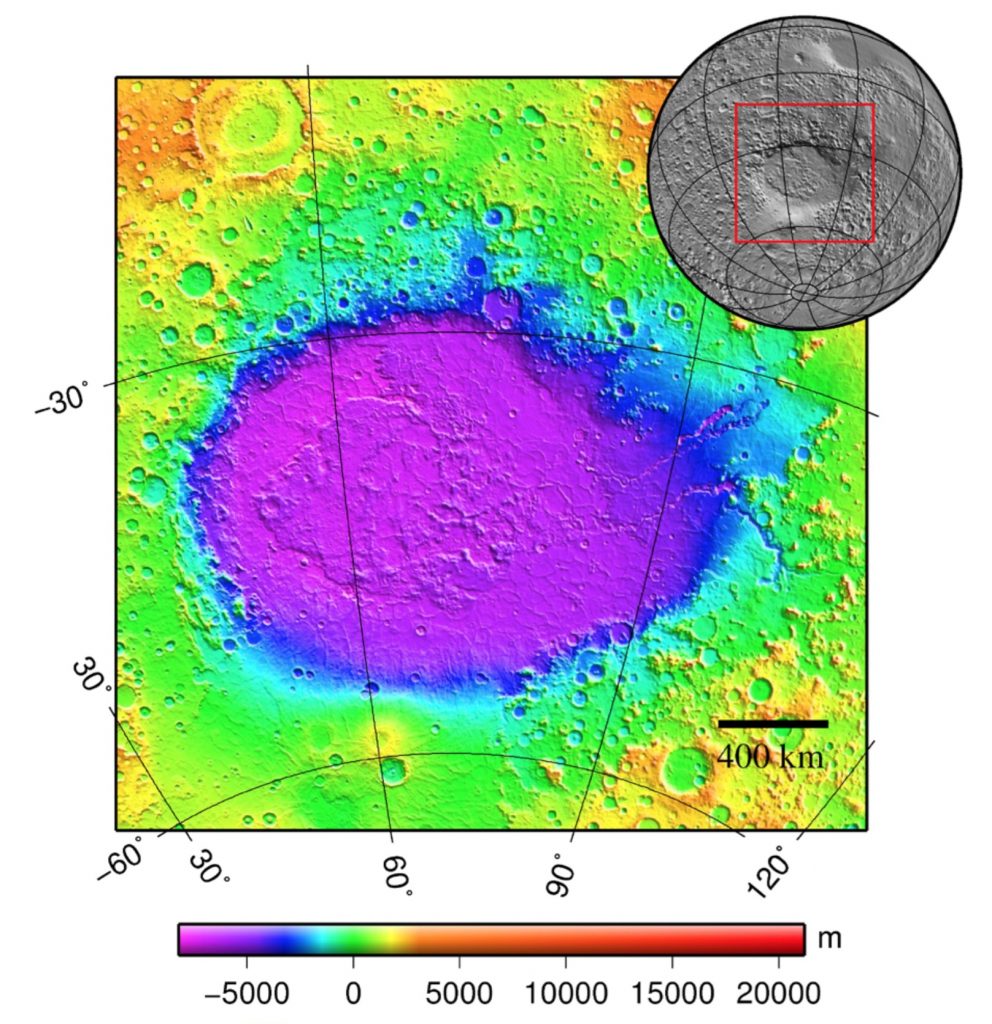

The first colonies will therefore likely be adjacent to mineral deposits, as the below image of the Hellas Basin area shows. The colonists themselves will likely have some expertise or willingness to work in the extraction of those resources.

The first colony would also likely be heavily dependent on continued imports from its Earthbound benefactor and would be a spartan environment. So how on Earth (pun intended) would you ever get anyone to move there?

Probably in the same way previous colonial powers persuaded the first settlers in America: give the people who go there access to land, money or power, beyond that which they could achieve on home territory. (Though, burning their boats on arrival probably also helped keep them there after they arrived.) The Spanish Encomiendas of the 1500s and onwards and the American Homestead Act of 1862 are great examples of this.

However, by what right would the earthbound powers be able to allocate that land? There is also the question of how long until the Martian colonists seek independence from politics on Earth, much like the states of the Americas did throughout the 1700s and 1800s. But that’s a slight digression.

Real estate on the surface of Mars would likely be valued in a strictly utilitarian sense, much akin to machinery in a factory. That is to say, it would have an initial cost, with ongoing maintenance expenses thereafter, and it would ultimately provide some commercial benefit, namely, housing colonists to operate the systems of the colony. The real estate would need to be valued in the currency of the benefactor state. This would be because local Martian currency would be too volatile, illiquid and prone to bouts of hyperinflation, depending entirely on the success or failure of resource shipments. Currency controls would likely need to be put in place. As a result of these regulations, a black market of some local currency would likely emerge.

However, if those colonies are economically and socially successful, the market would start to emerge, going from a simple utilitarian environment provided for housing purposes only to a real estate market that has more or less desirable locations and its own dynamics.

Where would those locations begin? Looking at the history of cities here on Earth gives us some clues. Value tends to accrue nearest to power of one kind or another; then subsequently to the social order of that society and its aesthetic appreciation.

In almost any country, real estate values in the political capital are higher than anywhere else. Being close to the source of governmental power has its advantages, even indirectly, and people are willing to pay more for that proximity. Similarly, areas where there is significant economic progress, however temporary, will attract new residents and higher prices – whether that’s Rome of the first millennium, Liverpool of the 1700s, Detroit of the mid-1900s or San Francisco of today.

However, aesthetics also come into play. Taking London as an example: the East side of the city has typically been the poorer and less valuable side of the capital, despite having equal proximity to the centres of political and economic power, and even having the possible advantage of being located closer to the main import and export points on the East side of the River Thames, which were heavily used up until the 1960s.

Why? Ultimately, wind direction played a major part in that evolution. As the majority of the time the wind direction in the UK is westerly (coming from the west towards the east), the heavy smoke of the city in the time of the industrial revolution all ended up blowing from the West End to the East End, making one side of the city dirtier than the other. Over time people displayed their preference for living in the cleaner side of London and moved there. This caused property prices to increase in the areas seen as more desirable, which over time resulted in a self-perpetuating process of migration by the relatively wealthy to the more expensive areas. There are of course numerous other factors to take into consideration, but this one relatively simple thing shows the importance of health and aesthetics.

So, where would the locations of political and economic power be? Where would the major points of business be? And where would the disturbances, mess or danger be?

The accommodation or offices of Mars’ leaders of the colony would be a likely starting point. There would also be economic power through the points of trade within the colony – such as ports. It is unlikely that the real estate in the immediate vicinity of these ventures would be the most desirable, despite the majority of the income of the colony being generated through mining or some other venture. Vibrations, traffic, accidents, storms or a multitude of other things would make those areas significantly less desirable, taking into account the emergent political and economic landscape. If the location and structure of the colony remained intact, then that starting point would likely propagate over time. This would mean that in some far distant future the former location of the commander’s office may be re-developed into the most attractive high-rise development of the time.

However, the location and viability of the colony may not always be the same. It may be the case that over time a new location is seen as more desirable. Consider the movement of the capital of Germany from Bonn to Berlin; Israel: from Tel-Aviv to Jerusalem; Brazil: from Rio de Janeiro to Brasilia. Each occurring as a result of a changing political situation. The latter is perhaps the most interesting, as it necessitated building an entire city from scratch in the middle of the jungle. In each case, political power moved, and so with it moved the politicians and those seeking to be near to the politicians.

So, something to think about as humanity gradually starts to move from Earth to other planets. If you’re looking for long-term investments in interplanetary real estate, keep an eye on where the power goes, and where the risks remain.