Covid 19’s impact on the Asia Pacific office market has been that buoyant demand leading into the pandemic was quickly stymied as corporate occupiers sought to limit cost exposures and assess their real estate needs. In line with this, vacancy has increased and rents have softened across most markets, pushing them towards greater tenant-friendly status. However, corporate occupiers must be aware that these changes may not bring the cost savings they might expect and that in some markets, tenants may have to pay more on a new lease than they were paying on the last year of an expiring lease.

The year ahead

Looking ahead, landlords are expected to continue experiencing headwinds in many markets across Asia Pacific. While the regional economy recovered to pre-pandemic levels in the fourth quarter of 2020, with forecast growth of 6.5% in 2021, recovery in commercial office markets has lagged behind.

The regional one-year rental outlook is for an average decline of around 1.7%, but with great variability around this average. Rents in Hong Kong are forecast to fall a further 13% over 2021, continuing the trend that started in early 2019. Rents in Hanoi and Tokyo are also under comparatively significant downward pressure due to forthcoming supply. In contrast, rents are forecast to increase the most in Seoul, at around 5% for the year. Seoul’s office market has been especially resilient during the pandemic so far, even posting growth of 3% in 2020, thanks to strong tenant demand and limited supply.

Overall, this is broadly positive news for any corporate newly entering any of these flat or declining markets. In short, they should be paying less than a new market entrant 12 months ago. However, what about existing occupiers looking to re-sign a lease? Although rents have been easing, past rental growth over the duration of an average lease term needs to be considered.

Rental exposure across the region

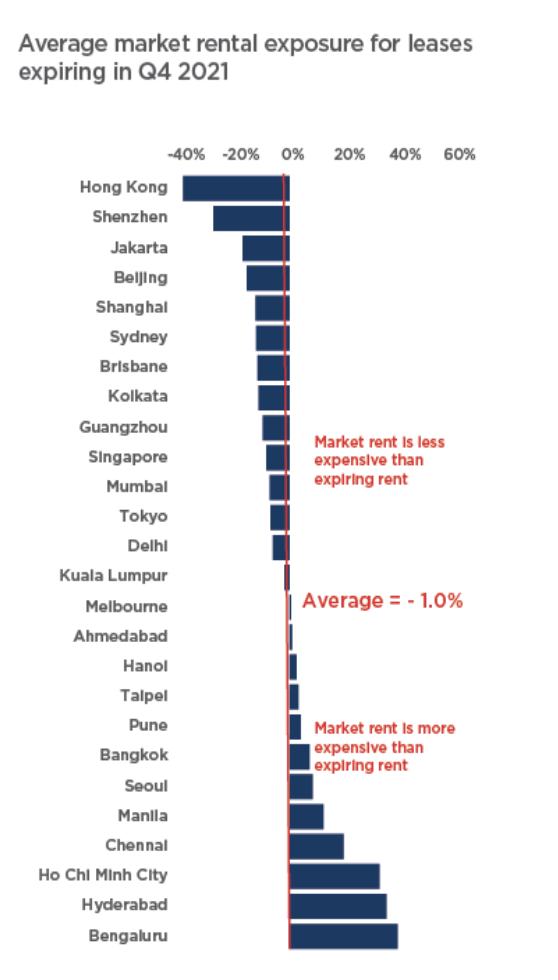

Looking at past rental growth together with the 2021 outlook provides an estimate of rental exposure – the difference in rent paid on a lease and market rent. To analyse more accurately, market conventions for annual rental escalations have been included.

The situation is delicately poised. A little over half of the markets analysed are over-rented by an average of 1%. In other words, rents currently being paid by occupiers are on average 1% above market rent, mainly due to the recent global softening. However, this also means that the opposite is

true for the remaining markets – market rents are above current lease rents.

Hong Kong sits at one extreme, with current lease rents being almost 40% above market rents, reflecting the steep market rent declines experienced over the past two years. After this, differences of over 10% also exist for Beijing, Jakarta and Shenzhen.

Of greater concern are the markets where tenants are under-rented – paying below expected market rent as at Q4 2021. Indian cities feature prominently here, reflecting their meteoric growth over the past few years. Bengaluru is the most under-rented, at 39% below market rent, closely followed by Hyderabad at 35% under-rented.

The underlying message here is that market conditions are perhaps more challenging for occupiers than they first appeared. While occupiers in some markets are likely to be able to make considerable cost reductions on lease negotiations this year, others could be looking at varying degrees of higher real estate costs at a time when corporates are more acutely seeking to minimise cost exposure.

Beyond a closer observation of market dynamics, corporates should explore additional strategies, including:

- Be proactive in managing corporate space needs in the most volatile markets to capitalise on expected rental declines or minimise rental increases.

- Ensure that real estate strategy is aligned to corporate enterprise goals, especially when considering alternative locations.

- Calculate space requirements accurately through workplace analysis.

- Apply thoughtful design and fit-out standard to help ensure maximum productivity.

To understand more, download Cushman & Wakefield’s Asia Pacific Rent Variability report.