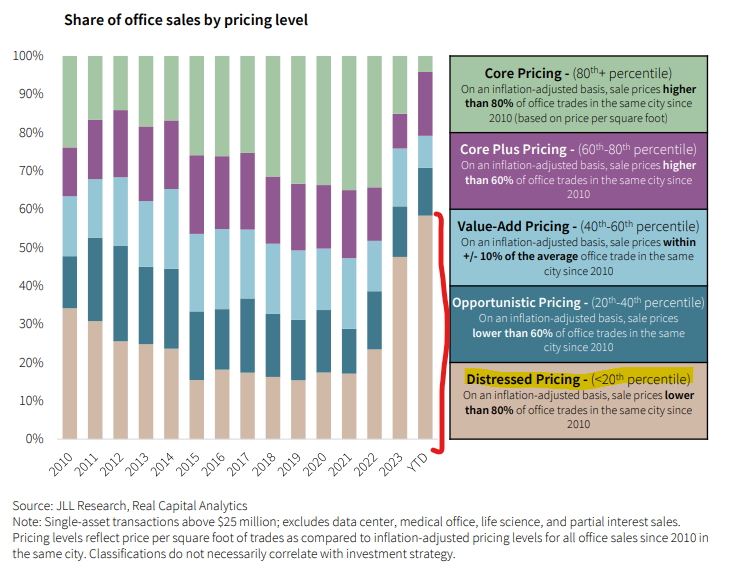

- Distressed Office sales are the most common sales

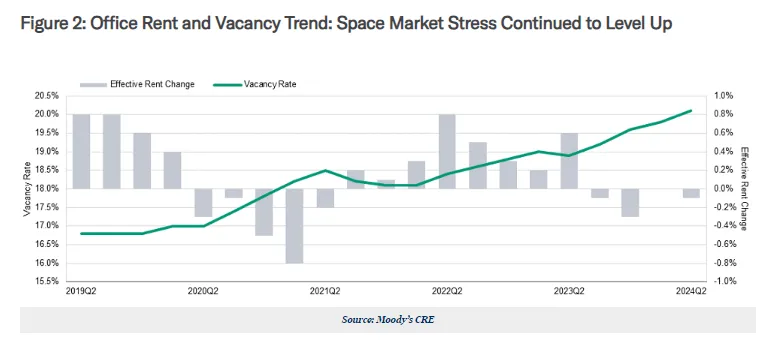

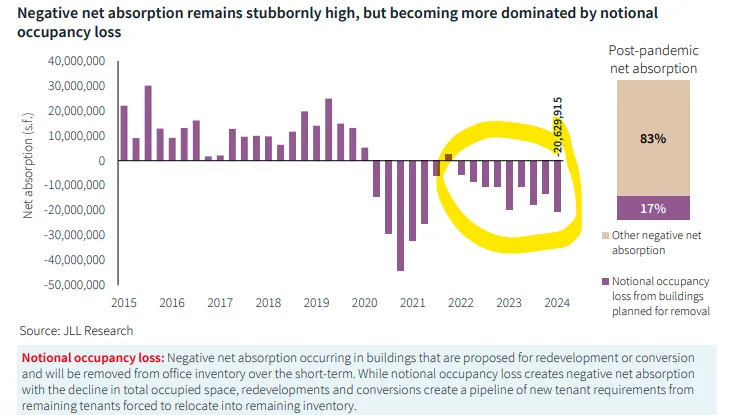

- checking in on vacancy and absorption rates

- the fabric of American life, forever changed (by longer distance living)

- not all construction is in the doldrums

It’s the slow-moving trainwreck that everyone saw coming, but it’s still coming.

Office buildings continue to trade at substantial discounts:

JLL

Distressed office sales are now more than 50% of total office sales.

Distressed is defined as a sales price (on per square foot basis) that’s lower than 80% of same-city office trades since 2010. So more than half of sales are falling into the sub-20th percentile of prices.

All those losses, and some big hitters think that (mostly smaller) banks are the next domino to fall sometime next year. Of course, anyone crying out for help would say “it’s not just us,” but we shall see.

It’s definitely true, though, that the underlying dynamics behind office continue to go the wrong way.

The story around office buildings is the directionally the same: there is less demand for the asset class, just as the cost of doing business got substantially higher. That’s generally not a favorable mix.

Whatever the excitement around Return to Office, the reality is that firms continue to cut back on their office space (in the aggregate, at least):1

- Vacancy rates continue to rise:

- Net-absorption continues to fall:

Demand for office space does not appear to have hit a bottom yet.

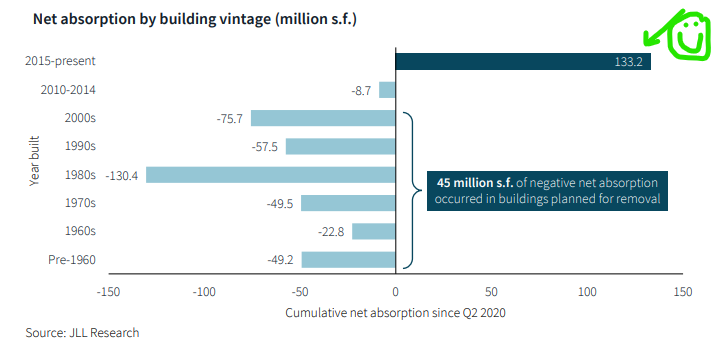

The good news, if you can call it that, is that newer, nicer offices are enjoying the benefits of “flight to quality.” (There’s some evidence that coffee places might be enjoying a partial RTO bump, as well).

Net-absorption for anything built after 2015 is still positive:

If you’re going to have office space, you might as well have nice office space, especially when it’s such a buyer’s market.

That’s good news for newer, heavily amenitized space.

WFH/Hybrid is the new normal

Why tenants are cutting back is pretty straightforward—general cost-cutting and persistent WFH/Hybrid work schedules, that are simply part of the new normal (as they should be).

Certainly firms aren’t getting bigger (at least not yet), with net-new hiring fairly tepid.

For the workers that are already hired, they just need less space, on the regular.

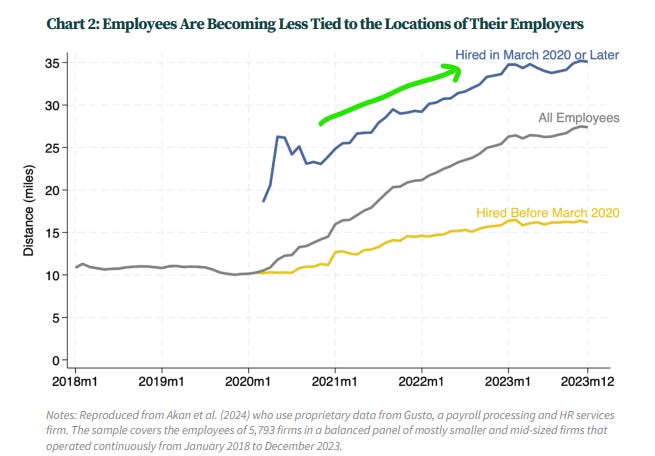

As Random Walk mused many moons ago, some changes are stickier than others, and the great reshuffling that occurred during the pandemic has definitively changed the fabric of American life.

Massive levels of job-switching, coinciding and/or causing an ex-urban shift, has created an entirely new generation of workers who live nowhere near their offices:

EIG

People hired March 2020 onwards live more than 2x farther from their office than everyone else.

It’s going to be awfully hard to get those people to come back to the office more than a couple of times per week.

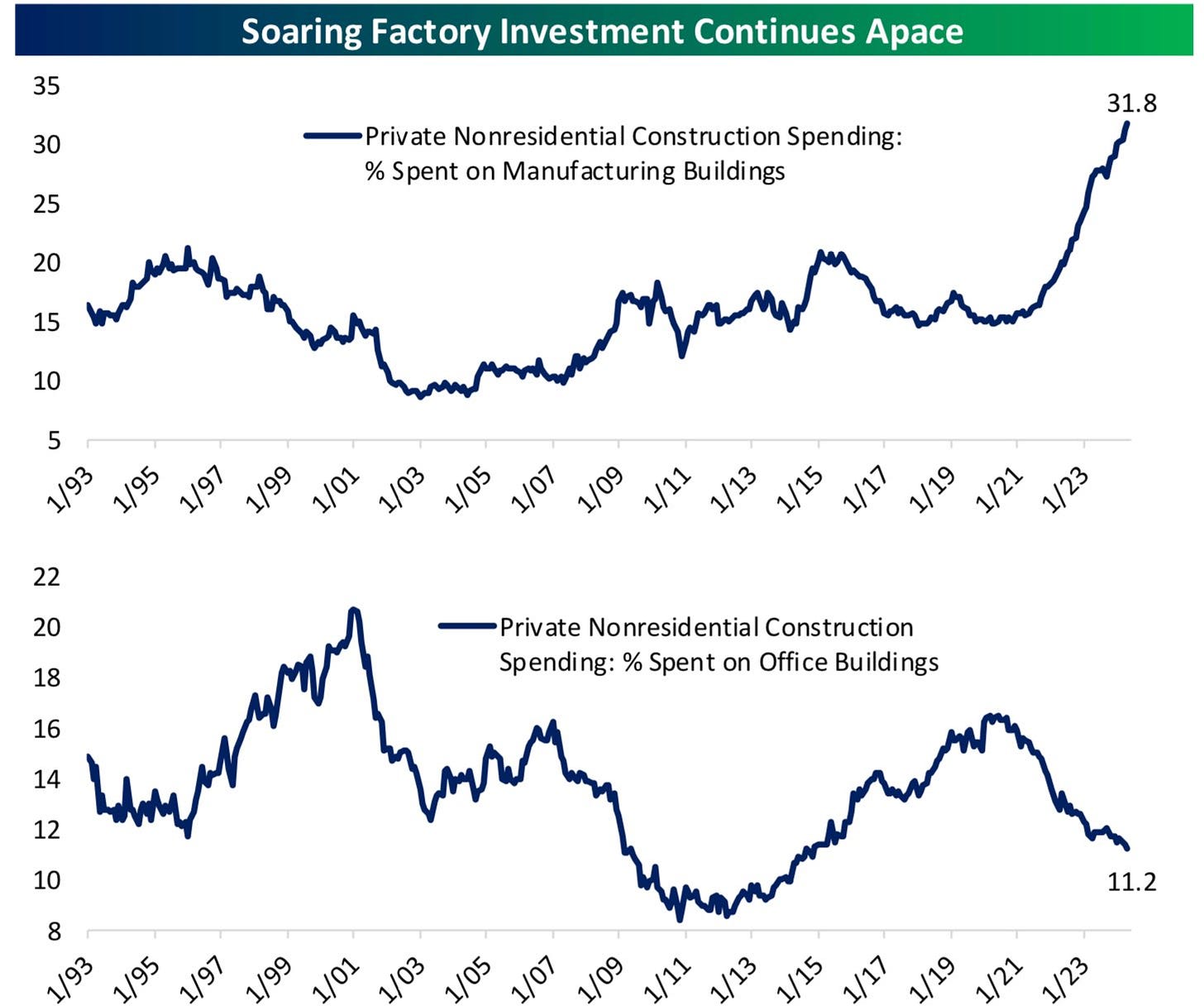

Not all construction is in the doldrums

Naturally, the real estate industry is not dumb, so when demand falls and costs rise, new development falls fairly precipitously, as it has.

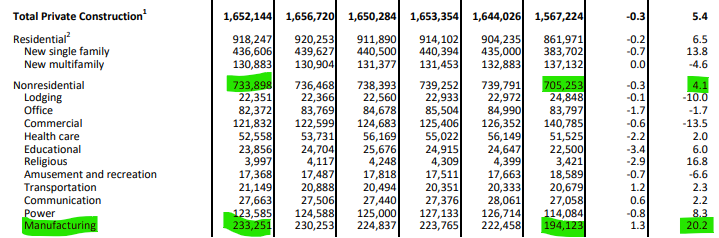

There is one(ish) exception: manufacturing facilities (and data centers):2

While office’s share of total construction has continued to slide, Manufacturing’s share has skyrocketed.

Put another way, non-residential private construction has grown ~$30B YoY, from ~$700B to ~$730B. Manufacturing accounts for all of that (and then some), growing from $194B to ~$230B:

Manufacturing construction spend has increased 20% yoy.

It’s counted as “private” construction spend, but presumably a lot of this is heavily subsidized investment in some combination of “strategic” (i.e. semiconductors) or “green” manufacturing.

Not that that’s a bad thing, necessarily, but it’s just a reminder of how important deficit-funded spending (which everyone agrees is unsustainable) is to the overall picture.

Does that mean the overall picture is unsustainable? Yes, that’s what it means, but over what time horizon, no one really knows. There is of course a lot that can happen in the interim, for better and/or for worse.

This article was originally published in Random Walk and is republished here with permission.