The world has been turned upside down by this pandemic, along with the prospects of many companies.

Perhaps some of your own holdings have soared to unexpected highs, or collapsed to unexpected lows. Several of my holdings certainly have. However, don’t pat yourself on the back or don a dunce cap too soon. In most cases, these dramatic moves are mostly down to luck, both good and bad.

As an example let’s take Dunelm and WH Smith. Respectively, these are the best and worst performing retailers in my portfolio so far in 2020 (ignoring Ted Baker, which I’ve already sold).

Before the pandemic I thought they had broadly similar prospects, with Dunelm performing well as the UK’s leading homewares retailer and WH Smith with an impressive travel retail business. But since the pandemic began their fortunes have gone in wildly different directions.

Dunelm: People buy more homewares when they’re locked at home

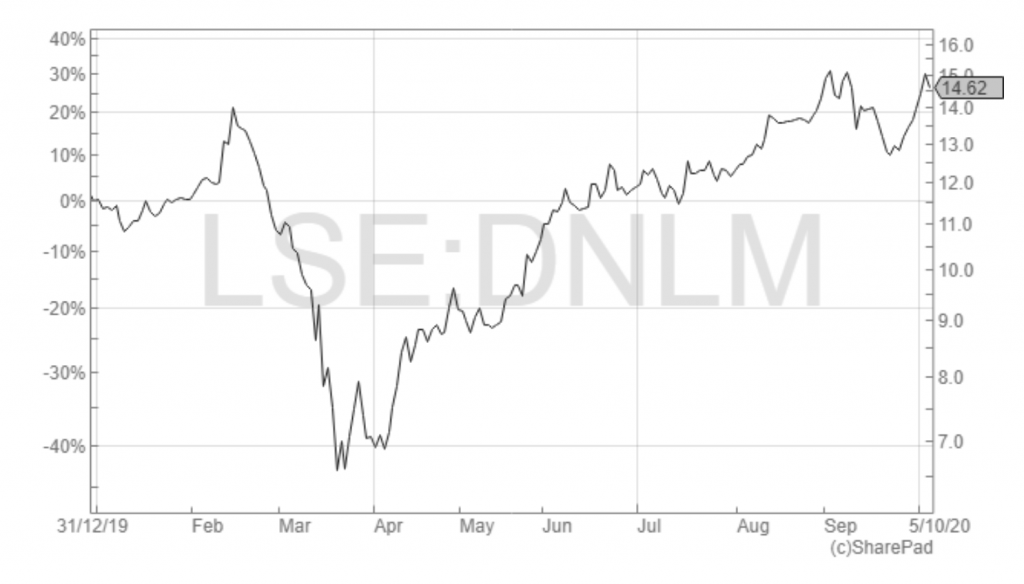

During lockdown Dunelm closed all its stores and almost all of its operations. As a precautionary measure, the dividend was also suspended. And yet Dunelm’s share price is actually up almost 30% since the start of 2020.

How did this happen? The answer is that for a retailer, Dunelm happened to be in the sweet spot. It sells homewares, and during lockdown more people were sat at home on their tired sofa looking at their home’s tired décor. Or they were posting pictures and videos on social media, where friends and colleagues can also see their tired décor.

Either way, lockdown meant more people wanted to spruce up their home interior and for that, Dunelm is #1 in the UK. It also helps that most Dunelm stores are large and out of town. That makes it easy to park up, put on a mask and stay far away from potentially contagious people.

I like Dunelm and I think it’s a very good business, but most of this recent share price rise is pure luck rather than skill (on my part or Dunelm’s).

WH Smith: In a pandemic almost nobody buys books to read on a plane or train

Like Dunelm, WH Smith is a market leader with a well-known and much-loved brand. Over the last decade or two it’s been wildly successful in rolling out stores and concessions in UK and international transport hubs such as airports and railway stations.

In fact the travel business is now significantly larger than the better-known high-street business. But unlike Dunelm’s out-of-town homeware stores, travel retail outlets have been one of the worst places to be during this pandemic, for obvious reasons.

WH Smith’s travel revenues declined more than 90% during lockdown and were still down almost 60% in July. The high-street stores fared better and have recovered more strongly. Even so, high-street revenues were still down 25% in July and WH Smith’s overall revenues were still down almost 60%.

A 60% decline in revenues is clearly unsustainable, so the company has had to raise additional cash, including a rights issue for £170m. More recently, WH Smith announced plans to reduce staff headcount by around 1,500 out of a total of 14,000.

None of this is good, and it seems clear that the pandemic has put a large and permanent dent in WH Smith’s value, especially if it takes a long time for travel habits to return to previous levels.

Does this mean WH Smith is a low-quality business compared to Dunelm? No.

Does this mean anyone who invested in WH Smith is an idiot because they could have put that money into Dunelm instead? Again, no.

I think both Dunelm and WH Smith are above-average businesses with strong brands, strong capabilities and lots of potential for future growth. Dunelm just happened to operate in a part of the economy that is boosted when people are forced to or choose to stay at home. And WH Smith just happens to operate in a part of the economy that is decimated when people are forced to or choose to stay at home.

So the huge difference in their recent performance is almost entirely down to luck, and has little to do with the skill (or lack thereof) of management or shareholders. In other words, if your portfolio is in the doldrums because it was tilted towards travel, don’t panic. You’re probably not an idiot.

And if your portfolio has soared because it was tilted towards homewares or healthcare, don’t celebrate too soon. You’re probably not a genius (Nassim Taleb might even call you a Lucky Idiot, but that seems a bit harsh).

Here’s another example from my portfolio of even more extreme levels of good and bad luck.

Senior PLC: Aerospace parts don’t sell when planes aren’t flying

Senior is a world leader in aerospace structures and components. Its primary market is civil aerospace, where it has significant long-term contracts to supply parts for the latest generation of commercial airliners from Boeing and Airbus.

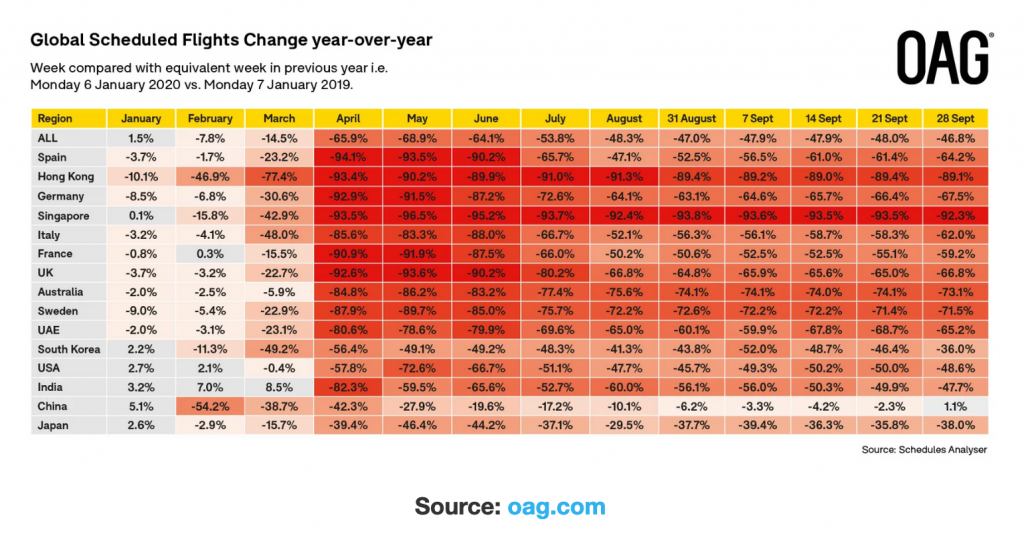

This is a good business to be in, because civil aerospace is generally expected to be a steady growth market for the foreseeable future. Unless, of course, there’s a pandemic. Covid-19 shut down most global air travel for months and has left the number of scheduled flights down about 50% from a year ago (as shown in the table below).

This collapse of demand caused havoc in the aviation supply chain, with strong and successful companies like Senior caught up in the mess along with everyone else.

Here are some questions worth pondering:

- Is Senior a good company? Yes.

- Was it well-placed in a market with good growth potential? Yes.

- Was it reasonable to expect a pandemic to virtually shut down the entire aviation industry? No.

- Did Senior shareholders make an obvious mistake, without the benefit of 20/20 hindsight? No.

- Is this a good example of very bad luck? Yes.

One option would be to sell up now and try to reinvest the proceeds into companies exposed to homeworking or healthcare. But that would mean selling Senior at a depressed price and buying popular stocks at elevated prices, and I’m not going to do that.

Instead, I’m going to sit tight and see what Senior can do with a very bad situation. There may be important lessons that I can extract and use in the next crisis.

Okay, that’s enough doom and gloom. Let’s finish with a more upbeat example of blind luck.

XP Power: Medical component sales go through the roof in a pandemic

XP Power is one of the world’s leading designers and manufacturers of power converters. XP’s speciality is developing power converters for original equipment manufacturers (OEMs) which manufacture devices used in critical settings such as healthcare, security or production lines. Failure of a device in one of these settings is costly, so manufacturers are willing to pay up to work with a trusted partner like XP.

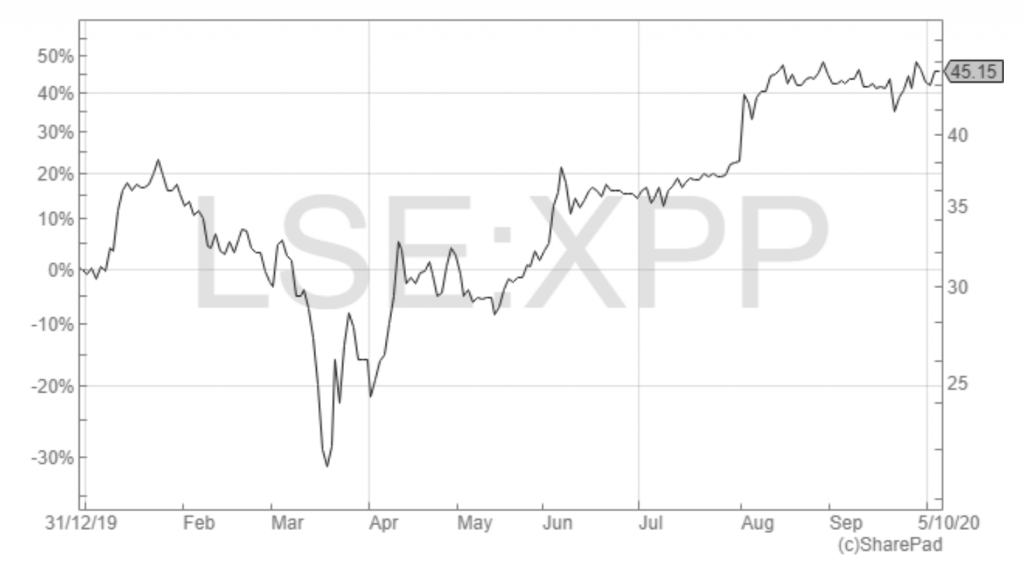

As far as the pandemic is concerned, the key part of the story is XP’s exposure to healthcare. XP’s power converters are used in hospital beds, CPAP (continuous positive airway pressure) machines, ventilators, ultrasound and lung x-ray machines. Demand for these has skyrocketed during the pandemic, with order intake up more than 40% from a year ago.

Was this an inspired move by XP’s management to position the business in case of a global pandemic? No.

Did I put XP Power into the portfolio because I thought something like this might happen? No.

Is XP a very good business whose operations and share price have massively benefited from the pandemic? Yes, and yes again.

Also, if you like the look of XP Power there’s a fantastic review of the company on the SharePad website.

Coping with extreme events and extreme good and bad luck

As a long-term investor you simply have to accept that you will have good luck and bad luck. And sometimes you’ll have extremely good luck and sometimes you’ll have extremely bad luck.

We cannot control luck, but there are some things we can do to take advantage of good luck when it happens to us, and to avoid the worst impacts of bad luck.

To take advantage of good luck you could:

- sell companies where valuations seem high, such as when investors are excited by short-term unexpected tailwinds.

To take advantage of (someone else’s) bad luck you could:

- buy companies where valuations seem low, such as when investors are depressed by short-term unexpected headwinds.

To avoid the worst impacts of your own bad luck you could:

- diversify broadly across companies and sectors so that no one company or sector would cause you to lose sleep even if it collapsed;

- own high-quality businesses with very strong balance sheets.

This pandemic still has a long way to go, and personally I think we’re perhaps halfway through the initial pre-vaccine phase.

However, if your investments are broadly diversified across a wide range of quality businesses purchased and held at attractive valuations, then it will take more than a bit of bad luck to keep you from your long-term financial goals.

This article was previously published by UK Value Investor.com.