Equity investors might need to top up funds by tens of billions in Germany and the UK, thanks to covid.

Declines in capital values and more conservative lending in the immediate aftermath of the global financial crisis created a major refinancing challenge for commercial property – to the tune of £70bn in the UK, according to our debt funding gap analysis. What exactly is the debt funding gap? Basically, it quantifies the gap between debt at origination and debt available at the moment of refinance. We wanted to find out whether the covid-19 induced recession would result in a new debt funding gap, and if so how large it might be. To do so, we focused on our expectations of capital values and loan-to-value (LTV) measures.

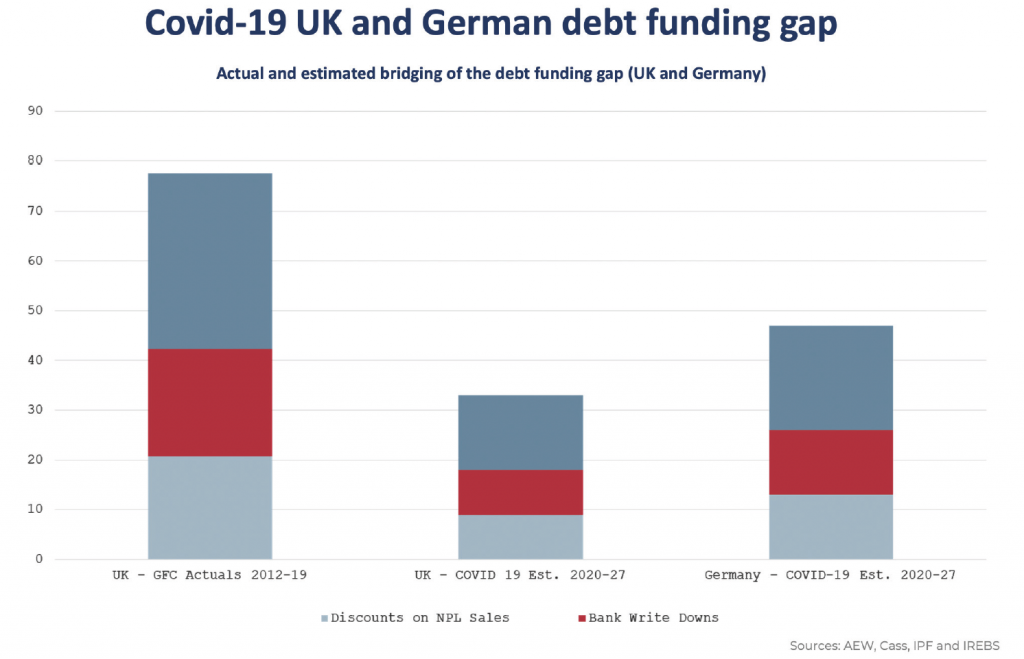

Based on recent market updates, we expect capital values to decline or to rise more slowly as a result of the covid-19 lockdowns’ impact on GDP growth, tenants’ ability to pay rent and increased liquidity and volatility risk premiums. However, as shown in figure 1, the effect is much more marked in the retail sector, mostly due to a significant one-off step-up in e-commerce penetration during the lockdowns, its long-term impact on retail tenants and investors’ return requirements.

Figure 1

LTVs before the onset of the pandemic were moderate compared with before the global financial crisis. We estimate current acquisition LTVs at around 50% across the European markets, compared with the 70%+ pre-GFC levels. More importantly, lenders’ LTVs have been adjusted downward during the covid-19 crisis, and it is reasonable to expect the 2020 full-year LTV average to come out below 50%.

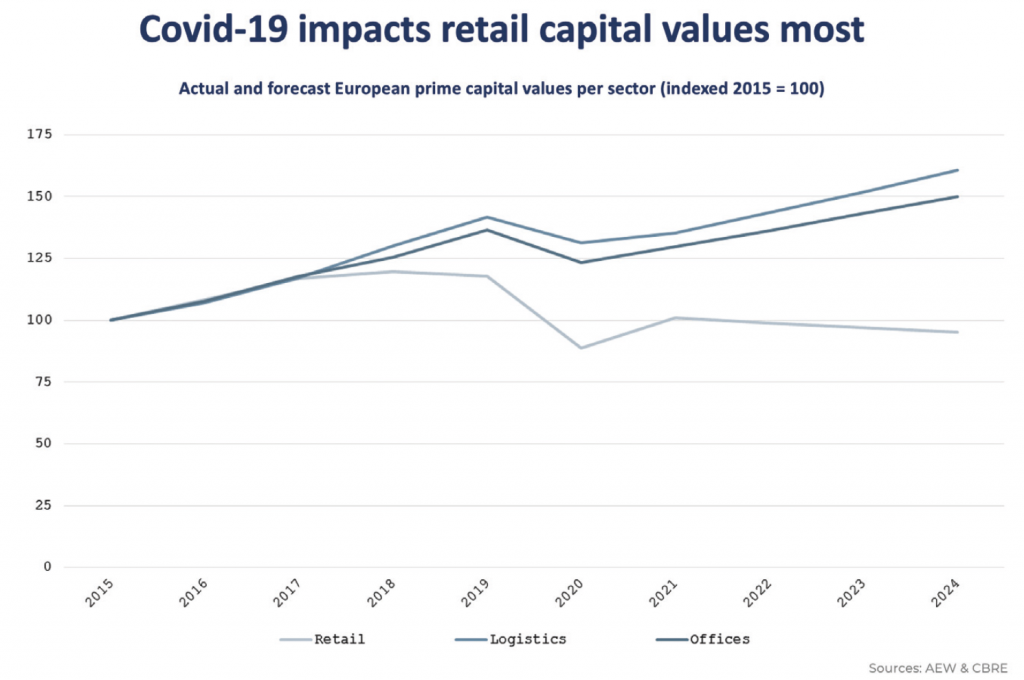

To quantify the impact on the real estate market of excess leverage and capital value declines, we estimate the debt funding gap, as illustrated in figure 2, by the following steps:

- the original acquisition of a sample property at €200m in 2016 with a loan at 75% LTV that needs to be refinanced in 2020;

- covid-19 related downside adjustment of the retail asset’s value of 37.5% over the next four years;

- refinancing of the new asset value at the bank’s lower LTV of 60%;

- to produces a debt funding gap of €75m – the difference between the €150m original debt and new refinancing of €75m.

Figure 2

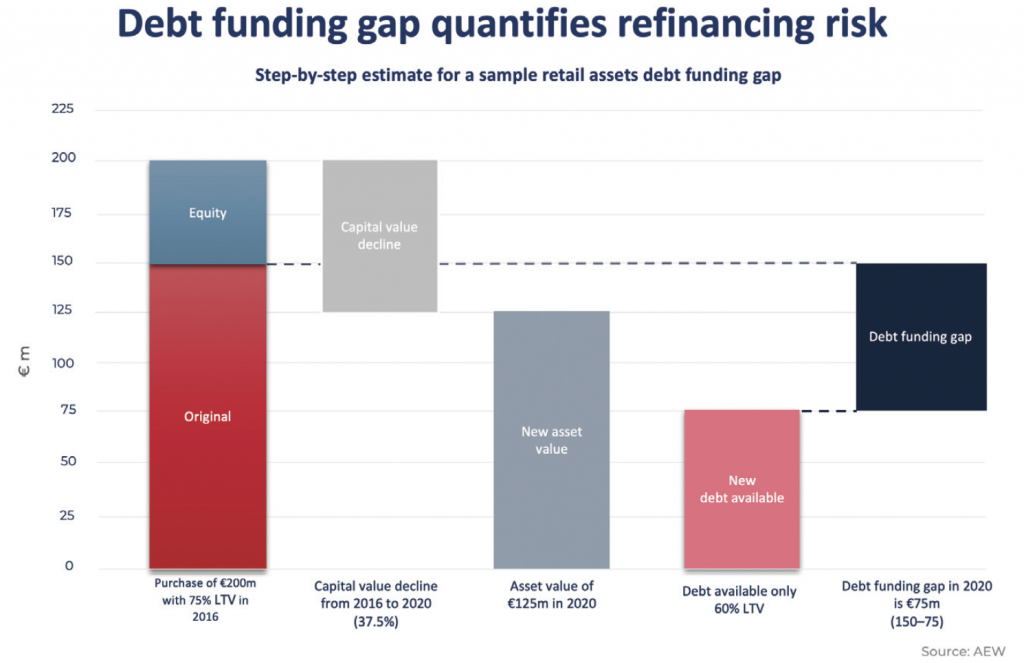

We estimate the UK commercial real estate debt funding gap to be around £30bn, or 16% of outstanding loans for the 2020-23 period. This is much lower than the £70bn, or 30% of outstanding loans, witnessed during the aftermath of the global financial crisis. In contrast (see figure 3), we estimate the German debt funding gap to be around 10.5% of total outstanding loans, well below the UK’s 16.6%. (Due to limited historical data availability, a comparison between the GFC and the current covid-19 environment is not possible for Germany.)

In absolute terms, the German debt funding gap at €54bn is larger than the €33bn debt funding gap in the UK. However, the German lending market is much bigger than the UK’s, with €515bn in outstanding commercial real estate loans, making the German gap smaller in percentage terms.

Overall, the reason for the lower debt funding gap in 2020-23 compared with post-2008 is mainly stricter bank regulations in the aftermath of the pandemic and more conservative acquisition LTVs. In addition, we expect capital value declines to be less severe than those associated with the global financial crisis.

Figure 3

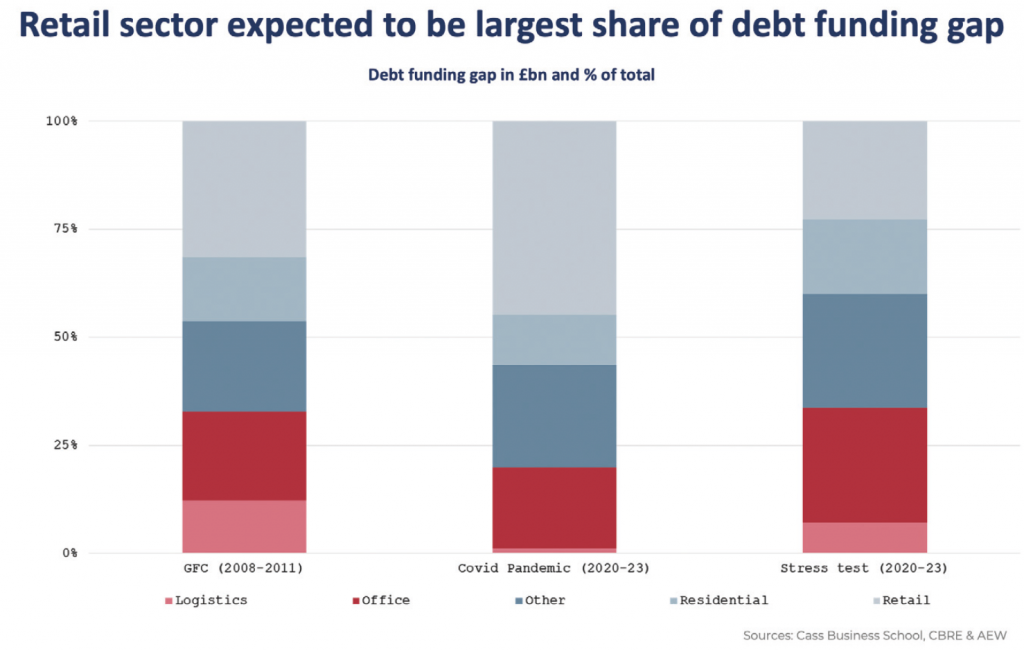

If we switch to sector-specific results (see figure 4), we notice that sectors such as logistics and residential are expected to be much more resilient and to contribute only a small portion of the debt funding gap. This highlights the differences between the covid-19 debt funding gap and the one in the aftermath of the GFC, which was more systematic and saw all sectors being influenced by the decline in values and decrease in debt availability.

The latter is also confirmed by our ‘stress-test’, which implies the same capital value declines as in the aftermath of the GFC to quantify the covid-19 debt funding gap.

Figure 4

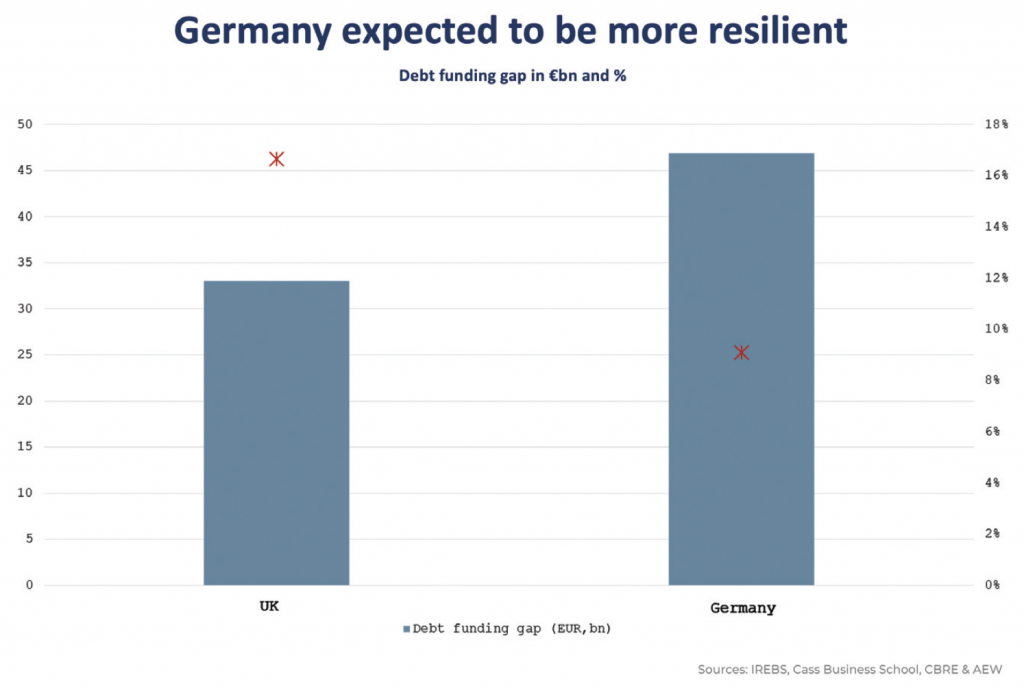

So, what can be done to solve the debt funding gap? Typically, as witnessed during the aftermath of the GFC, the debt funding gap can be bridged by discounts on non-performing loan (NPL) sales, bank writedowns and equity top-ups.

As illustrated in figure 5, historical data shows that the approximately £71bn GFC debt funding gap in the UK was bridged for 55% by discounts on NPL sales and bank writedowns, with the remaining 45% coming from equity top-ups. If we use the same UK GFC percentage allocation for our covid-19 related 2020-23 debt funding gap, we estimate that equity investors need to top up by €39bn in Germany and the UK combined in the next four to eight years.

This will require some tough discussions between investors and lenders, but based on improved bank tier 1 capital ratios and the relatively modest system-wide LTVs, it seems reasonable to expect a more proactive and quicker resolution compared to the GFC.

Figure 5