Comparing farmland and property.

This commentary argues that farmland values may double over the next 10 years, while over the same 10 years residential and commercial property values are unlikely to increase.

What happens to farmland in times of inflation?

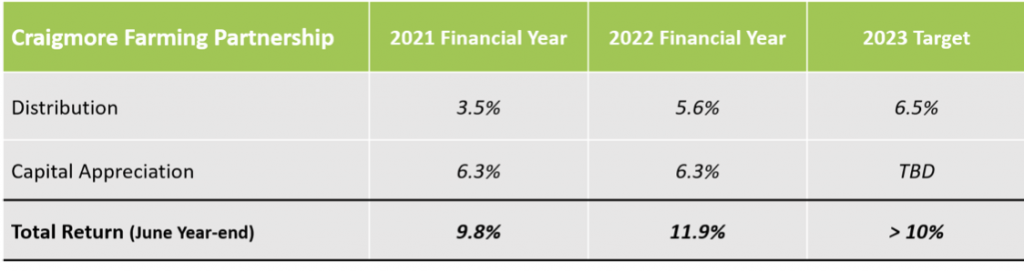

Farm profits tend to rise strongly in times of inflation. Craigmore farm revenues have grown 12% per year since 2020, while costs have increased at less than 5%. This is enabling increased cash distributions. We are targeting 6.5% this year in Craigmore Farming Partnership:

Increasing profitability is leading to a steady increase in land values. Capital growth has been 6.3% pa in the last two years.

Total returns of over 10% per year on farmland have been well ahead of residential real estate and equities in New Zealand, which have been flat to down for two years.

But won’t rising interest rates also become a brake on farmland values?

Leverage on farmland averages 25% in New Zealand and 16% in the US (noting they have similar interest cover, since dollar yields of US farmland are lower). With these low levels of debt, changes in interest rates are not the main driver of land prices. When New Zealand interest rates halved between 2014 and 2020, pastoral land prices remained stable (or even fell slightly for dairy land) because most farm produce prices were not increasing.

In sum, it is agricultural returns that are the main determinant of land prices, not interest rates.

What next for farmland?

Finance buffs understand that anything increasing in value at a rate of 7.5% compound doubles every 10 years. If farm gate inflation averages 5% over this decade, and productivity and factor efficiency gains contribute 2.5% further EBIT growth, then farmland values should, subject to lags, capitalise into a doubling of prices over the same period.

In fact, farmland returns may out-perform inflation. Climate change and de-globalisation (eg, frictions relating to Ukraine) are putting many agri-commodities in tighter supply and less well connected to end users.

What about property?

Marginal buyers of residential and commercial property typically use leverage. This means yields of urban property correlate with interest rates, so that prices rise as interest rates fall and vice versa. Thus, in the period between 2010 and 2020, interest rates in most western countries halved and, as a result, property prices doubled.

With higher inflation, rents are now rising in many urban property markets. It is reasonable to assume they may continue to grow over a decade in which inflation averages 5%.

In this scenario, borrower interest rates may rise from lows of 2% to between 6% and 8%. Indeed, mortgage rates have already risen from 3% to 6% in the US and the UK. In this context, percentage cash yields from urban property should approximately double.

If property yields double, this would roughly off-set gains from rental growth, so prices of residential and commercial property may end the decade approximately where they began.

Why might we expect 5% inflation?

Since at least 2009, economic policymakers have attempted (and in local terms succeeded) in addressing each new crisis as it comes along with government and monetary largesse.

There is in the West no longer a constituency for sound money. We now prefer our economic leaders to be pragmatic and innovative, rather than slaves to some dead economist.

In this context it is reasonable to assume, given the choice between a risk of inflation and political unpopularity, Western governments will continue to spend more and tax less than they should. Policies of the Western countries are becoming more Italian and less Teutonic.

The Bank of England’s resumption of quantitative easing in the last week of September, at exactly the time they had previously announced they would commence quantitative tightening, illustrates the challenges faced by central banks and governments as they navigate each crisis.

In this political and policy context I don’t think it is unreasonable to assume inflation may average 5% or more as countries lurch from crisis to crisis over the course of this decade.

Conclusion: this is likely to be farmland’s decade

If farm commodity prices rise 5% pa, if other gains drive a further 2.5% growth, and if land prices track farm EBIT returns then it is axiomatic that farmland will double.

Indeed, in some markets, agri-land is already up 30 to 40%. In New Zealand, lag effects in capital formation mean momentum is only now building. It is not too late to get involved in farmland’s decade.

Keep in touch.