When news hit on Monday morning that a Blackstone entity was taking Apartment Income (AIM Communities) private, the market quickly tried to make sense of the $10 billion headline purchase price. The $39.12 per share price represents a 25% premium to where the stock had traded, but that is of little consequence to anyone not holding AIRC shares. What market participants really wanted to know was the implied cap rate the transaction represented.

A large transaction of geographically diverse, mostly Class A apartment buildings would be a bellwether in a commercial transaction market that has been tepid at best. Earliest reports suggested a cap rate in the high 5s (5.7-5.9) while others looked much lower and some exceptionally roughshod approaches put it well into 6s. Throughout the week I have received messages representing the entire range, confidently proclaiming what it “really was.”

My efforts here will be two-fold. First, I will as plainly as possible try to show how analysts arrived at these different outcomes for something that should be a relatively straightforward calculation of trailing Net Operating Income over Price. More importantly, I will hopefully demonstrate the shortcomings of cap rate as a stand-alone valuation metric. In the spirit of Box’s aphorism “All models are wrong but some are useful,” I will provide a framework for understanding implied cap rates concerning what Blackstone hopes/needs to happen to meet their hurdle rate on this deal.

A (Very) Brief AIMCO History

Apartment Investment and Management Company (Aimco) was founded in 1975 as a real estate investment trust (REIT) focused on the ownership, management, and redevelopment of apartment communities. In 2020, Aimco announced its plan to separate its business into two separate, publicly traded companies through a spin-off transaction creating Apartment Income (AIRC) and Aimco (AIV).

Apartment Income (AIRC) would focus on stabilized properties, mostly older vintage but higher-end in high-growth markets. Aimco (AIV) would retain the name and a smaller portfolio of more opportunistic property. AIV owns an enviable portfolio of Brickell development land for example. The idea was that as two separate companies, the value could be maximized as the market could better understand the strength and stability of the AIRC portfolio. In contrast, the AIV portfolio could potentially fetch a higher multiple for its growth prospects. The details of the spin, and specifically its rationale, will have salience later when we take a look at what Blackstone hopes to get out of this acquisition.

The Property Management Quirk – 5.7% (but not for you!)

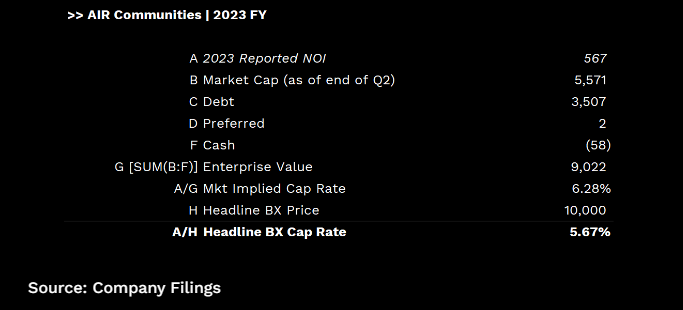

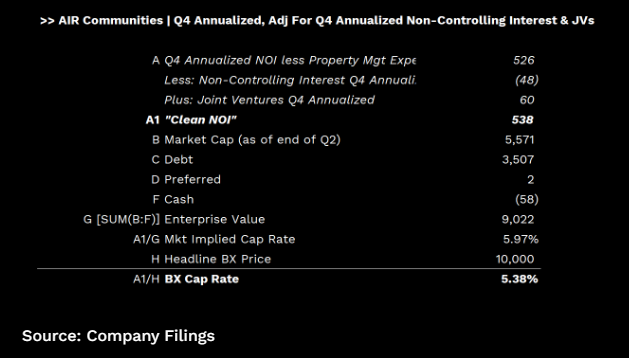

AIRC, as a publicly traded company, discloses relatively granular financials. A quick search of the 10-K for the 4th Quarter supplemental will reveal a reported full-year net operating income of $567 million. Looking at this in light of the full capital stack, you can see that as of Q2 close AIRC was trading on the public markets with an implied cap rate of 4.87% using a market capitalization of $5.6 billion. In this light, Blackstone’s $10 billion offer, or $3.8 billion for the equity when accounting for debt assumption, looks like a rough 5.7% cap rate.

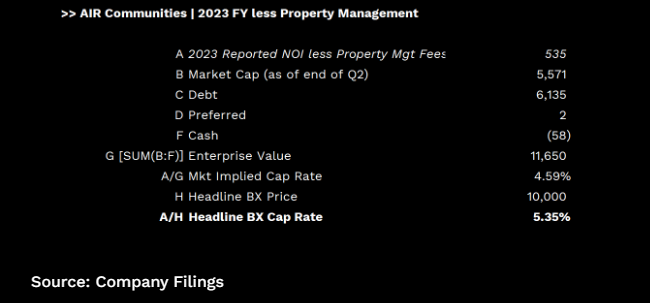

This represents the analysis you might do in about 30 seconds after a headline hits, but it’s a bad shortcut to take. REITs, for entirely debatable reasons, report property management expenses below the NOI line. This arguably helps with comparability, the choice between internal and third-party management, and highlights the underlying efficiency of the property. Perhaps, but property management is an unavoidable economic cost of property ownership, and unlike a REIT’s corporate overhead, it does not experience any operating leverage with scale. Any new owner would rationally think of their property management expenses as being very much above the NOI line.

For 2023, AIRC had property management expenses of ~$32 million, when you reduce NOI by this amount the cap rate drops to 5.35%.

Non-Controlling Interest, JVs and T12 vs LQA – 5.17-5.35% (The Range of Reasonability)

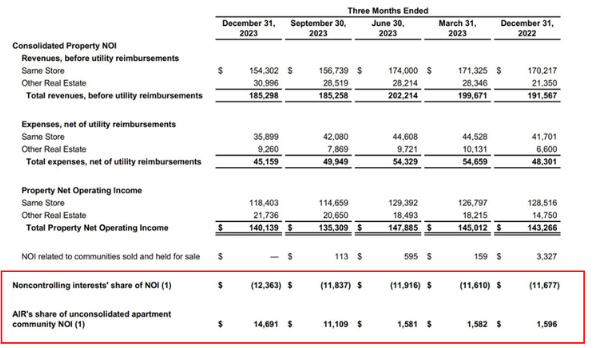

While we conceptualize REITs as tradable baskets of real estate, they are ultimately corporate entities that engage in a variety of transaction types including partnerships and joint ventures.

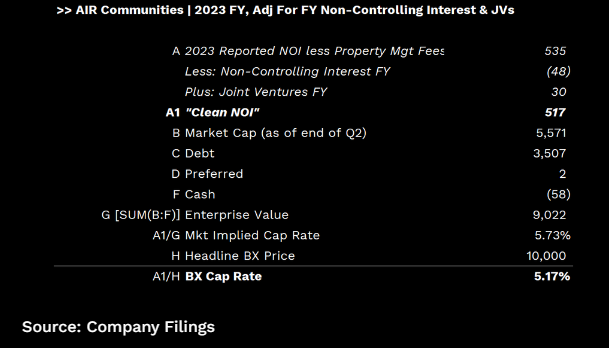

For deals where AIRC owns more than 50% but less than 100%, the NOI is fully consolidated, overstating the NOI “available” to ARIC shareholders in accounting terms. For properties where AIRC owns less than 50%, the NOI is unconsolidated and the reported NOI number is short the proportionate amount of NOI from these deals. These are disclosed in the supplemental, boxed in red below:

Using full-year numbers but properly accounting for these amounts and continuing to back out property management fees the cap rate drops to 5.17%.

We’re working towards a number the market is probably more comfortable with. A transaction in the high 5s would have implied other large-cap REITs were trading at approximately fair value, yet the entire sub-sector rallied throughout the day after the deal was announced. I took this to mean the initial reports of high 5s were probably quick back-of-the-envelope calculations that didn’t incorporate the nuances of REIT business models.

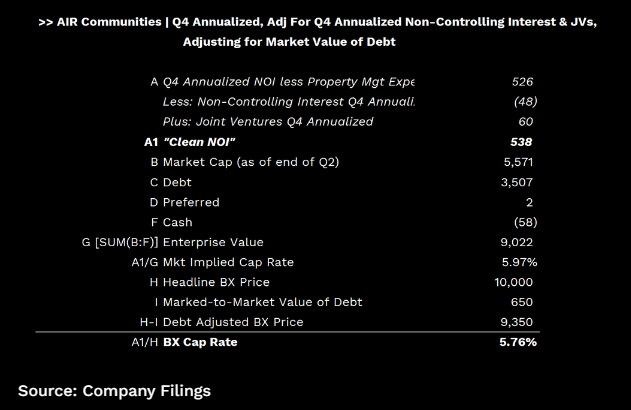

Looking at the path of both reported NOI and the JVs in the supplemental above, total property NOI declined throughout the year as JV NOI ramped. The full-year numbers may not represent the reality Blackstone is stepping into. Running this same calculation but annualizing all Q4 numbers instead of using full-year reported NOI puts the cap rate back into the 5.40% range.

The Debt Assumption, Property Tax, and Transactions Cost – 5.00% (Expert Mode)

The $10 billion headline transaction value includes $3.2 billion of net debt that Blackstone is assuming. That debt consists of $2.3 billion of in-place property debt ($2.2 billion of which is fixed rate) and $1.1 billion of term loans, unsecured debt, credit facilities, and preferred equity.

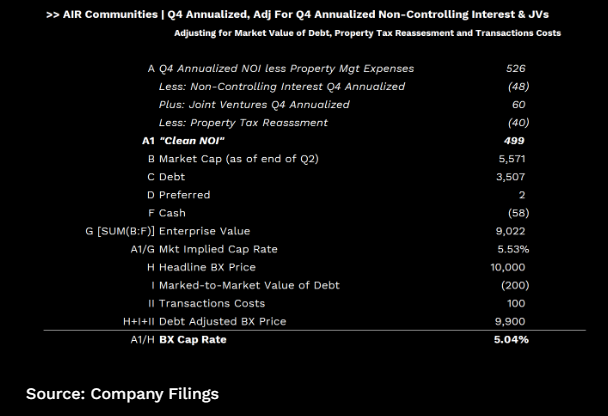

The $2.2 billion of fixed-rate debt has a weighted average rate of 4% and a weighted average of 7 years to maturity. The value of that debt is conceptually worth the present value of the savings the in-place debt offers relative to replacing it at prevailing market rates. Using a replacement rate of 5.50% and a discount rate of 5%, I assume the value of the marked-to-market value of the debt is ~$200m. In the below calculation, I reduce that amount from Blackstone’s purchase price.

A common gripe of implied cap rates is that they don’t account for how property tax reassessment will impact NOI for a hypothetical new owner. The impact to future NOI can be significant, especially in California where Prop 13 keeps assessments frozen in time. The primary challenge of adjusting for them, especially in take-privates of REITs with geographically diverse portfolios, is estimating the actual impact short of fully underwriting each property.

I pulled all of the multifamily parcels with ownership tied to AIRC’s headquarters in Denver from CoStar in an attempt to derive a “worst-case scenario” tax impact. The list I was able to compile is not exhaustive but provides an average per unit assessment of $165,500.

Should all the assessments be updated to Blackstone’s per unit purchase price of $461,000, the NOI impact of taxes would be an additional $57 million hit to NOI using a .009 average millage rate.

I don’t believe this is likely and Blackstone’s press release indicates they will be keeping AIRC’s management team in place, which could signal a deal structure that avoids any tax reassessment. Using JP Morgan’s estimate of a 5.9% cap rate, I was able to back into an NOI impact from taxes using their model of roughly $20 million. Splitting the difference I have used a (still punitive) $40 million hit to NOI as a result of property taxes.

Finally, in this calculation, I included 1% in transaction fees which I add to Blackstone’s purchase price assuming they are baking the costs into their underwriting of the deal. With these three additional considerations, including the adjustments made previously, the cap rate begins approaching a round 5%.

If you’ve made it this far, you may still be wondering, “So, what cap rate did Blackstone actually buy this for?” That question is crucially important to Blackstone, but less crucial for you, who I am guessing is not in the 99.9th percentile of commercial property investors in the world. In my opinion, a +21,000 unit deal is a difference in type, not degree from the transactions that make up the bulk of the commercial real estate market. Blackstone has a long-established strategy of using their size to “buy wholesale and sell retail.” In this case, the cap rate is more in service of creating multiple metrics that can both be theoretically “right” to flatter both buyer and seller.

Even though cap rates are simply the reciprocal of a cash flow multiple they do not use a sharply defined measure of that cash flow. Just like its OpCo brethren’s EBITDA, the creativity and expansiveness of add-backs and adjustments are only limited by the analyst’s imagination. In practice, the parlance of cap rates is less about comparing transactions and more about comparing the flat yield on the property at acquisition to the cost of capital financing it.

While you can debate the wisdom of the acquisition and the realistic path to the required fundamental performance, it is worth considering the incentives. Blackstone Real Estate Partners X closed its fundraising in April with $30.4 billion of commitments. To offer some scale the largest real estate ETF, Vanguard’s Real Estate ETF, has $32 billion of assets. Combined with BREIT’s $60 billion of equity it’s an unfathomable sum of capital to put to work.

One could argue a $10 billion apartment portfolio with the appropriate geographic exposures helps ensure BREP at least captures the beta component of returns. If you had $10 billion of capital, with a little leverage and few lucky breaks, you too could get to be the largest private equity firm in the world.

This article was originally published in ARMADA and is republished here with permission.