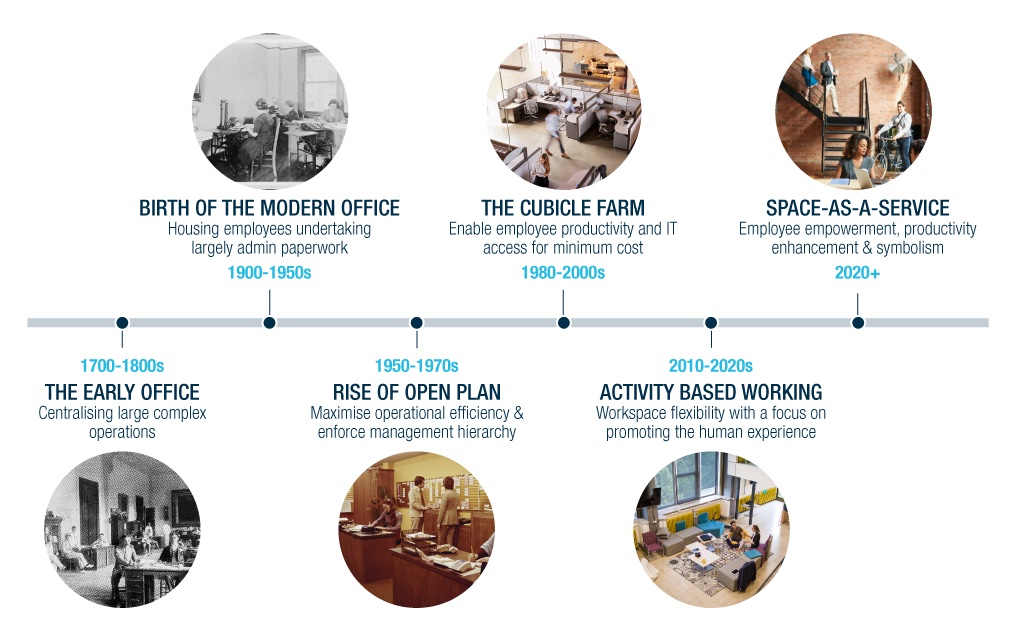

We are in the midst of the next evolutionary cycle.

Enforced mass home-working caused by the pandemic has viscerally demonstrated that in today’s tech-infused world, knowledge-based ‘work’ need not necessarily be performed in an office. This has triggered public debate on what the future holds for offices and indeed whether they have a future at all. Our take on this is that office demand is evolving, not disappearing, bringing an unparalleled opportunity for long-term investment performance to those who act decisively with courage and conviction today. Now more than ever, it is vital that office investment, divestment and management decisions are correct.

Office occupier and investment activity since the pandemic began has been woeful. This is used by some as evidence that the office is dead. European take-up in 2020 fell 37% year-on-year according to CBRE.

Investment volumes fell 21% according to RCA. Average vacancy rates have risen and income returns have fallen significantly as landlords battle just to maintain rents, let along grow them. Such data is backwards looking though, and given the magnitude of the pandemic it’s bound to paint a negative picture. Forward-looking indicators are more informative and suggest that the outlook for the office market is very positive, provided stock aligns with occupier demand.

The future will be different: five observations

We draw five observations from forward-looking indicators:

Offices are desired. Repeated surveys shows that a plurality of employees and employers value the office and want to return there at least some of the time. The pandemic has demonstrated the benefits of home-working, but also some of its challenges. Offices remain indispensable to most businesses and play a vital role in attracting the talent.

Workplace patterns will change. Most employees and employers favour a split home/office working week with the majority of staff spending at least three days a week in the office. This may allow some companies to downsize, but most will still need the capacity to accommodate the full team on any given day. This will either require occupiers to lease sufficient space directly or defer demand to flexible leasing solutions which will support aggregate demand.

Task-based locational choice. Some tasks are better suited to the office or home environment. To maximise productivity, office space will pivot towards facilitating the specific tasks for which it is best suited, primarily those based on collaboration, teaching, selling, interpersonal communication and creativity. Think more meeting rooms, break-out spaces and social areas and fewer desks. This suggests the propensity to use the office will vary by industry and role depending on the tasks individual businesses and employees perform.

Employment will grow. European ‘office-based’ jobs are set to rise by 2.7 million over the next decade, according to Oxford Economics. Even if office space per person falls, this will support growing demand over time, especially as new workers will be young gen-Z-ers who indicate the strongest office-based preference. Over the past few decades, the amount of office space required per person has fallen, but aggregate demand has still risen due to employment growth.

Incentives to shape behaviour. Surveys show most businesses believe offices are fundamental to long-term growth and branding. Given their perceived importance it is likely that strong incentives, such as high specification space and additional on-site perks will be used to influence behaviour. This may be combined with pay adjustments to discourage full-time home working. Employee preferences may also shift if office networking, educational and asymmetrical information transfer benefits emerge post-pandemic. These factors will tilt employees towards spending more time in the office.

“Occupiers will be unwilling to comprise on specification, location or office experience”

Office demand is thus evolving, not disappearing, as space changes to reflect modern working practices. These trends pre-date the pandemic, but have been turbo charged by it. As the future path is much clearer to all, occupier recalibration will occur rapidly, creating winning and losing assets. Occupiers will be unwilling to comprise on specification, location or office experience. They will be prepared to pay for the best space which delivers productivity and employee fulfilment, of which there is an acute shortfall. Offices must work harder to demonstrate more compelling benefits to home working.

Office investors should prepare for significant value creation and loss. Many will be fearful, but those who understand where occupier demand is going and work backwards to determine what that means in terms of the physical characteristics of winning assets, micro and macro-locations will win. They can acquire offices that are, or can be made to, align squarely with future occupational demand. In doing so they can assemble resilient office portfolios to which demand will migrate, capturing long-term performance while taking advantage of current uncertainty and weak sentiment to acquire such assets at a discount. This requires courageous action and conviction but, in our view, will bring rich rewards.