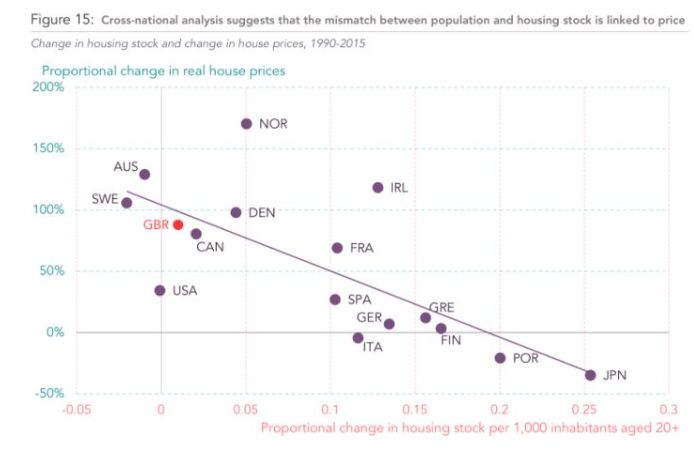

The Resolution Foundation’s depressing claim that one-third of millennials face renting their whole life has made headlines today. But the think tank’s report also contained the encouraging — and unsurprising — revelation that countries building plenty of homes have generally not seen huge price rises, despite low interest rates and a big banking sector. Perhaps it’s too early to admit defeat.

Source: “Home Improvements”, Resolution Foundation, 2018. Reproduced with permission.

Accounting for changes in incomes would likely make the picture even clearer, as the government’s own numbers to justify the Housing Minister’s comments on immigration showed last week, because rising incomes greatly boost demand for bigger and better homes. And yet this country continues to plan for future housing demand as if rising incomes didn’t matter, and then pretends to be surprised when the shortage gets worse.

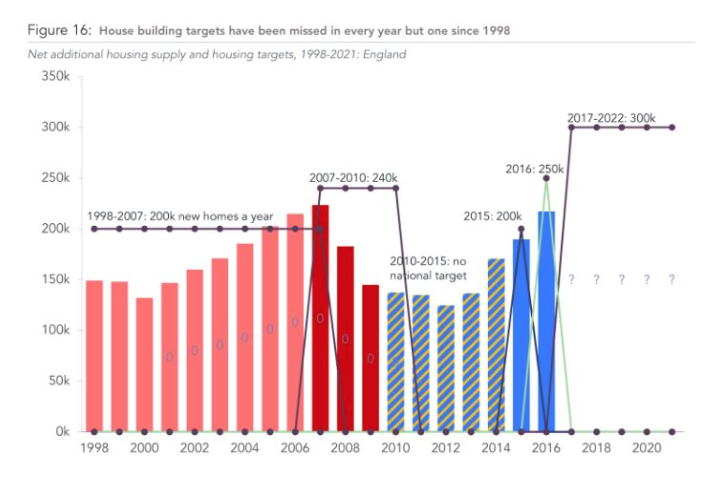

It is good to see a high-quality research institution stress that a household can only form when a new home is built – which is why counting households is a silly way to try to argue there is no housing shortage – and provide sobering evidence that governments have generally failed to meet their housing targets for two decades:

Source: “Home Improvements”, Resolution Foundation, 2018. Reproduced with permission.

There’s also a refreshing admission of the “short term political pain” that would result from most efforts to end the housing crisis, and a bold new call for a proper pilot of Tim Leunig’s Community Land Auctions, which should at least help get more homes built in areas of high demand where the value uplift from granting planning permission is greater. The report adds other sensible ideas to build more homes and create a fairer supply.

Lindsay Judge, the report’s author, also suggests mitigating the pain of renting with reforms similar to those in Scotland: cap rent rises for three years and allow the landlord to evict during that period only to sell or occupy or for other major reasons – recognising that will do nothing to help the supply shortage, and may sadly make the political insider-outsider challenges even harder to solve.

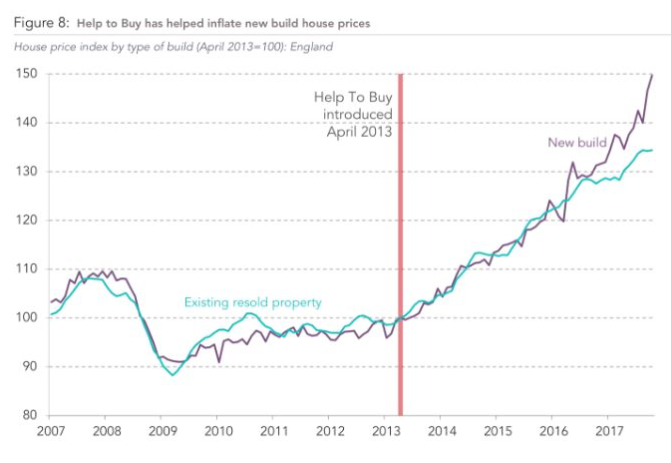

There are bolder proposals to increase Housing Benefit and Housing Allowance and reform property taxation to reduce subsidies to owners of second homes or bigger homes than they need or want. It might be easier to bring more focus to, and ultimately end, to Help to Buy, which they say initially helped production but more recently stoked prices:

Source: “Home Improvements”, Resolution Foundation, 2018. Reproduced with permission.

One minor quibble: it’s not quite true that private developers have never come near the 300,000 homes a year the government says we need. They built 287,000 in 1935 and nearly as many in both 1936 and 1937, for example. More generally, it would be great to see the Resolution Foundation address the longer history of housing and why, since 1940, our stock of homes has never grown at the rates of the 1830s using Georgian construction technology, let alone the much higher rates of the 1930s, as housing analyst Neal Hudson has shown. The system is fundamentally broken.

How much much closer does this report get us to a politically achievable end to the housing crisis? There, the picture is less rosy. Notwithstanding many excellent points, it’s hard to see much that will overcome the high political hurdles and also generate the needed radical boost to supply.

Nonetheless, this is a helpful contribution to the debate and, as Torsten Bell noted at the launch, it’s great to see an ever-growing number of voices calling for more homes. It’s a pity we can’t all agree how to do it.

Article originally published by CapX.