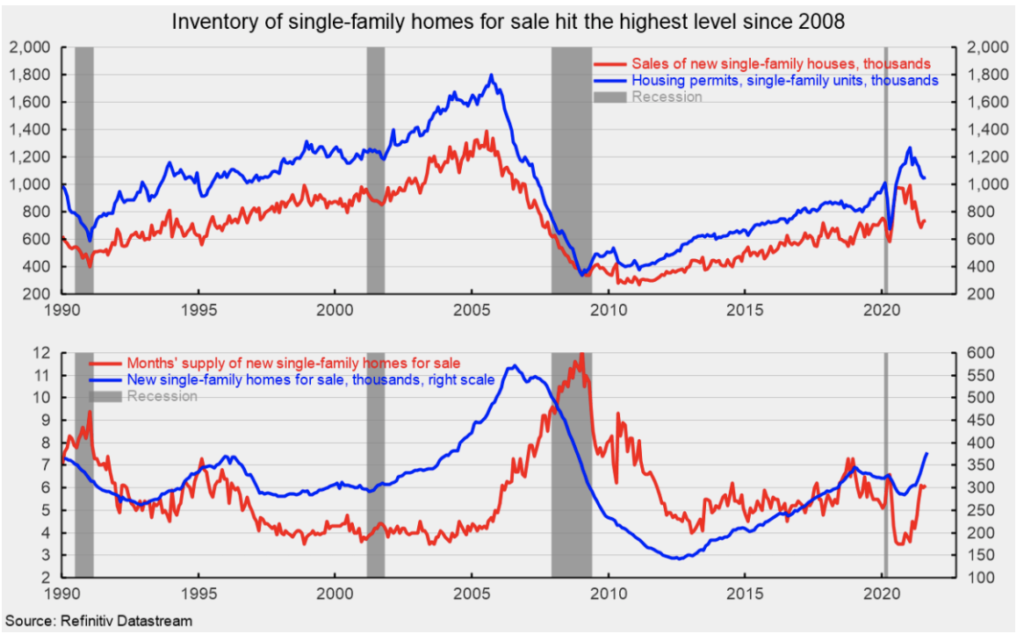

Sales of new single-family homes posted a small gain in August, increasing 1.5% to 740,000 at a seasonally adjusted annual rate from a 729,000 pace in July. Despite the gain, sales are down 24.3% from the year-ago level and are 25.5% below the 993,000 pace in January (see top of first chart). The declining trend in new home sales has been matched by permits for future construction (see top of first chart).

Sales of new single-family homes were up in three of the four regions of the country in August. Sales in the South, the largest by volume, rose 6.0% while sales in the West gained 1.4%, and sales in the Northeast gained 26.1%. However, sales in the Midwest were off 31.1% for the month. From a year ago, sales were down between 16 and 47% in the four regions.

The total inventory of new single-family homes for sale rose 3.3% to 378,000 in August, the highest level since October 2008 (see bottom of first chart), leaving the months’ supply (inventory times 12 divided by the annual selling rate) at 6.1, up 1.7% from July and 74.3% above the year-ago level (see bottom of first chart). The median time on the market for a new home fell in August, coming in at 3.6 months versus 4.4 in July.

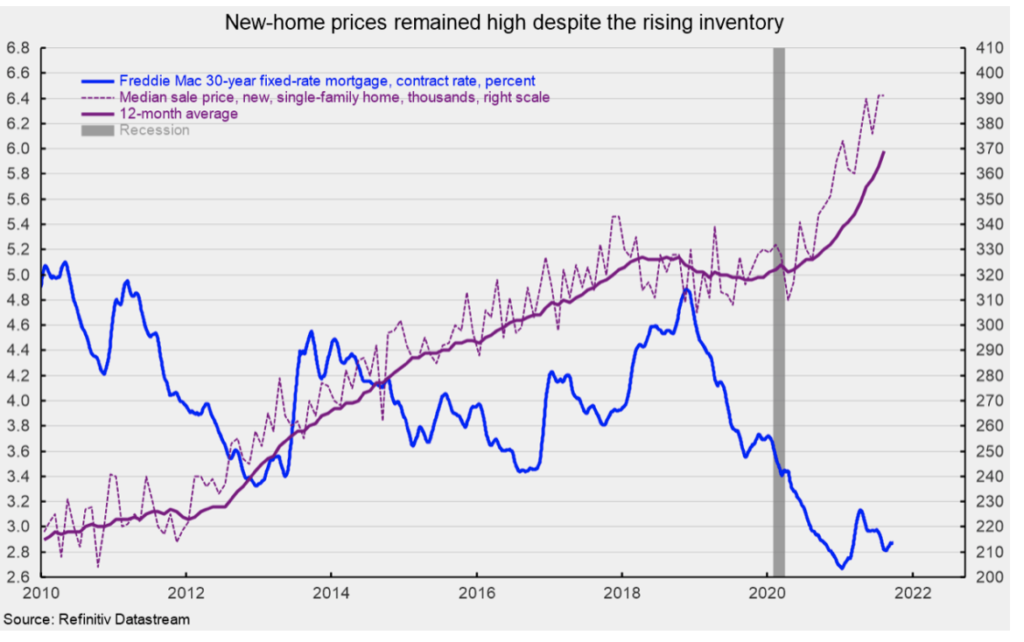

Recent headwinds for the housing market include somewhat higher mortgage rates and sharply higher home prices. The average rate of a 30-year fixed-rate conforming mortgage was around 2.8% in August. The average rate is up from a low of 2.65 in January but lower than the 3.18% in April 2021. The average rate was as high as 4.94 in November 2018 (see second chart).

The median sales price of a new single-family home was $390,900 (see second chart), unchanged from July (not seasonally adjusted). The gain from a year ago is 20.1%. On a 12-month average basis, the median single-family home price is at a record high (see second chart).

Record-high prices and somewhat higher mortgage rates are forcing some buyers out of the market and contributing to slower sales, rising inventory, and less new construction. However, the recent surge in new Covid cases may provide some continued support for less dense housing. It is likely that these conditions will continue to impact the overall housing market, and on balance, further reduce demand, leading to looser supply conditions and slower future price increases.

Originally published by the American Institute for Economic Research and reprinted here with permission.