Article by Centre for London Research Manager, Silviya Barrett.

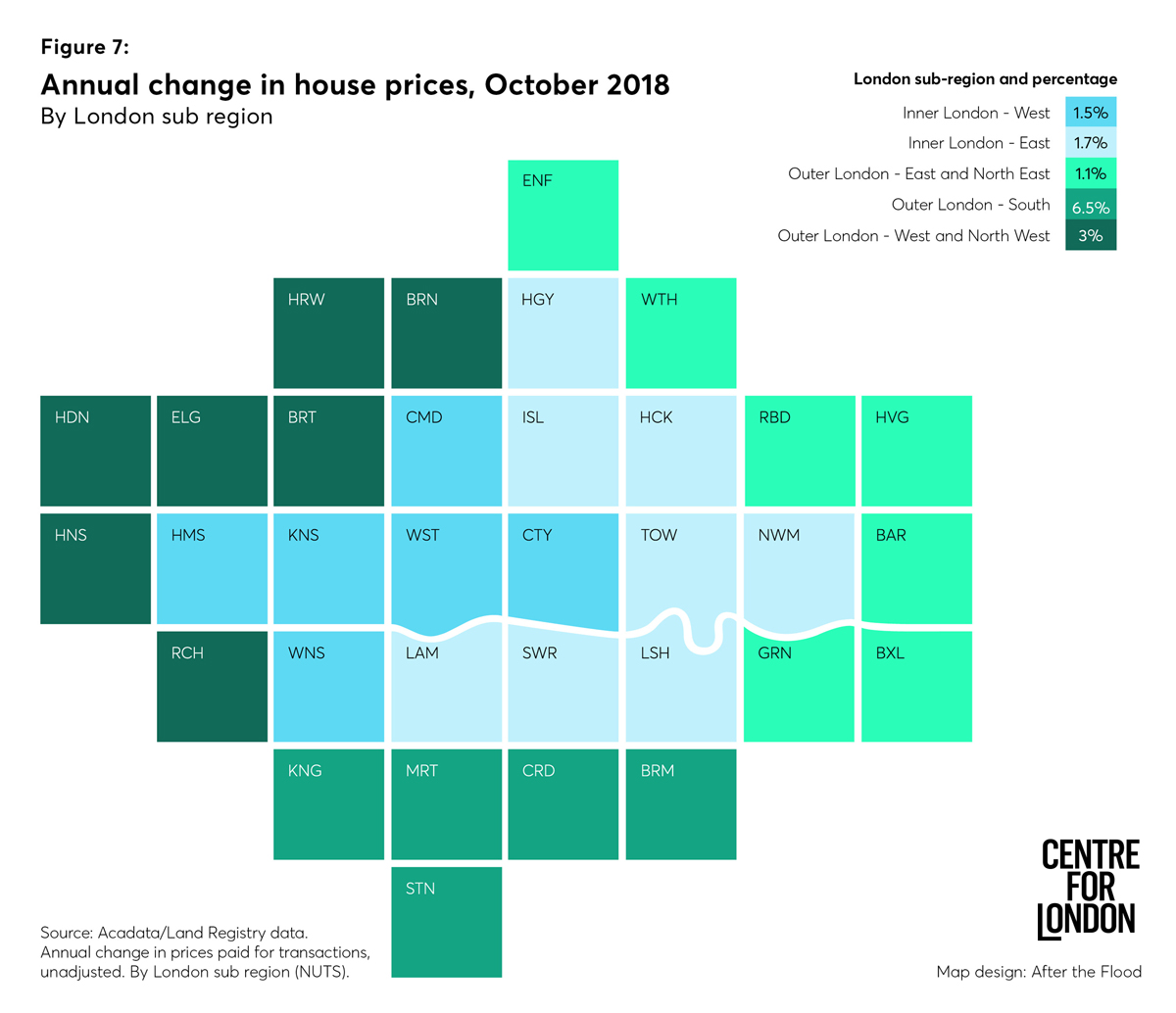

The number of people living in rented accommodation in London has been growing for years. Private renters now outnumber mortgaged home owners in the capital. It’s not that home ownership has become less desirable, it has simply become less attainable: despite a cooling down of the market, the average house price in the cheapest inner London borough is still £502,000. A sum which is too dear for most.

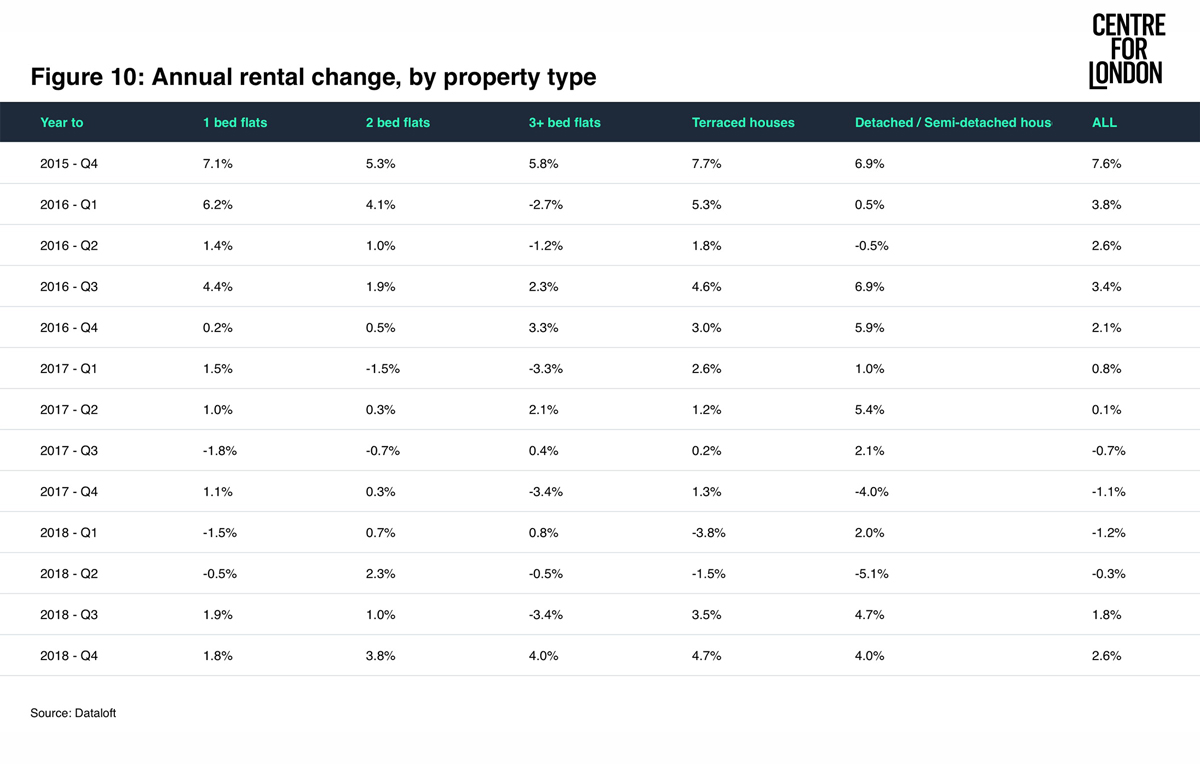

As previous Centre for London research has shown, rising housing costs are eating away at discretionary income. This is having the biggest impact on private renters – who are least sheltered from increases in housing costs. Although there was a short period of relief when rents declined or levelled out in 2017 and the first half of 2018, they have now started to rise again.

Figures from Dataloft found that actual rents paid increased by 2.6 per cent in the 12 months to December, with bigger increases for larger properties. This means that at the end of 2018 the average rent paid per property in London reached a whopping £1,516.

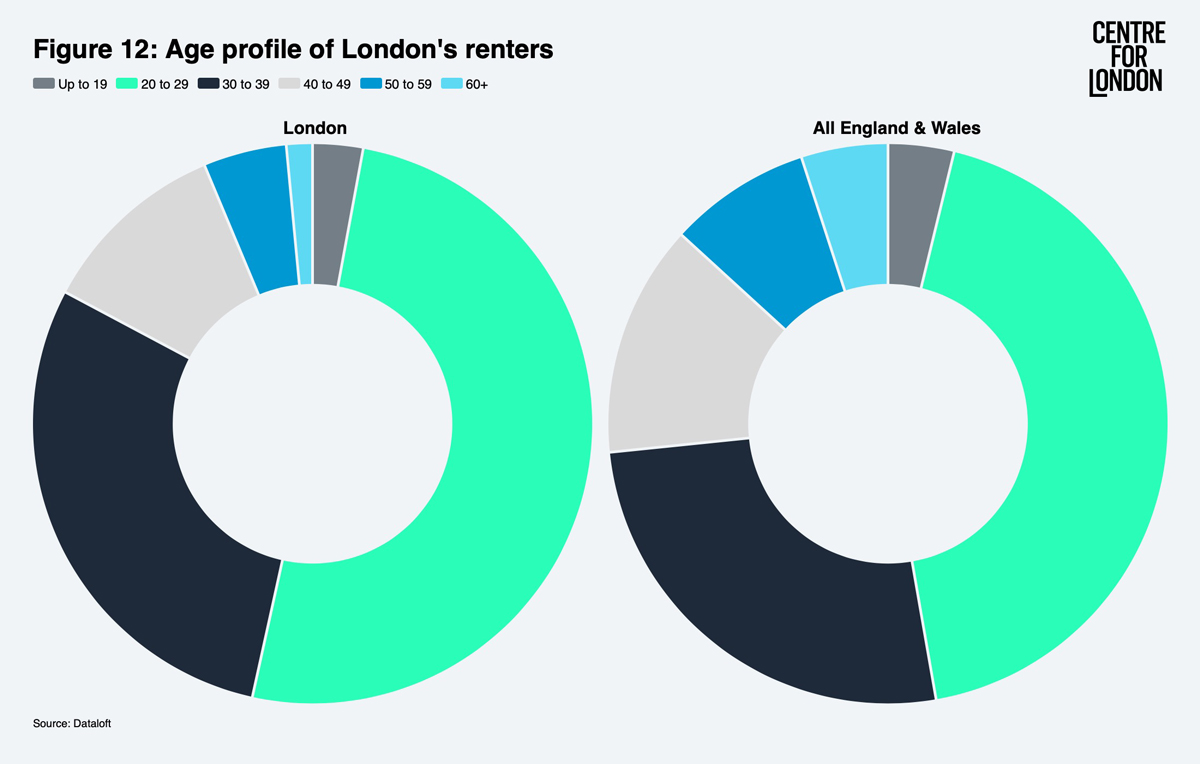

At the same time, London renters are getting younger. In 2015, the average age of a London tenant was 34 years, compared to 32 today. And renters in London are also younger than in the rest of the country. Over half of renters in London are under the age of 29, compared to just 47 per cent across England and Wales.

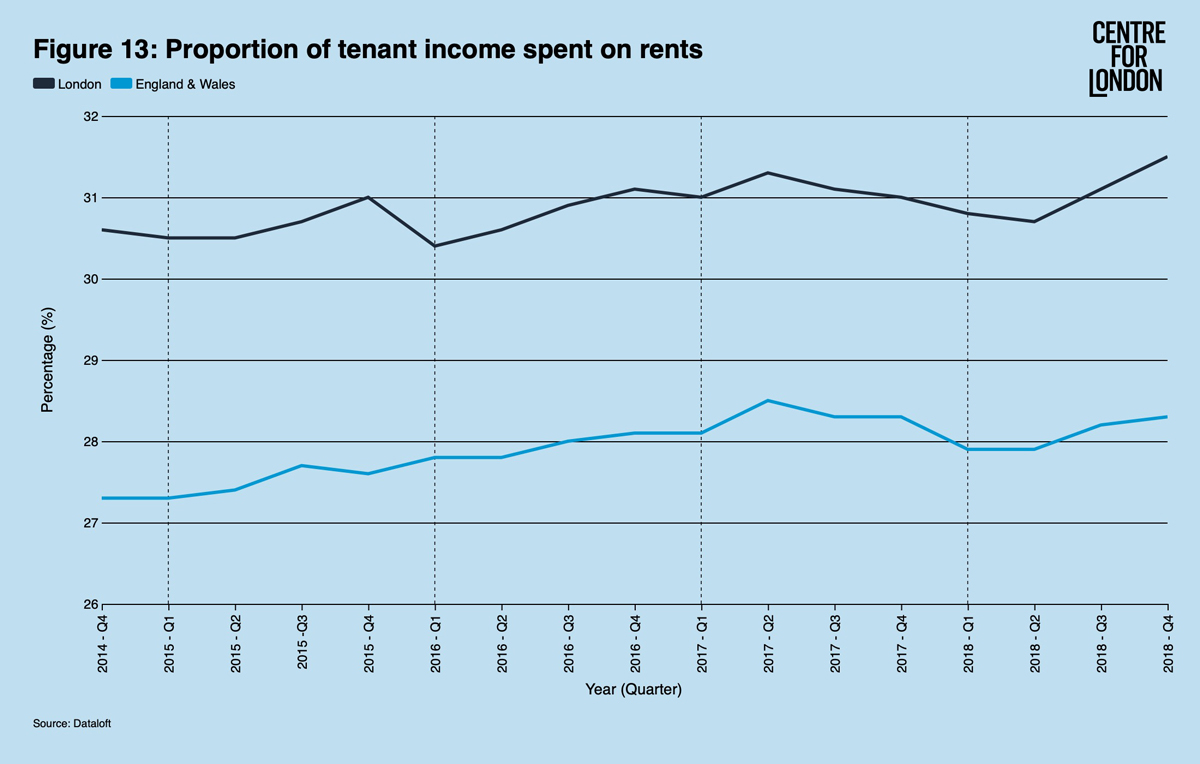

This younger generation of renters are likely earning less than their peers further down their career, so rent is eating up a larger chunk of their wages. The proportion of individual income spent on rent by London tenants increased from 30.7 per cent in Q2 2018 to 31.5 per cent in Q4 2018 – the highest level it has been in the last four years and consistently above the average in England and Wales.

The double whammy of wage stagnation and rising rent levels is hitting London’s renters hard. Many Londoners on lower incomes may need to trade off housing and commuting costs, or struggle to remain in the capital altogether.

Despite not having the power needed to implement rent controls, Sadiq Khan has announced he will make rent control a key part of his 2020 manifesto. Some cities across the world have versions of rent control rules. It will be interesting to see if the Mayor can find a model that works for London without suppressing supply – but success will be reliant on central government willingness to grant these.

Article originally published by Centre for London.